S&P 500 Returns 26% in 2023

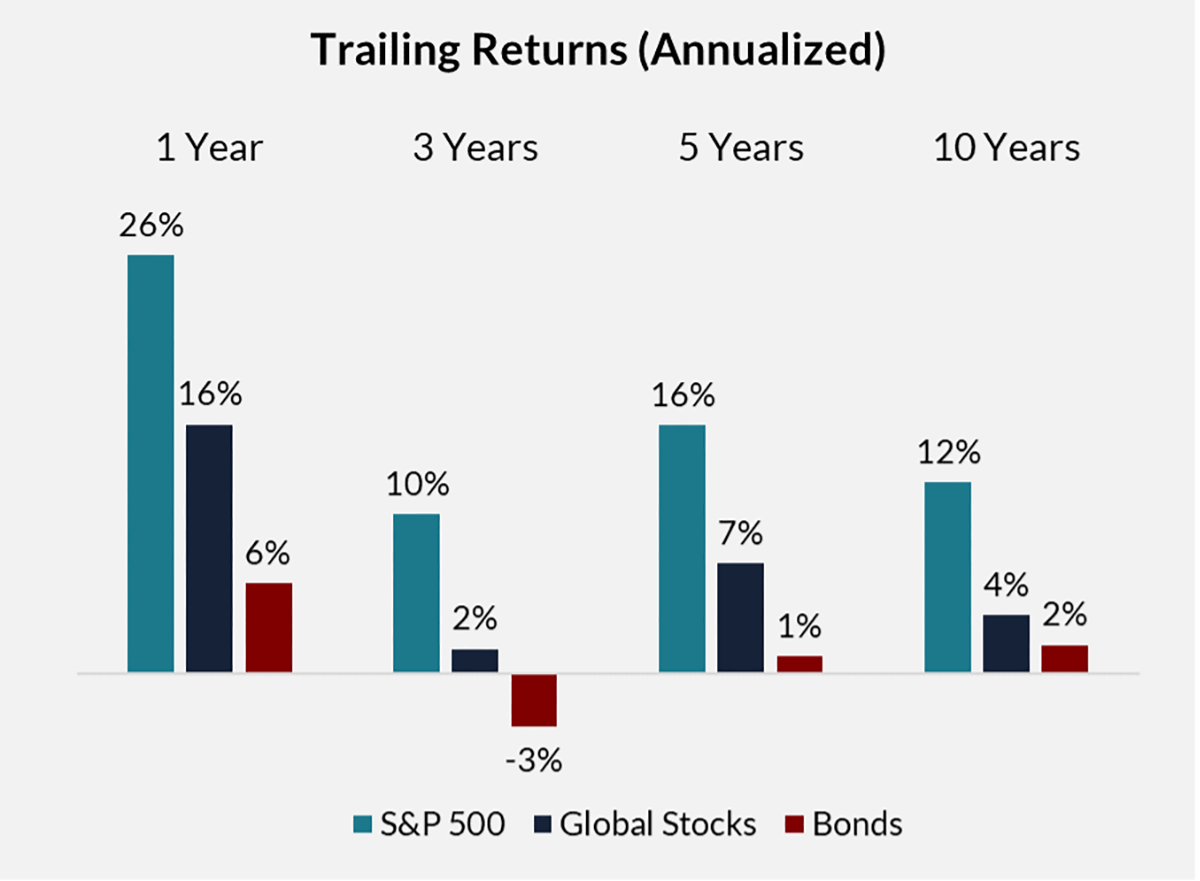

The S&P 500 delivered an exceptional return in 2023, rising more than 26% including dividends. Global stocks have lagged U.S. stocks for the past decade, but still managed a 16% return last year. Even bonds showed signs of life, rising almost 6% as interest rates declined late in the year.

Not many people would have expected this result. Early in 2023, there were fears that rising interest rates might cause a recession or a banking crisis. The geopolitical situation was as tense as it has been in decades, and Washington, D.C. seemed more dysfunctional than ever. None of it ended up mattering for stock investors, who were more interested in Big Tech’s emerging artificial intelligence opportunity.

What Happens Next?

You might be thinking: “Well, that was fun, but what happens next? Surely the market is due for a pullback after such a strong year?”

We don’t make forecasts about the short-term direction of the market. We have no idea what stocks are going to do over the next year, and truthfully, neither does anyone else. However, history suggests that a strong return one year doesn’t mean returns are going to be bad the following year.

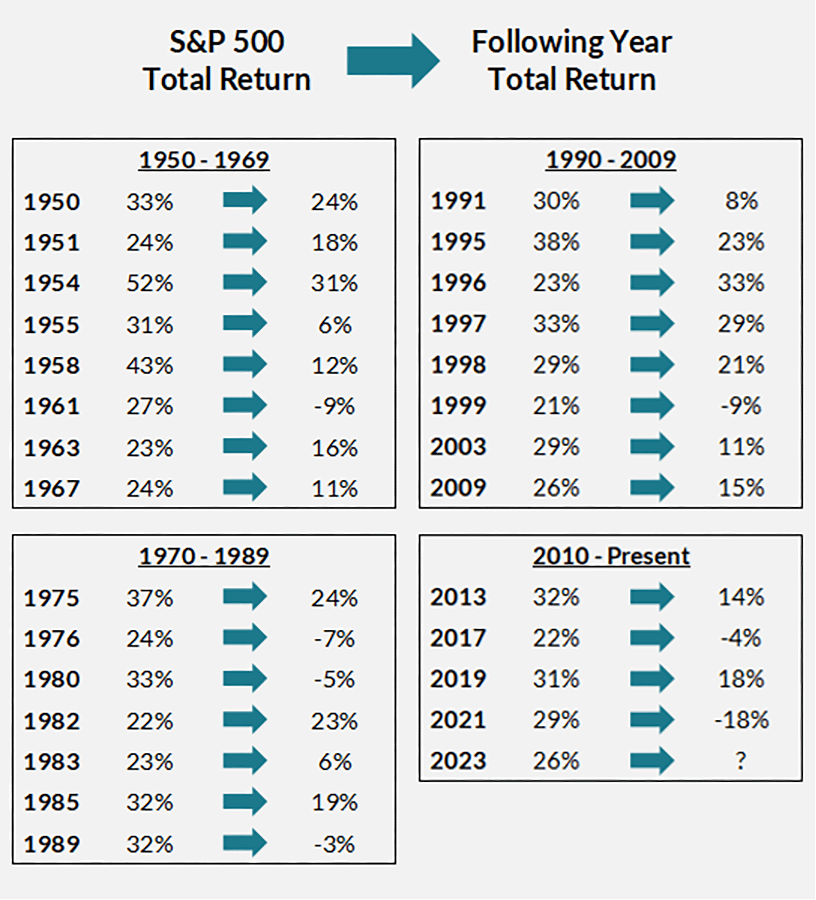

Since 1950, there have been 28 calendar years with a total return greater than 20%. We’ve listed them below, along with the total return the following year:

Of the 28 years with a 20%+ total return:

- 17 were followed by a 10%+ return

- 8 of those featured another 20%+ return

- Only 7 were followed by a decline.

In other words, after the S&P 500 rises 20%, you’re more likely to get another 20%+ year than a decline! On average, the subsequent year saw an 11.4% total return.

What To Do

Our advice when it comes to market-timing is the same as ever: Don’t do it. It’s tempting to try to “sell high and buy low,” but most investors who try it end up doing the opposite: They sell low and buy high. Historically, the S&P 500 has delivered a positive return in four years out of five, so the odds are in your favor when you simply stay invested.

To quote Charlie Munger (who sadly passed away last year at the age of 99): “The big money is not in the buying and selling, but in the waiting.”

That said, it’s always a good idea to make sure your portfolio allocation is putting you on track to meet your long-term financial goals, and that you’re not taking excessive risk. Reach out to a Trajan Wealth fiduciary advisor to review your financial plan today.

Matt Coffina, CFA

Matt Coffina, CFA, is the portfolio manager for Trajan Wealth’s Expanding Moat and Defensive Moat strategies. He seeks to invest in companies with strong and improving competitive advantages, above-average revenue and earnings growth, and reasonable valuations. Matt has more than 15 years of experience as a portfolio manager and analyst. Even if it weren’t his job, he would happily spend all day learning about businesses and trying to identify stocks with a favorable risk/reward tradeoff.

Matt Coffina, CFA

Matt Coffina, CFA, is the portfolio manager for Trajan Wealth’s Expanding Moat and Defensive Moat strategies. He seeks to invest in companies with strong and improving competitive advantages, above-average revenue and earnings growth, and reasonable valuations. Matt has more than 15 years of experience as a portfolio manager and analyst. Even if it weren’t his job, he would happily spend all day learning about businesses and trying to identify stocks with a favorable risk/reward tradeoff.