“Public opinion always wants easy money, that is, low interest rates.”

-Ludwig Von Mises

The Year In Review

| Index | YTD TR (%) | December 2023 |

|---|---|---|

| US Large Cap - S&P 500 | 26.26% | 4.53% |

| US Large Cap – Tech Heavy NASDAQ | 44.07% | 5.62% |

| International Equity – MSACWI ex US | 16.22% | 5.02% |

| US Small/Mid Cap – Russell 2500 | 17.39% | 10.72% |

| Bloomberg Aggregate Intermediate Bond Index | 5.53% | 3.83% |

S&P 500 Closing Prices

S&P Volatility in 2023

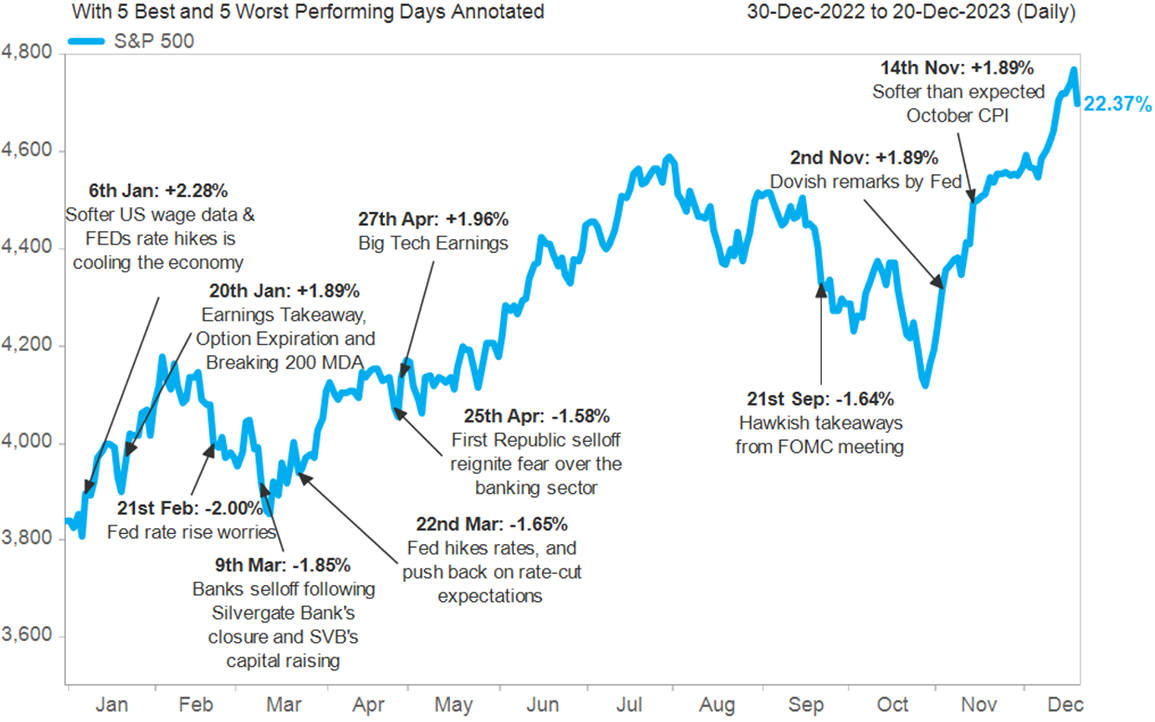

While broad US equities posted excellent performance in 2023, reviewing a time series chart helps understand the level of volatility borne by investors in US equities. In the first quarter, the market was up almost 10% before giving up essentially all its gains by the end of March. Subsequently, data showing a cooling of inflation, and upside surprises in GDP growth, triggered a strong rally – roughly 20% over the course of the subsequent summer. However, by the end of summer, the Fed reiterated that getting to “price stability” – that being an inflation rate of 2% remained its overriding priority, at a time when inflation data was hovering in 4%-5% range. Unsurprisingly, the market interpreted the Fed’s remarks to imply that short term (money markets) rates would remain “higher for longer” and US equities fell about 10% till the end of October. The October inflation data released early November depicted a sharp fall in inflation to 3.1% and the Fed left its policy rate unchanged at the final two FOMC meetings in November and December. The perception that the Fed might lower rates in the first quarter of 2024 started to permeate in the financial markets, accelerating returns in both the equity and fixed income markets. Why? Lower rates reduce the discounting of future cash flows, resulting in higher asset valuations if cash flow projects remain unchanged. Thus, in the immortal words of Ludwig Von Mises – “Public opinion always wants easy money, that is, low interest rates.”

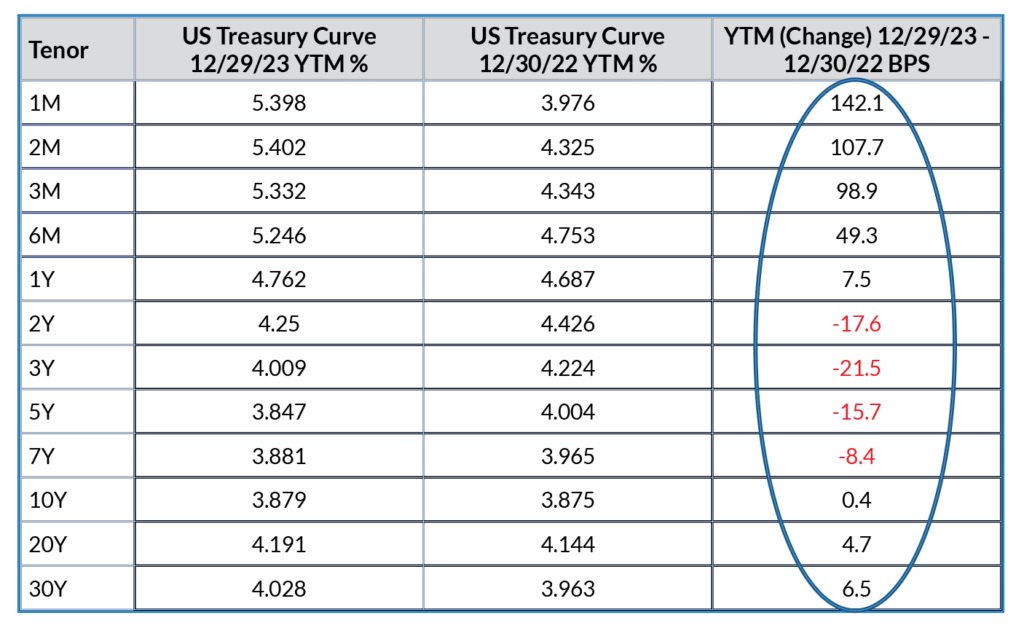

Now it makes sense to recollect the Fed’s mission as we explore the scenarios of the direction of monetary policy. The Fed’s first mandate is “price stability” – widely interpreted as an ongoing inflation rate of 2%. The second mandate is “conditions for growth” – a more nebulous statement which many interpret as low unemployment and economic growth in line with productivity and population growth. Taken at face value, we at Trajan Wealth do not see an immediate need for the FOMC to do anything yet. Suffice to say that month to month inflation data is volatile (January data on prices paid for services showed an upward trend) and with variations in the data, we expect variations in both long/intermediate term interest rates, as well as prices on contracts on future short-term rates. Accordingly, we do expect the levels of volatility seen in 2023 to persist into the New Year.

US Treasury Yields:

Trends in 2023 & Forward Implications

Recommendations

We continue to advocate an elevated level of diversification across asset classes and develop specific asset allocation perimeters that cater to individual risk-tolerance thresholds. In addition, we encourage clients to alter asset allocations as they approach retirement or individual circumstances evolve. In the context of higher yields relative to the 2010-2020 decade and the potential of moderating economic growth, Fixed Income assets should command a higher weighting in most portfolios; we would highly recommend our clients to reach out for a portfolio review if one hasn’t been done over the course of the last 24-48 months. We also believe that non-traditional asset classes – “real assets” such as real estate and infrastructure, as well as private equity and private credit merit consideration given the real portfolio enhancement opportunities as we transition to a potentially lower growth and earnings environment. For investors with a long-term investment horizon, the illiquidity premium in private assets is an attractive source of additional returns.

*Investment in private equity may require accreditation.*

Udayan Mitra, CFA

Udayan is Trajan Wealth's CIO with over two decades of experience in the investment management industry. He earned a Bachelor of Science degree in Economics from the London School of Economics and an MBA in Finance from Rice University.