Everything You Need to Know About Private equities

What is Private Equity?

“Private Equity” is a general term for investments in privately held companies, also known as “Private Markets” or illiquid alternative assets. Private Equity involves investing in privately held companies, ranging from small, early-stage growth companies to large enterprises across various industries and locations. It can be a way to invest in some of the most innovative and transformative companies before they become well-known household names.

Types of Private Equity Investments

We mentioned “start-up” examples, but a whole universe of private market investments exists. They range from start-ups to mature businesses, including real estate, infrastructure, and private lending. These opportunities, which are not typically available to the general investing public, offer an exclusive chance to diversify your investment portfolio.

Infrastructure

Infrastructure

Real Estate

Real Estate

Venture/ Growth

Venture/ Growth

Private Credit

Private Credit

Buyout

Buyout

What Are Private Equity Funds?

There are different ways to invest in private equity, but a common method is through a private equity fund. A private equity fund is a collection of money used to invest in privately owned companies that match a set investment strategy. The fund is managed by a private equity firm, which acts as the ‘General Partner’. Investors who contribute money to the fund become ‘Limited Partners.’

Opportunities For The Long-Term Investor

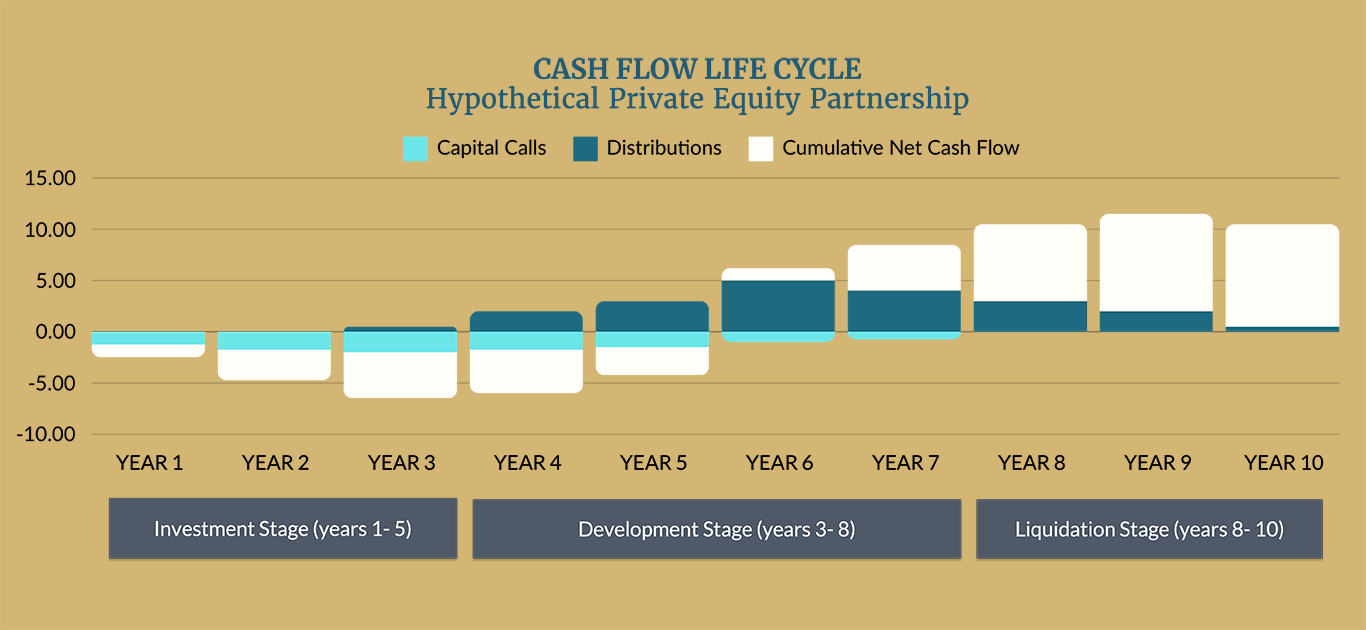

- Investing Stage: The pre-launch investing period is formative and involves creating the private equity fund, determining the strategy, drafting offering documents, securing funds from investors, and identifying initial and investing in target companies.

- Development Stage: The development period is when the fund implements strategic, operational, and financial improvements to enhance the investments growth and profitability potential.

- Liquidation Stage: Also known as harvesting, this is the period during which the manager arranges exits from target companies and distributes capital to investors.

Pros and Cons of investing in Private Equity

Institutional investors, such as hedge funds, mutual funds, endowments, and wealthy individuals, are often attracted to private equity investments. Their capital provides funding for early-stage ventures and plays a significant economic role. However, there are other factors to consider when investing in private equity.

Positives:

History of outperformance

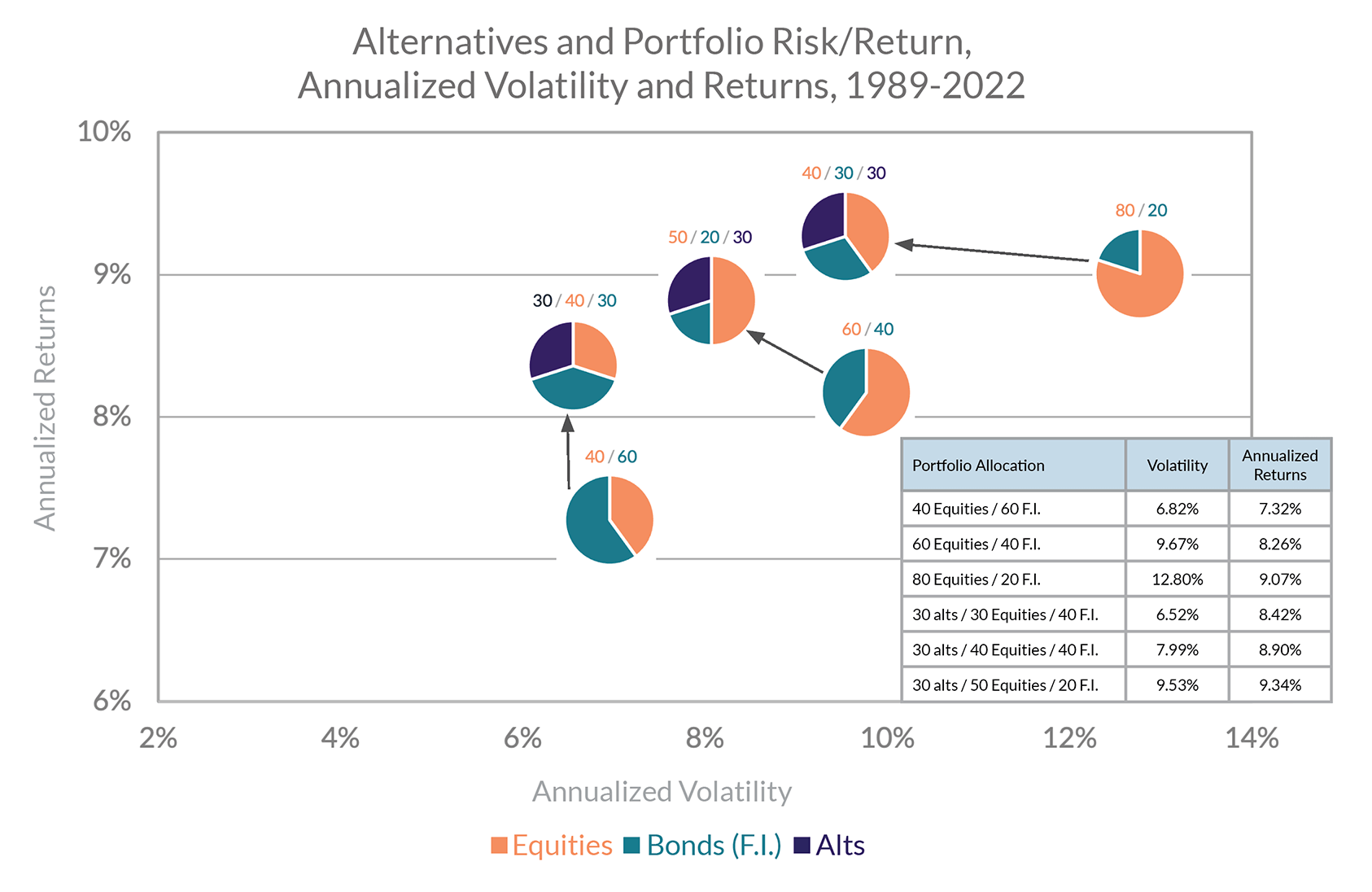

Private equity has historically outperformed stocks with lower volatility long-term, providing extra compensation due to illiquidity. Carefully adding private equity to a traditional stock and bond allocation can enhance portfolio returns and lower risk, as illustrated in the chart.

Asset Class Diversification

Private equity has a low correlation with public equities, offering diversification benefits. Managers invest capital directly into private assets and work to increase their value over time.

Vast market opportunity

The universe of private equity is vast, since most companies globally are privately held. In contrast, the number of publicly traded U.S. companies has dropped significantly.

Downsides:

A long-term investment horizon

Private equity investors typically need to allow for a 5 to 12 year investment horizon.

Due diligence of general partners is critical

The primary expertise of a private equity firm lies in managing a fund, so the Limited Partners delegate all control to the General Partner. General Partners add value by selecting management teams, improving operations, governance, and financial structure.

Limited Access

These funds may not be readily available for the average investor. Investors need to meet asset requirements to show they have sufficient liquidity to meet initial investment and capital calls.

How To Invest In Private Equity

Trajan Offering Examples

- MLG Capital – Private Fund VI

- Overlay Capital’s Innovation Fund

- Overlay Capital’s Infrastructure Fund

Receive guidance from a fiduciary advisor who will put your best interests first. We do the homework – especially when finding opportunities for sophisticated investors seeking unique opportunities outside public markets.