“History provides a crucial insight regarding market crisis: they are inevitable, painful, and ultimately surmountable.”

~ Shelby M.C. Davis

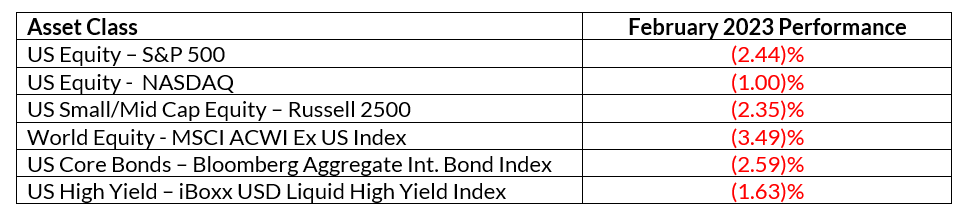

February MarketsI

Fig. 1 – Bloomberg

After posting strong returns in January, risk assets across most major sectors declined at a relatively modest clip in February. The declines were triggered by the Fed raising overnight rates by 25 bps, or 0.25%, at the February 1st FOMC, and maintaining a generally hawkish stand on the need to reduce inflation to its target 2%-2.5% range in its public communications thereafter. Major inflation indexes remained elevated at 5%+ levels, disappointing practitioners who were optimistic about further disinflation with the steep YOY declines in commodity prices and the sharp slowdown in home price appreciation. The employment market remains surprisingly resilient, with US unemployment at a multi-decade low at 3.6% and non-farm payroll growth averaging near 300,000 in the fourth quarter of 2022. Not to be outdone, employment growth in 2023 started at a brisk clip, with 517,000 new non-farm jobs created in the month of January. There is increasing conviction on Wall Street that the job market has to ease, and US unemployment has to rise before the Fed even considers pausing its current tight monetary policy stance. The first rate cut – earlier anticipated in early 2024 has been pushed back by several quarters (see chart 2. on page 2 – “Market expectations for the Fed Funds Rate”).I

Essentially, the market is now pricing a peak Fed Funds rate of 5.25%-5.50% for the current cycle, suggesting 75 basis points – or 0.75% in further rate hikes. As the peak rate is achieved, practitioners assume that the Fed will maintain Fed fund the rate for at least the next four quarters. Fed Chairman Powell opined that assumptions of an eventual rate cut are premature at this stage and indicated that rate cuts would only be considered till “price stability” (interpreted by us as an inflation rate of 2%-2.5%) is restored. At this juncture, the target seems some way off (see chart two on labeled US Inflation – Core PCE Deflator).

Fig. 2 – Carlyle Group, Bloomberg, BLS

U.S. Inflation – Core PCE DeflatorIII

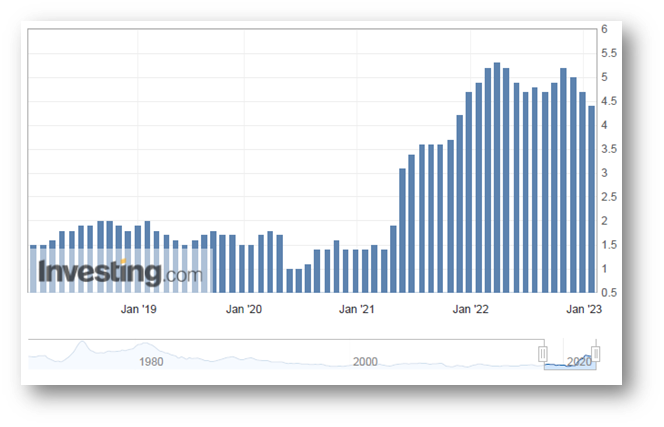

Fig. 3 – Investing.com

U.S. Real Interest RatesIV

Fig. 4 – Carlyle Group, Federal Reserve Bank

While monetary policy is likely to remain tight for the remainder of the year, we feel that the bulk of rate increases – the trigger for last year’s troubled markets, are behind us.

- As depicted in the above chart, real interest rates, which mean interest rates minus anticipated inflation over specific periods, have now turned positive across short, long, and intermediate maturities. Recall that at the peak of Covid-19 in 2020 through 2022, real interest rates were negative – meaning holders of fixed-income securities suffered a steep decline in purchasing power (interest income lower than inflation). In fact, negative real interest rates were a phenomenon that occurred intermittently across various maturities from 2009 through 2019, as the Federal Reserve maintained an extraordinarily accommodative monetary policy.

- Now that real rates are positive, we feel inflation will come under control. However, higher rates also temper the return outlook for corporate profits, consumer spending, and stock market performance. We at Trajan Wealth avoid making predictions – however, we do indeed feel that the strong double returns that equity markets generated over the 2010-2020 decade are not likely going forward into the next cycle.

So, what does this mean for our clients and their overall asset allocation? We would argue, nothing! We would remind clients that economic and market predictions are simply just that, predictions. Predicting markets or the overall economy is a highly hazardous occupation – the track record of market predictors, in particular, is abysmal. Furthermore, there isn’t any reliable level of consistency in among the winners and losers in the market forecasting business – yesterday’s winners tend to be tomorrow’s losers . As such, we continue to advocate the time-old mantra of basing investment decisions and asset allocations on objectives and goals. No two investors are the same, but one largely common metric among our clients is that time horizons tend to compress with the passage of time, and risk appetites diminish as employment windows shrink. Also, because of lower anticipated returns from risk assets going forward, a prudent financial decision would entail saving and investing a greater proportion of discretionary income.

Reminder – Risk Factors Going into 2023

As discussed in previous newsletters, we continue to believe that high global indebtedness poses a distinct refinancing challenge for lower quality issuers. This risk is amplified in the event of slow or receding economic growth. In addition, global geopolitical risk remains elevated, and the traditional lever of credit growth to support both consumer and investment spending in the event of a recession has been severely curtailed.

Recommendations

We continue to advocate an elevated level of diversification across asset classes following individual risk-tolerance thresholds. In this context, Fixed Income assets should command a higher weighting. However, we also believe that non-traditional asset classes – “real assets” such as real estate merit consideration given persisting inflationary pressures. We also expect elevated levels of market volatility going forward, if only due to rapidly rising financing costs that may adversely affect corporate profits. As such, absolute return strategies – trend following, equity/credit market dispersion, which benefit from volatility may be appropriate for certain investors in an overall asset allocation. We continuously look for these unique sources of returns for our clients and will make recommendations as we develop additional strategies and update our asset allocation models.

UDAYAN MITRA, CFA

~ Trajan Wealth Chief Investment Officer