If you’re in search of a way to reduce your 2023 tax bill and give back to the community, donor advised funds may be worth considering.

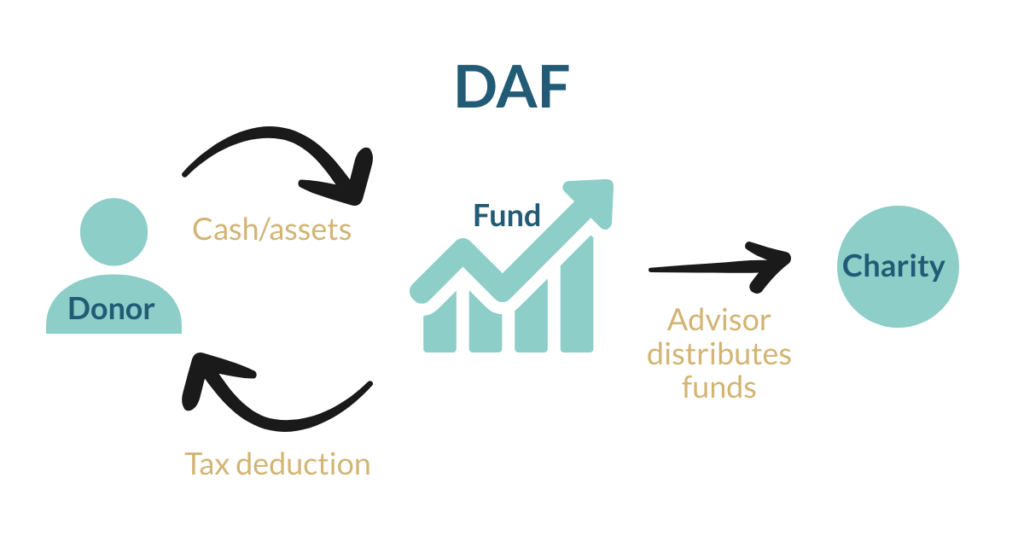

Also known as a DAF, a donor advised fund is a charitable investment strategy you can use to support charities that are important to you, while receiving tax-advantages. You may contribute cash, stocks, bonds, mutual fund shares, private company stock, cryptocurrencies, and other types of assets through a DAF.

New SECURE 2.0 law tax benefits for 2023

You may claim a tax deduction the year you contribute to the DAF, rather than the year your contribution actually goes to the charity. Note that this is new legislation for 2023; previously donors didn’t receive the tax deduction until the charity received the DAF assets.

Using the DAF five-year carrying forward strategy, you can prepay five years’ worth of donations, taking the combined contributions as a tax deduction this year. Here’s an example of how the five-year carry forward strategy works:

Let’s say you donate $1500 per month or $18,000 per year to a charity. If you’d like and are able to, you can prepay five years’ worth of donations by contributing $90,000 in a DAF today. While the DAF would use the funds to distribute $1500 per month to a charity, you’d enjoy a $90,000 tax deduction this year instead of $18,000 per year for the next five years.

When the charity receives the gift, they are responsible for taxes, if applicable, depending on their tax status.

Selecting a non-profit beneficiary

You don’t have to select a nonprofit beneficiary (charity) immediately when making a contribution to a DAF. Instead, you can wait to decide which IRS-eligible nonprofits you want to donate to. Waiting to designate a non-profit provides more time for the DAF’s investment strategies to accumulate in value. Here are other things to note about DAFs:

- There are no contribution limits on how much a donor may contribute to a DAF.

- All contributions to the DAF are irrevocable and cannot be taken back once they are gifted.

- All donated assets belong to the sponsoring organization, with the donor maintaining advisory and grant-making privileges.

- All grant recommendations from DAFs must be approved by the sponsoring organization.

DAFs as a tax-savings strategy

Capital gains taxes are imposed when you make a profit from selling an asset. Fortunately, you won’t be responsible for capital gains taxes on assets you contribute to a DAF as long as you don’t liquidate the assets first and then donate them to the DAF. Here’s other things to know about DAFs and taxes:

- Publicly-traded securities or illiquid gifts that have been held for more than one year must be donated at fair market value directly to the DAF.

- Donors can receive an immediate income tax deduction for cash, check, or wire transfer of up to 60 % of adjusted gross income (AGI).

- The deduction for securities and other appreciated assets (i.e. closely held stock, real estate, illiquid assets) is up to 30 % of AGI.