You’ve met with a financial advisor and crafted a great financial plan. You’ve detailed your financial goals and understand your risk tolerance. But now comes the hard part: Sticking with the plan! Especially when the stock market isn’t cooperating.

The S&P 500 has historically delivered returns a bit over 10% per year, including dividends (before taxes and fees). Over 20 years, that’s enough to turn $100,000 into nearly $700,000! Unfortunately, stock market returns don’t come in a straight line. Here are three reasons not to panic during a market downturn.

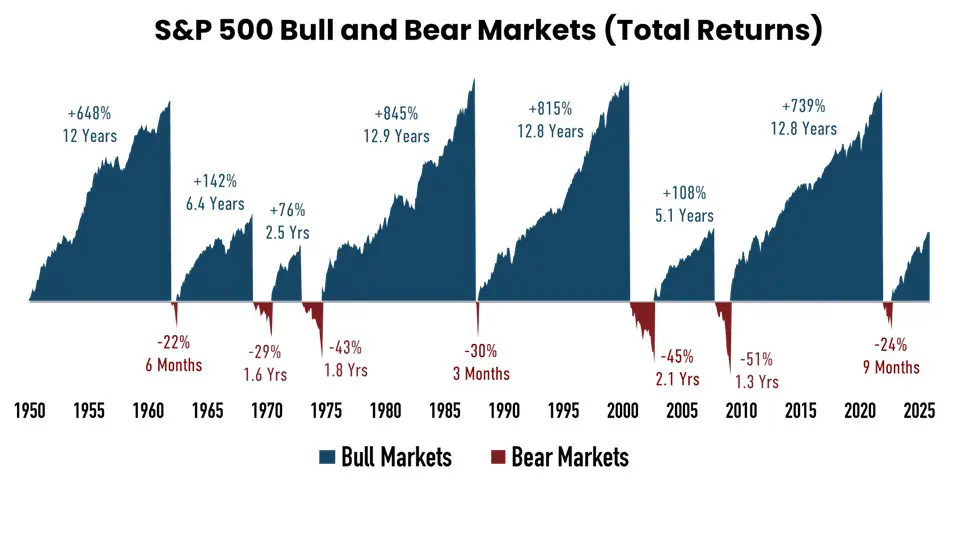

Reason 1:Bull Markets Are Typically Stronger and Longer Lasting Than Bear Markets

Bear markets, defined as a decline of 20% or more from a previous high, happen about once per decade. During the 2008-09 Global Financial Crisis, the S&P 500 was down more than 50%!

The good news is that bull markets are typically stronger and longer lasting than bear markets. As can be seen in the following chart, over the past 75 years, the average bear market lasted slightly longer than a year and involved a peak-to-trough decline of about 35%. The average bull market lasted more than nine years and involved a gain of nearly 500%.

Source: Bloomberg, Trajan Wealth estimates. Bear markets are defined as a decline of 20% from a prior peak. Bear markets are shown from the peak to the trough, and bull markets from the trough to the peak, using monthly data from 1950 – 2025.

Understanding Market Cycles in Your Wealth Management Plan

The first step in preparing for a market downturn is to recognize that bear markets are inevitable. They are a normal and expected part of investing in stocks. But they don’t last forever. Historically, it’s only a matter of time before we get back to a bull market.

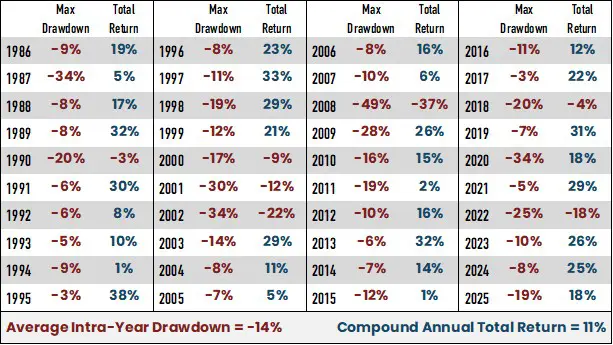

Reason 2:Smaller Drawdowns Are Even More Common, But Also Temporary

You might be thinking, “that’s not so bad, I can deal with one bear market every 10 years.” But that’s only part of the story. Even during bull markets, it’s extremely common to see smaller declines of 5%, 10%, or 15%.

Historical S&P 500 Intra-Year Drawdowns

These stock-market corrections are normal, and they don’t derail the market’s long-term trajectory. Here’s a table showing annual S&P 500 total returns over the past 40 years, along with the maximum intra-year drawdown (the largest decline from peak to trough) experienced during the year.

Source: Bloomberg, Trajan Wealth estimates.

Every year featured at least one drawdown, ranging from a 3% dip in 2017, to a 49% collapse in 2008. On average, the maximum intra-year drawdown was 14%.

And yet the S&P 500 managed to deliver a positive full-year return in 33 of these 40 years, with an 11% compound annual return across the full period. There were several years with large double-digit drawdowns, where the S&P still finished the year with large double-digit gains. The most recent example came just this past year, as the S&P 500 experienced a 19% drawdown early in 2025 amid tariff fears, but finished the year up nearly 18%.

Why Overreacting to Volatility Hurts Returns

As with bear markets, smaller corrections are inevitable. They come with the territory when you invest in stocks. They only become a problem if you overreact: Selling during a correction or bear market locks in your loss.

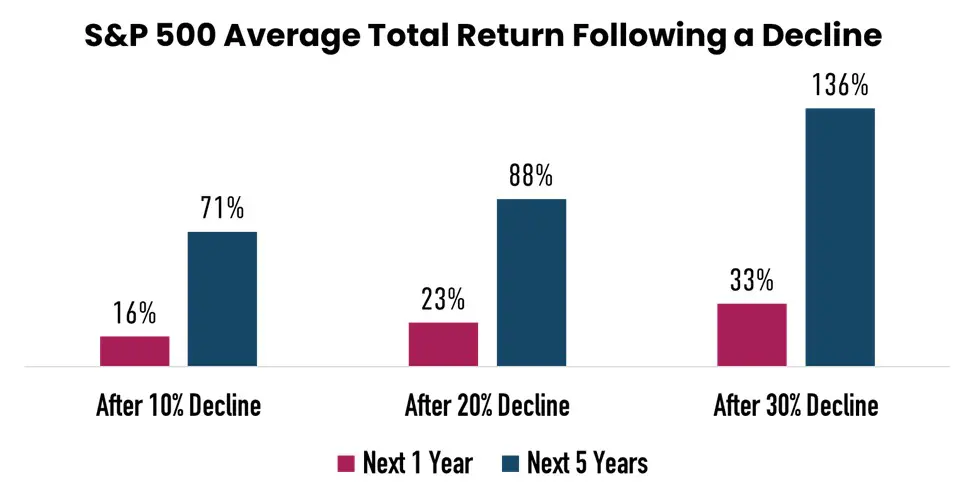

Reason 3:The Stock Market Usually Bounces Back Quickly After a Decline

Let’s say the market is already down. What comes next? Of course there are no guarantees, but historically the S&P 500 tends to recover from losses quickly.

Average Forward Returns Following Market Declines

As seen in the following chart, when the S&P 500 was down 10% or more in a 12-month period, on average it rose 16% over the next year and 71% over the next five years. When it was down 20% or more, on average it climbed 23% over the next year and 88% over the next five years. And when it was down 30% or more, that was followed by a 33% average gain over the next year and 136% over the next five years.

Source: Bloomberg, Trajan Wealth estimates. Data from 1950 – 2025, measured over rolling 12-month periods.

Bottom line, stock market declines are no reason to panic. Historically, the market bounces back sooner or later (usually sooner). Successful long-term investors know to sit tight and wait it out.

Is Your Financial Plan on Track?

Discipline and patience are the keys to long-term investment success. For a fiduciary partner who can help you stay on track, contact Trajan Wealth.