My nephew called me the other day. He’s 22 years old and has been working at Starbucks the past two years. He managed to save a few hundred dollars, which he used to open a Roth IRA. I’ve never been prouder of him!

But he had no idea what to do next. I walked him through the logistics of getting the money invested, and then offered some simple advice:

- Start early.

- Buy stocks.

- Don’t sell.

I would say the same to any young investor.

Start Early:The Power of Compound Returns

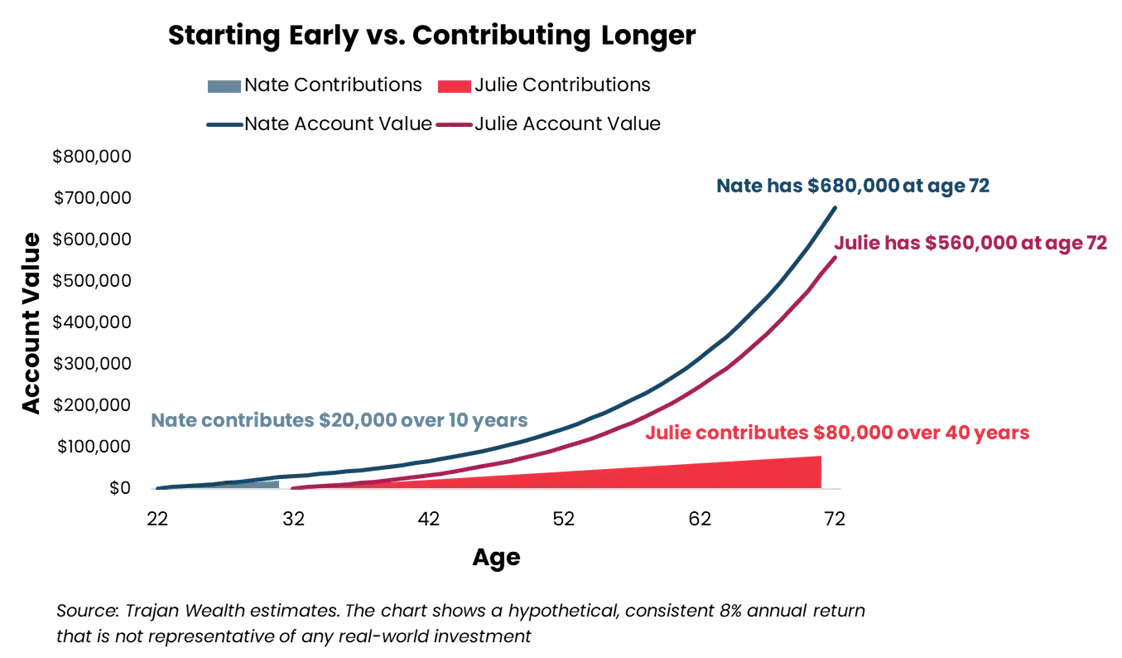

Pretend my nephew had a twin sister: Let’s call them Nate and Julie. Nate starts investing $2,000 per year at age 22. He does that for the next 10 years, and then never invests another dime. Julie gets a later start. She invests $2,000/year beginning at age 32, but she continues to invest a similar amount for the next 40 years, to age 72. Assuming they both earn an 8% annual return, who do you think will end up with more money by age 72?

The Math Behind Starting Early

Would you be surprised to learn that it’s Nate, even though he only contributed for 10 years instead of 40? It’s true! Using the assumptions above, Nate would end up with nearly $680,000, compared to Julie’s $560,000. That’s the importance of starting early. Nate’s account would have longer to compound returns, which more than makes up for the lack of contributions in the later years.

Buy Stocks:Aligning Assets with Your Investment Horizon

To avoid taxes and penalties, my nephew will have to wait until age 59½ to withdraw earnings from his Roth IRA. In other words, his investment horizon is at least 38 years, and possibly longer depending on when he eventually retires. With an investment horizon like that, choosing an asset allocation is straightforward: Focus on stocks.

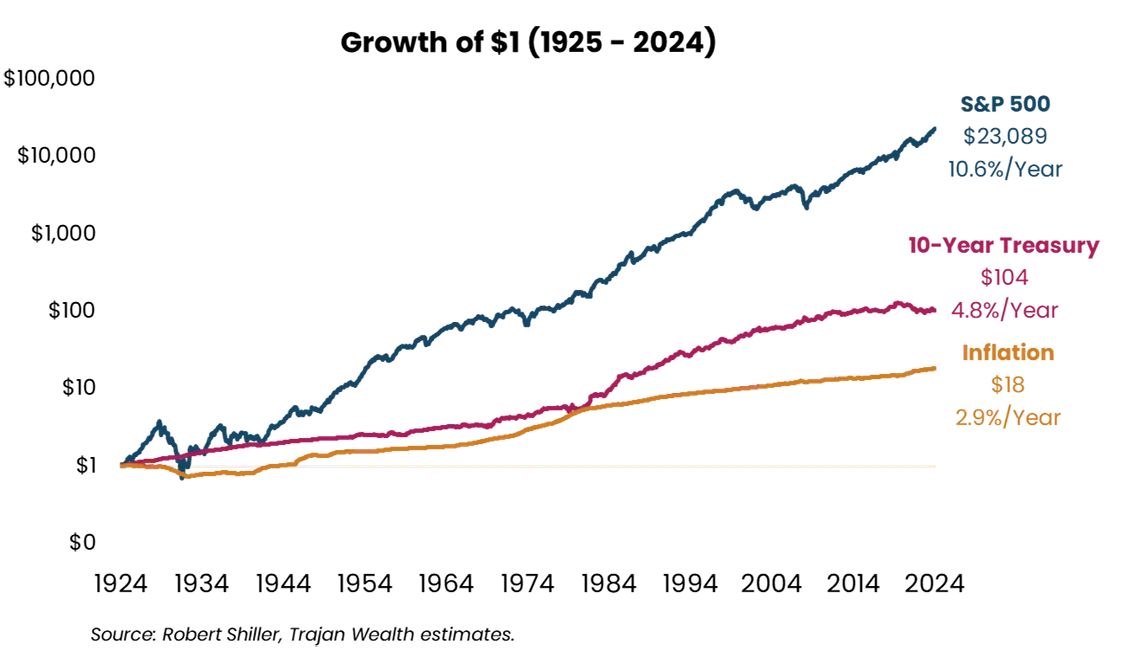

The Long-Term Outperformance of Stocks

Stocks have massively outperformed bonds and most other liquid assets in the long run. For example, $1 invested in the S&P 500 (or predecessor indexes) at the beginning of 1925 would have grown to more than $23,000 by the end of 2024. That’s a 10.6% annualized total return compounded over 100 years. By comparison, an investment in the 10-Year Treasury would have only grown to about $104, or a 4.8% annualized return over 100 years. Inflation averaged 2.9% per year during this time.

Understanding Stock Market Volatility

The tradeoff with stocks is volatility: You must be willing to tolerate some major ups and downs, including the occasional bear market (a 20%+ decline) or even more serious crashes. The S&P 500 declined more than 50% during the 2008-09 financial crisis! That brings me to my last bit of advice…

Don’t Sell:Discipline and Patience are the Keys

The worst thing an investor can do, at any age, is to panic and sell during a bear market. That’s how you turn a temporary setback into a permanent loss. I would even suggest not checking your account statements, though hardly anyone has the discipline to do that. Vanguard founder Jack Bogle suggested the same:

“This is one of the most important rules of investing. If you never peek from the age of 20 to the age of 70, you’ll rip that first 401(k) statement open at age 70, and I recommend you have a doctor on hand because you’ll go into a dead faint. Your heart might even stop. You’re going to have an amount of money you can’t even imagine.”

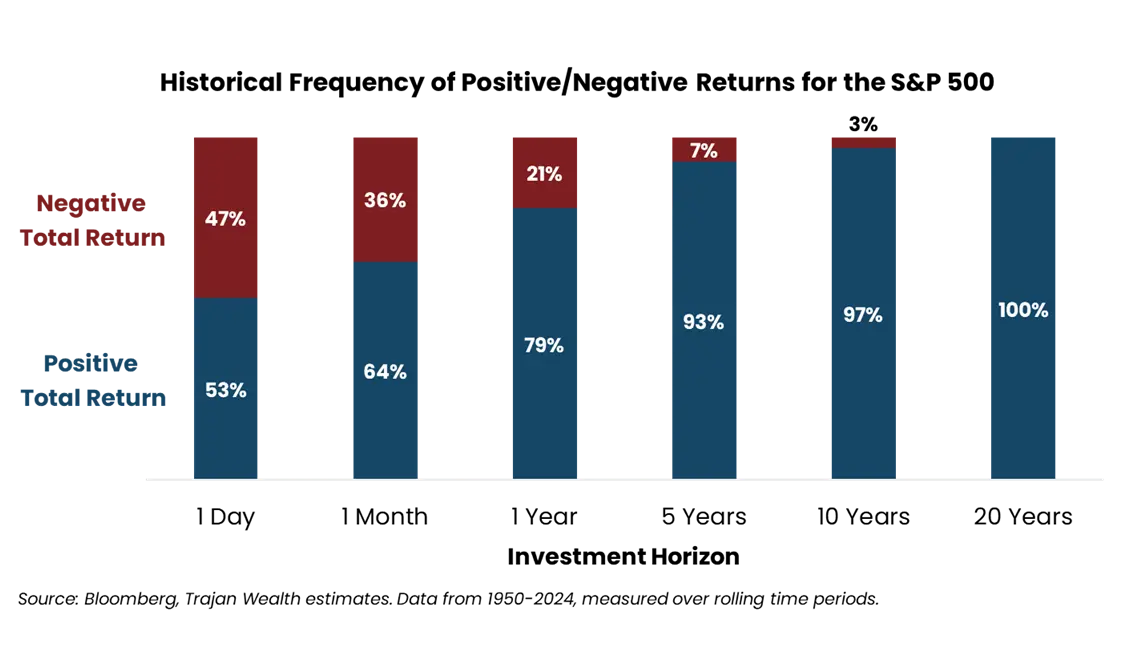

The Historical Probability of Positive Returns

Discipline and patience are the keys to success for a stock investor. The longer your investment horizon, the higher the probability of a positive outcome. Historically, the S&P 500 has delivered a positive return on only about 53% of trading days, but 79% of 1-year periods, 93% of 5-year periods, 97% of 10-year periods, and 100% of 20-year periods.

A Simple Formula for a Prosperous Retirement

So good luck, “Nate”! Start early, buy stocks, and don’t sell—a simple formula for a prosperous retirement.

![]()

Don’t Wait to Start Building Your Retirement Wealth

Contact Trajan Wealth today for a free consultation.