“Rule #1 of Investing: Never Lose Money. Rule #2: Remember Rule #1.”

~ Warren Buffett

Silicon Valley Bank, Credit Suisse, and the Credit Market Saga

The Federal Reserve Bank’s Open Market Committee (“FOMC”) raised the target Fed Funds rate by 0.25% at the March 22nd FOMC meeting bringing the target overnight rate to between 4.75% and 5.00%.

Fig. 1 – Bank of America Global Research

The rate hike occurred amidst the collapse, and subsequent government/central bank engineered depositor bailouts of three banks – two here in the US and one in Europe. Silicon Valley Bank and Signature Bank could no longer control depositor outflows as yields on assets on their balance sheets (long-dated US Treasury and Mortgage-Backed Securities issued before 2022) fell well below interest offered currently on short-term money market instruments such as newly issued 6-month US Treasury Bills and high quality, short-dated US Corporate Commercial Paper. Treasury Bills and Commercial Paper are the main components of prime money market funds. With money market funds offering significantly higher interest than bank savings and checking accounts, both Silicon Valley Bank and Signature Bank faced the classic “bank runs.” To avoid market turbulence, the US Treasury, along with the FDIC and the Federal Reserve Bank, extended full FDIC insurance guarantees to depositors (including previously uninsured balances) and injected liquidity into the two banks, while administering a “managed” bankruptcy of the bank’s parent holding companies. In Europe, a large global bank, Credit Suisse, faced similar problems from many years of mismanagement. The Swiss government, along with the Swiss monetary authorities, administered similar programs to make depositors whole while engineering a takeover of the bank’s parent company by a rival, UBS AG.

The reason why many banks are currently under duress is that their assets (typically loans and marketable fixed-income securities) are typically longer dated than their liabilities – interest obligation to depositors. Many banks significantly over mismatched their asset-liability models over the past decade as short-term rates (the basis for interest on checking/savings accounts) were near zero, while yields on long-term securities (a large component of bank assets), although low by historical standards, offered an attractive spread to short term rates. However, with both long and short-term interest rates up dramatically in 2022, banks faced the squeeze of declining market values in the long-dated fixed income portfolios and the demand for higher returns by depositors. This is an ongoing problem – a recent CNN article revealed an aggregate of $620 billion in unrealized losses in the balance sheets of regional US banks. Faced with the dilution in bank equity, we expect bank lending standards to tighten and the cost of bank credit to rise sharply.

The Federal Reserve Bank is acutely aware of the banking problem. Yet Chairman Powell has repeatedly reiterated that the primary focus of monetary policy remains the fight to bring down inflation from over 5% to the long-term target of 2%. With a tightening interest rate policy and tighter credit standards going forward, the bond market is pricing in a significant economic slowdown. As the Fed raises short-term rates, bond investors are actually buying up longer-dated bonds in the belief that the Fed will have to reverse course as growth contracts and unemployment rises.

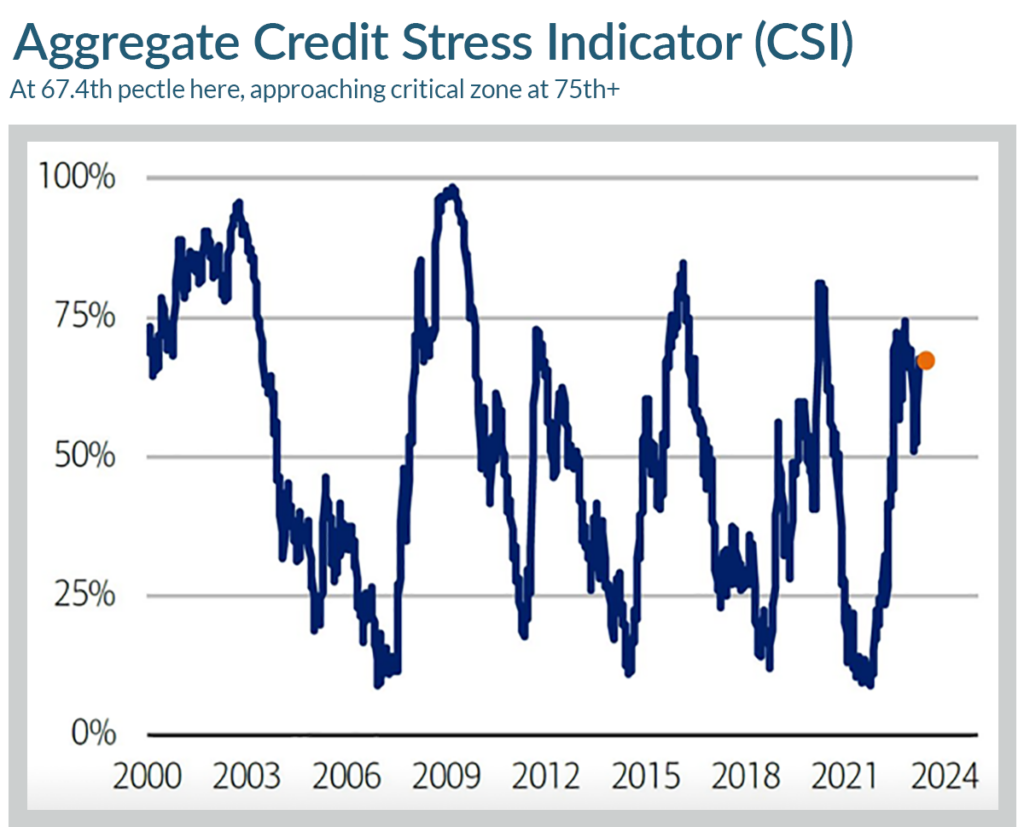

Fig. 2 – S&P Global Ratings Research and S&P Global Market Intelligence ‘s Credit Pro

Why should investors care about economic cycles, particularly if they are long-term focused? The simple reason is that many investable assets are corporate obligations (stocks, corporate bonds), and companies face the vagaries of supply and demand on their output as well as debt servicing obligations on their financial liabilities. Furthermore, many other investable asset class sectors – Real Estate (REITs), Infrastructure (MLPs), and certain Absolute Return strategies deploy leverage (borrow money) to spruce up returns. When costs of financing (interest on debt) rise and lending standards tighten, the prospects of financial distress increase significantly. As such, as depicted by charts I and II, periods of stress in the credit markets correlate highly with corporate defaults; with lower rated (i.e., lower quality) issuers are particularly exposed to the prospect of failing to meet debt obligations. To be clear, debt defaults unusually lead to Chapter 11 bankruptcy filings – a process in which corporate shareholders are essentially wiped out, and creditors receive either a fraction of unpaid loan balances or fresh equity in the new company that emerges post-bankruptcy petition. Either way, both shareholders and creditors experience a permanent loss of capital, a prospect that we at Trajan Wealth are singularly focused on avoiding in client portfolios. We take to heart Warren Buffett’s immortal rules about investing – Rule # 1 – “Never lose money.” Rule # 2, “Remember Rule # 1.”

Trajan Wealth’s Guiding Principle on Investing

Simply put – To preserve and sustainably grow investor capital by maximizing risk-adjusted returns across a diverse set of asset classes.

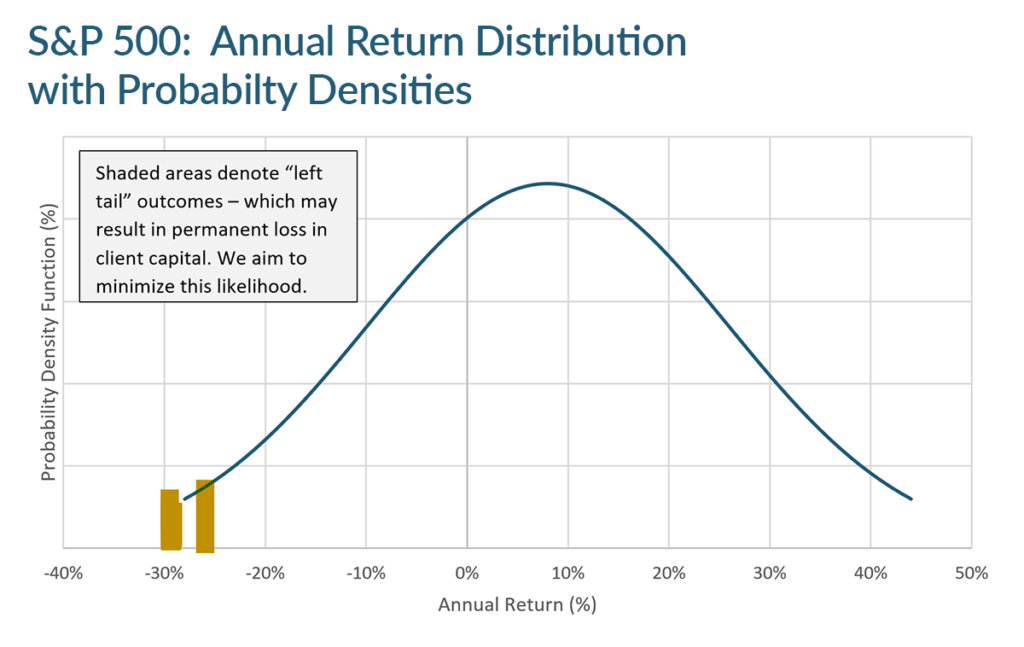

Fig. 3

By preserve, we mean to minimize the possibility of permanent losses in investor capital emanating from defaults, bankruptcies, and margin calls caused by excessive borrowings. By preventing permanent losses, we can sustainably grow client money if we ensure that we are paid adequately for taking on incremental risk. Accordingly, we look at maximizing risk-adjusted returns on all our strategies, given our knowledge that risk is a double-edged sword, helping to enhance returns during bullish markets while causing catastrophic losses in bear markets. Understanding that diversification is the only potential free lunch in investing, we offer our clients a myriad of complimentary asset classes to build asset allocations that serve their individual needs.

Recommendations

We continue to advocate an elevated level of diversification across asset classes and develop specific asset allocation perimeters that cater to individual risk-tolerance thresholds. In the context of higher yields and the prospect of slower economic growth, Fixed Income assets should command a higher weighting among most allocators. Within asset classes, Trajan Wealth’s investment team is maintaining its quality bias. We also believe that non-traditional asset classes – “real assets” such as real estate merit consideration given persisting inflationary pressures. We also expect elevated levels of market volatility going forward, if only due to rapidly rising financing costs that may adversely affect economic growth and corporate profits. As such, absolute return strategies – trend following and equity/credit market dispersion, which benefits from volatility may be appropriate for certain investors in an overall asset allocation. We continuously look for these unique sources of returns for our clients and will make recommendations as we develop additional strategies and update our asset allocation models.

UDAYAN MITRA, CFA

-Trajan Wealth Chief Investment Officer