There’s been a lot of talk about inflation recently, so we thought today we’d take some time to walk through the basics of inflation. With today’s economic conditions, limited supply, and high demand, consumer prices are rising at their fastest rate in thirteen years. Understanding this aspect of our economy can make a difference in how you think about your own finances and plan for the future!

What is Inflation?

Inflation refers to “the sustained increase in prices of goods and services within a period” (Investopedia). That is to say, over time, the price of goods and services goes up across a sector or an industry (think about the price of cars!). As certain industries increase their prices, inflation spreads throughout our entire economy.

While this may sound like a negative thing, according to Forbes, most economists consider a small amount of inflation to be the sign of a healthy economy. As a matter of fact, the Federal Reserve sets an inflation target rate of 2%. It encourages us to use our money today – whether through spending or investing – instead of socking it away where it’ll surely lose some of its value.

However, when a country’s economy sees too much unchecked inflation we can see negative effects. That’s why economists are so diligent in tracking it.

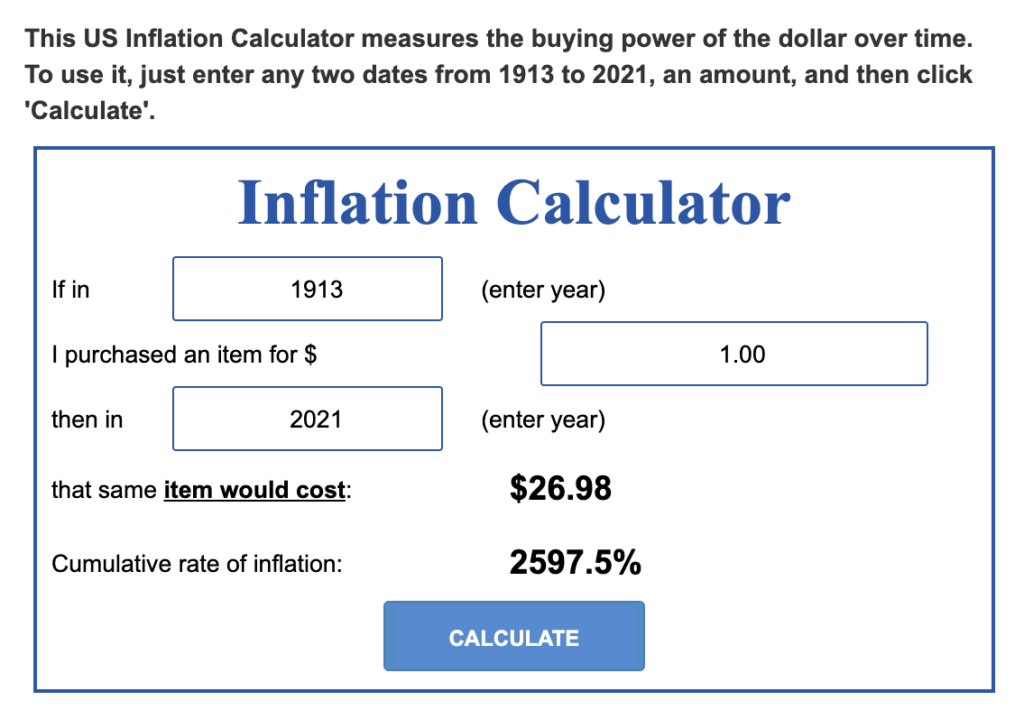

Curious about prices in the past? You can use this inflation calculator to track price changes over the years. It’s fascinating to watch!

How is Inflation Measured?

Here in the U.S., our inflation rate is measured by the Personal Consumption Expenditures Price Index, the Producer Price Index, and the Consumer Price Index. Economists use these different measurements to get a holistic picture of the current inflation rate and keep tabs on the health of our economy.

Looking at consumer goods, not all are experiencing the same rate. Food has slightly increased, while gas and vehicles are experiencing double-digit increases. Other items experiencing inflation include home furnishings, airline fares, and apparel. Since COVID-19, clothing at retail stores has continued depleting as manufacturing halted, creating demand for products ordinarily accessible.

What Causes Inflation?

Rising prices are almost always linked back to two causes, related to the age-old idea of supply and demand. We refer to them as Cost-Push and Demand-Pull Inflation.

Cost-Push Inflation

If a good or service is limited in some way (for example, COVID-19 halted the production of many companies), but folks are still clamoring for it, we’ll see prices rise. A good example of this is gas prices. When gas supply is limited, you’ll see prices rise, even if the demand remains the same.

Demand-Pull Inflation

If the demand for goods or services goes up, but the supply remains stagnant, prices will go up. This might happen because a good becomes incredibly popular or more people have more money to spend on a certain type of product (thus, increasing its demand).

How Does IT Affect Me?

At its core, it means your dollar buys less over time. Inflation doesn’t just impact consumer goods. It can also affect your investments. Inflation risk can occur when investments are not optimized to address the rising costs of goods and services, which can prematurely deplete a retirement portfolio. So what can investors do to offset inflation risk?

- Allocate part of their portfolio to specific products to allow asset allocation strategies to address inflation.

- Improve financial literacy and develop a budget to manage spending

- Reduce the use of credit since it’s likely to increase interest rates

As you’re preparing for your future, the cost of living is simultaneously going up. That’s why we recommend putting aside more money than you think you need. That will help ensure that you’re set down the road.

Trajan Wealth Can Help You With Your Financial Planning

We can’t know what the future of our economy holds. But one thing we do know? Thoughtful planning will help set you up for success. At Trajan Wealth, we love helping people plan for the future – whatever it brings. Contact us today to get started!