Everything You Need to Know About Fiduciaries

Table of Contents

What is a Fiduciary

A Fiduciary is an individual who acts in the best interest of another party regarding their finances. This could be with estate planning, private wealth, investments, or if the individual plans to retire, a Fiduciary can help.

“If a financial professional tells you that they are a fiduciary, but they “hate annuities and never really use them, can they really be a true fiduciary?”

What is the difference between fiduciaries and other financial advisors?

When it comes to financial advisors, there are numerous types, as well as various certifications and licenses that they may hold. Essentially, there are two groups: Fiduciaries and brokers. The primary difference between a broker and a fiduciary is determined by who the advisor is working for. A broker works for their firm, while a fiduciary works for the client.

Broker

Works for their firm.

Fiduciaries

Works for the client

Broker

Works for their firm.

Fiduciaries

Works for the client

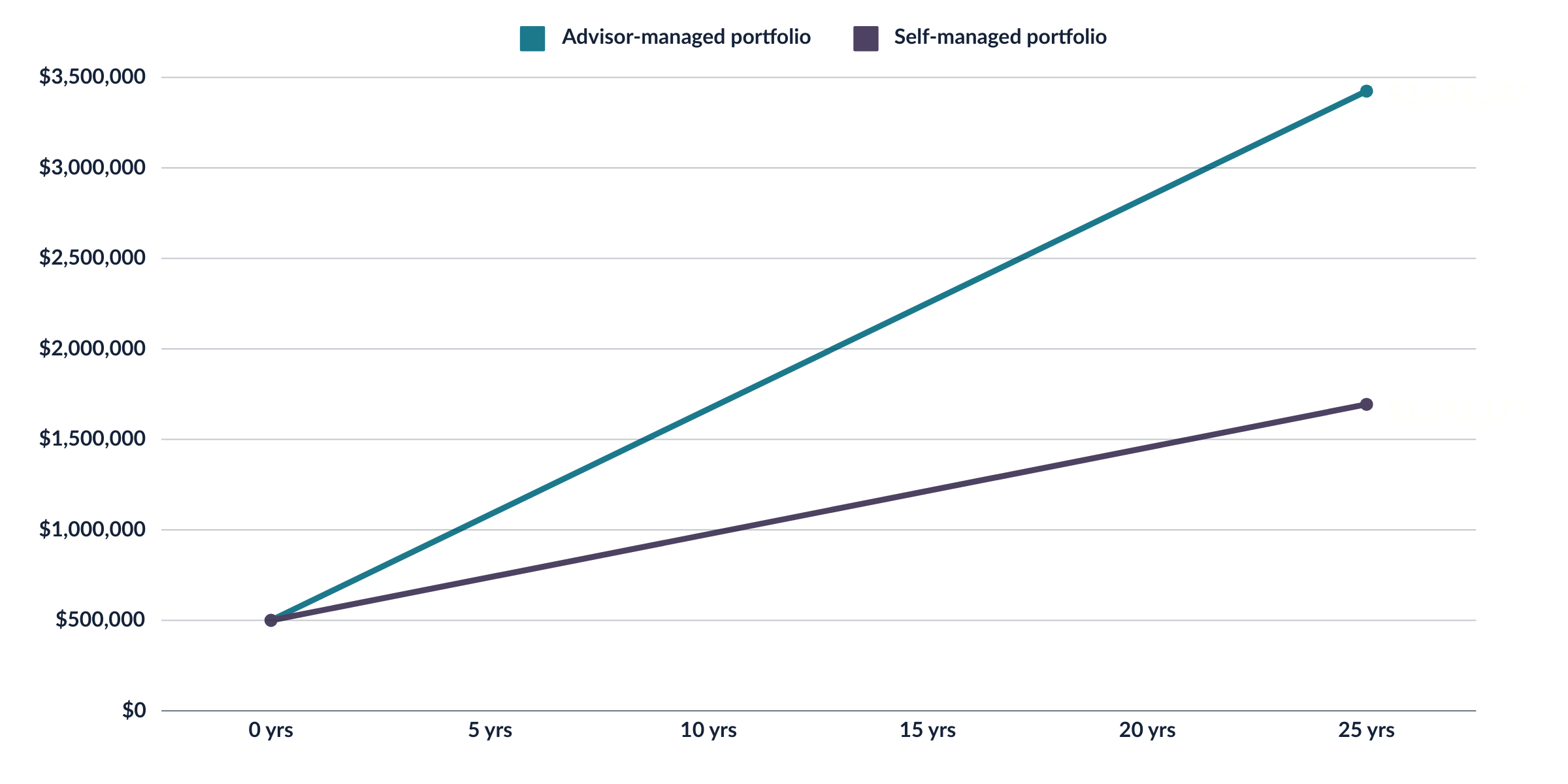

Investors without advisors can have less discipline in volatile markets, so they’re more likely to miss recovery days.

Source: Data from Trajan Analytics. Past performance does not guarantee future results. For illustrative purposes only.

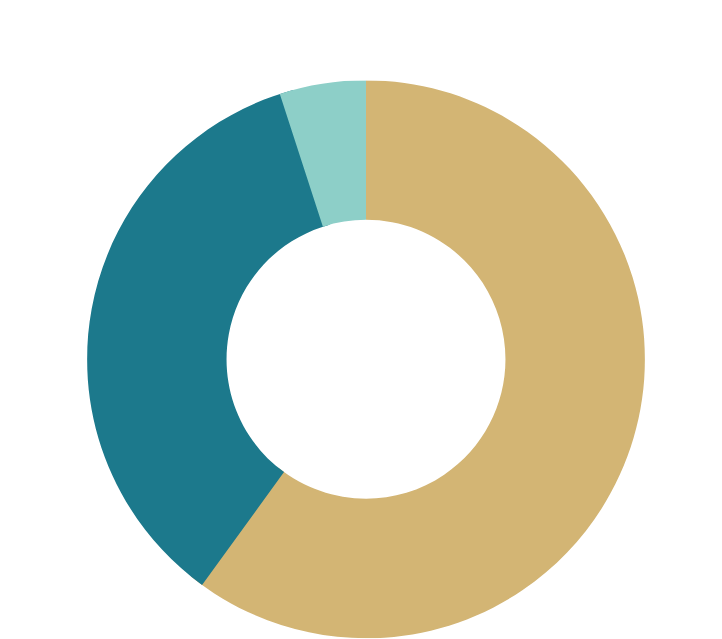

Your portfolio’s risk level can change over time. If one asset class performs better than others, it can become “overweighted” compared to the rest.

More risk without rebalancing

“The advisors aren’t getting commissions, they’re getting compensated based on our coming up – so if you do right by us, we do right by you – so I like that aspect of it. The fiduciary relationship is something that’s really a trusted relationship and that’s very important to us.”

Benefits of working with a Fiduciary at Trajan Wealth

When it comes to financial advisors, there are numerous types, as well as various certifications and licenses that they may hold. Essentially, there are two groups: Fiduciaries and brokers. The primary difference between a broker and a fiduciary is determined by who the advisor is working for. A broker works for their firm, while a fiduciary works for the client.

Benefits of working with a Fiduciary at Trajan Wealth

When it comes to financial advisors, there are numerous types, as well as various certifications and licenses that they may hold. Essentially, there are two groups: Fiduciaries and brokers. The primary difference between a broker and a fiduciary is determined by who the advisor is working for. A broker works for their firm, while a fiduciary works for the client.

Do you have the time or energy to spend researching and creating the best financial plan for yourself? Most of us don’t. But let’s say you do have the time to explore different investment options, allocate your investments properly, and keep up with daily market changes. What if your plan fails? Will you have the time you need to make up for losses? Financial advisors spend their time researching your investments every day, so you don’t have to. It’s our job.

Volatility in the market triggers our fight-or-flight instincts. No matter if the markets are rising or falling, it can be hard to keep let your emotions from overruling logic. You can be too emotionally tied to your investments. One snap decision could cost you a lot of money – and possibly your retirement. A fiduciary advisor can help you from an objective and rational perspective. We have the experience and separation to consider your investments with a long-term perspective.

Consistently reviewing your portfolio allows you and your advisor to re-evaluate your investments and make sure you are on track to hit your retirement goals. Market conditions change over time, and if you don’t keep up, your portfolio may not stay aligned with your needs.

For example, when people retire, they are often in a lower tax bracket during their first and possibly the second year of tax filing. There may be an opportunity to convert taxable investments to tax-free investments with lower tax consequences than if they liquidate. There are also many different strategies to keep your taxes down, even before retirement, allowing you to save more for the future. An advisor can help you navigate the tax implications now and in the future of your investments and retirement plan.

Stress-free approach to protect and help grow your investments.

We specialize in rolling IRAs and 401(k)’s over.

We walk you through the process and even complete paperwork for you.

Our Fiduciary Advisors have set low transparent fees that align with your growth.

We take the time to understand your specific situation.

How to work with a Fiduciary

To confirm if a financial advisor is a fiduciary, you can ask for their status and verify it. One way to check their registration with the SEC is by using FINRA’s BrokerCheck database.

If you are working with an investment advisor firm, you can also check for an advisor’s Form ADV on the SEC’s IAPD page. This will give you information about their registration with the SEC or state, their business operations, and any misconduct they may have been involved in.

Source: Vanguard. Assuming 5% annualized growth of a $500k portfolio vs 8% annualized growth of an advisor-managed portfolio over 25 years. Chart not to scale. Hypothetical study.

FAQ

Yes, as a Fiduciary Advisor, we are obligated to always act in your best interest.

A fiduciary cannot act out of self-interest. If our advice carries any potential conflicts of interest, we’ll raise the issue with you. You can also read about our relationships in our CRS form and ADV forms.

All Trajan Wealth clients, regardless of investment level, receive annual reviews with a Portfolio Manager and can reach out to us with questions anytime. The frequency of the reviews increases as your portfolio grows. Read about our client benefits here.

*Filmed testimonial from actual client, no compensation, no conflicts.