“The financial crisis was linked to the fact that banks had excessive leverage and too many risky assets. The solution is not to try to dictate to banks what they can do or not do, but to require them to strengthen their capital to absorb potential losses and hold less risky assets.”

- John Paulson, Former Treasury Secretary.

Market Returns & Outlook

| Index | YTD TR (%) | February 2024 |

|---|---|---|

| US Large Cap - S&P 500 | 7.11% | 5.34% |

| US Large Cap – Tech Heavy NASDAQ | 7.33% | 6.22% |

| International Equity – MSACWI ex US | 1.55% | 2.55% |

| US Small/Mid Cap – Russell 2500 | 2.68% | 5.43% |

| Bloomberg Aggregate Intermediate Bond Index | (1.68)% | (1.41)% |

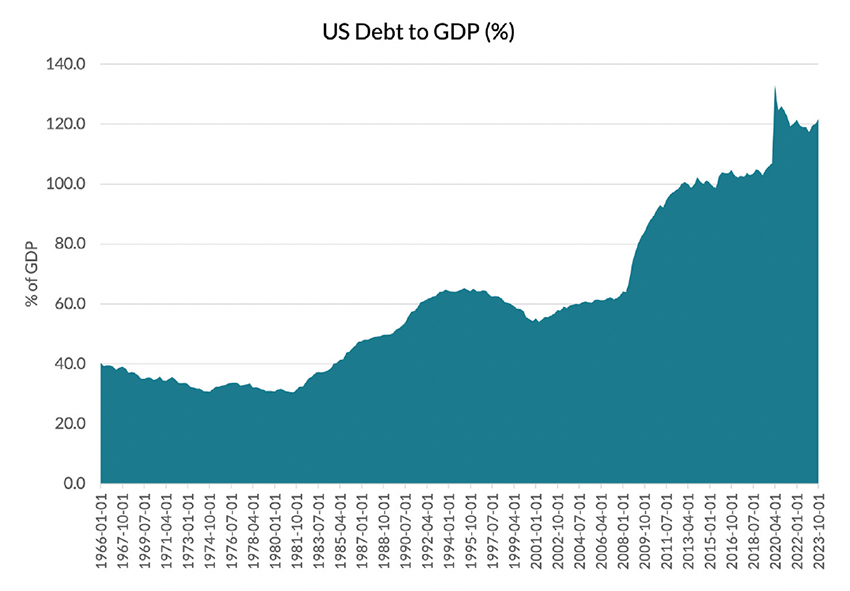

US Debt Interest Payment as a Percentage of GDP

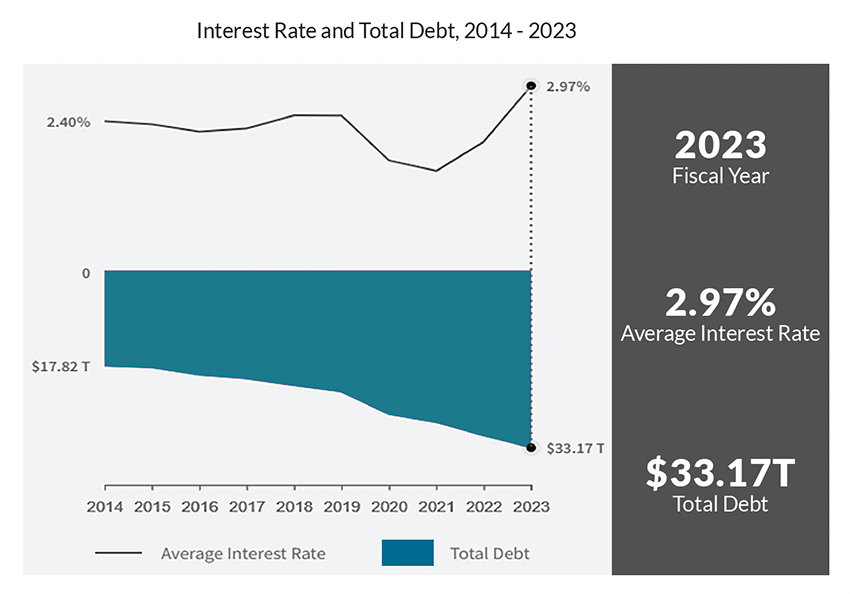

Now, while we certainly welcome the commencement of a “goldilocks environment”; which is to say, strong growth, employment, and corporate earnings data in the midst of decelerating inflation, there is a significant looming risk factor that makes us more nuanced in the future trajectory of returns across most risk assets. US Federal Debt is rapidly rising to alarming levels and consuming an ever-increasing percentage of the Federal budget.

US Federal Debt Servicing Costs

Implications

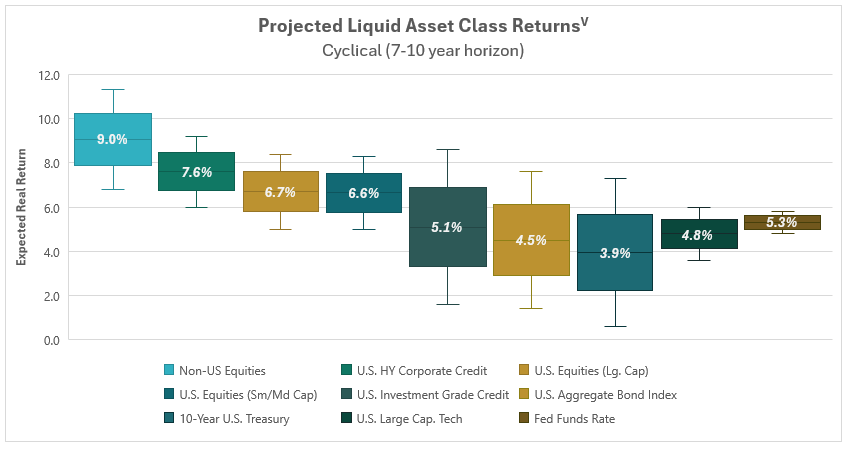

Recommendations

We continue to advocate an elevated level of diversification across asset classes and develop specific asset allocation perimeters that cater to individual risk-tolerance thresholds. In the context of higher yields and the prospect of slower economic growth, Fixed Income assets should command a higher weighting in most portfolios. With interest rates projected to be higher in the next cycle compared to the past, we believe there is a large possibility of “repricing” in certain interest rate sensitive sectors. High quality income-producing assets like commercial real estate and perhaps certain infrastructure-type assets may be available at dislocated prices offering attractive entry opportunities. We are actively seeking out these opportunities as they help reduce the duration of client portfolios through higher cash flow while dampening overall volatility. We would highly recommend our clients to reach out for a portfolio review if one hasn’t been done over the course of the last 24-36 months and discuss the opportunities in our alternative investment offerings, particularly real estate and infrastructure.

*Investment in private equity may require accreditation.*

Udayan Mitra, CFA

Udayan is Trajan Wealth's CIO with over two decades of experience in the investment management industry. He earned a Bachelor of Science degree in Economics from the London School of Economics and an MBA in Finance from Rice University.