The Trump Administration’s announcement of ‘reciprocal tariffs’ has introduced a significant layer of uncertainty into the market landscape, demanding a thorough reassessment of potential consequences. Historical parallels, particularly the Smoot-Hawley tariffs, serve as a stark reminder of the potential for economic disruption. While we acknowledge the inherent risks, we also recognize the importance of proactive analysis and strategic planning. At Trajan, our aim is to provide a balanced perspective, equipping our clients with the insights and tools necessary to navigate this evolving situation with informed confidence. We believe that understanding historical context, combined with rigorous analysis of current market dynamics, is crucial for mitigating potential risks and identifying opportunities for strategic adaptation.

Our intention is to provide a realistic assessment of the potential consequences (if the tariffs stand) rather than “sugar coat” the current market turbulence (S&P 500 now down -15.3% YTD, NASDAQ -20.9%, Dow -11.5%)1 with the bland “everything works out” in the long run forecast. As investment practitioners, our job is to be open, transparent, and insightful; otherwise, we lose credibility.

Let’s take a closer look:

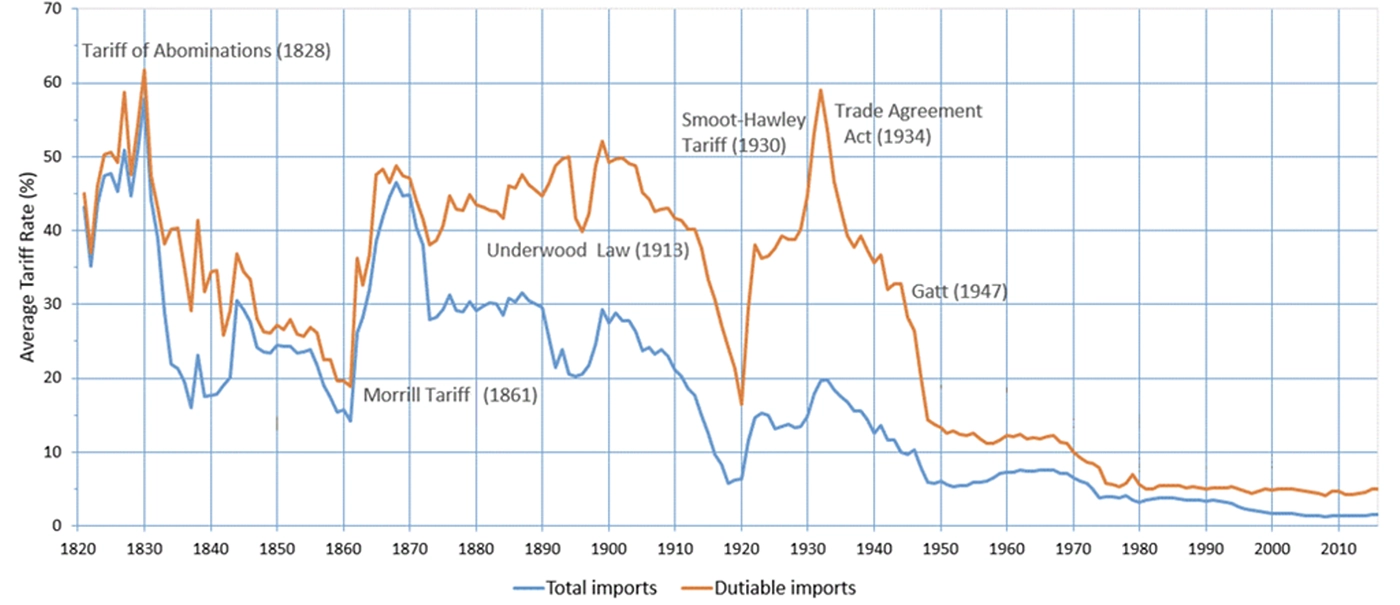

1. The tariffs are large and sweeping….but not unprecedented! The last time we saw tariff increases of this magnitude was in 1930, following the stock market crash of 1929. Congress instituted the Smoot Hawley tariffs in 1930, increasing tariffs on dutiable imports by 20% to 30%, and overall tariffs by almost 10%. Sounds familiar? This coincided with the onset of the Great Depression and economic pain across much of the world as trade partners retaliated. High tariffs remained in place through much of the 1930s and into World War Two – see graph below. Indeed, some economic historians (read Niall Ferguson’s The War of the World) attribute the rise of political instability in Europe and the Far East to the economic stresses and business fissures of the 1930s – I’ll leave the reader to decide.

U.S. Average Tariff Rates (1821-2016)

Source: U.S. Dept. of Commerce, Bureau of the Census, Historical Statistics of the United Stated 1789-1945, U.S. International Trade Commission, dataweb.usitc.gov

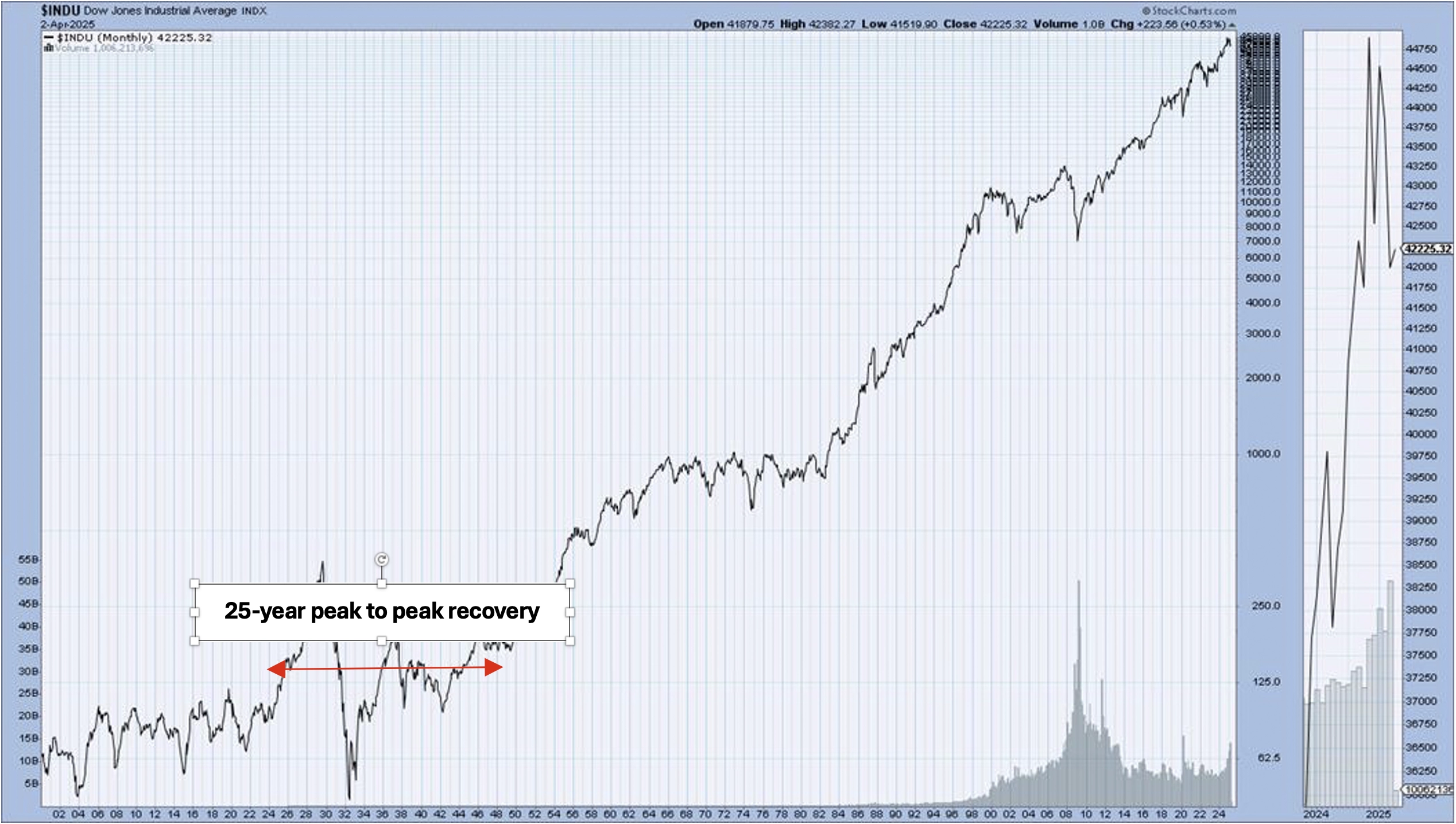

2. Since tariffs of this magnitude are not unprecedented, what happened in the markets the last time? Briefly, it took 25 years2 for the index tracking Blue Chip US Stocks – the Dow Jones Industrial Average to fully recover – during which the index delivered an annual average return of 0%, with a standard deviation of almost 25%. Yes, stocks do win eventually but can experience decades of negligible returns. Also, as regards tariffs, corrective policy changes help in market recoveries…

Source: stockcharts.com

3. Why are tariffs so negative for the capital markets? TARRIFS ARE TAXES on individuals and the private sector, which explains why policymakers in the United States have used it sparingly/judiciously and in a targeted manner in the post-World War Two years. Indeed, tariffs and the economic malaise they helped generate in the 1930s were identified as a factor in the political turmoil/war that followed, culminating in various post-war agreements, including Bretton Woods and the General Agreement on Trade and Tariffs (GATT) in 1947. Look at the first chart once again – by the early 1950s, the Smoot Hawley tariffs were completely unwound. The correlation with stock appreciation (see chart two again) is striking. To be sure, correlation is not causation, but the economic stimulation effects of lower taxes (and I reiterate tariffs are taxes) are beyond dispute. Also, the acceleration of equity returns following the repeal of tariffs – seen in the slope of the Dow Chart since 1950, provides further evidence businesses produce the strongest earnings when faced with limited government in both tax and trade policy. The economic performance of nations that segmented themselves from international trade reinforces the view the correlation between economic efficiency and unrestricted competition.

4. Why is the Trump Administration pursuing this? We conjecture that the administration is playing a high stakes poker to reduce tariffs among our major trading partners. Previous administrations too pursued targeted tariffs to change counterparty behavior – Clinton threatened to increase duties on Japanese cars in the mid 90’s to stop currency manipulation, both Trump and Biden imposed tariffs on Chinese steel/aluminum to punish dumping, Biden sanctioned the export of critical technologies to China to punish IP theft; but these were limited and targeted. Many view Trump’s tactics as a ploy to bring other countries to the negotiation table to reduce/eliminate their tariffs on US exports. As of the time of writing, the situation remains fluid. The reduction of tariffs by all countries along with the repeal of Trump’s tariffs would be the best possible outcome – an outcome that most of us hope will happen.

5. But “hope” is not a strategy. Clearly, a tariff war is not in anyone’s interest – yes, the US will probably be the least impacted by a global slowdown given that the US imports much more goods than it exports, but collapsing global growth will affect all countries if an off-ramp solution is not found. In similar vein, certain industries will be affected more than others – large exporters will be impacted more than companies that have a domestic revenue base, but nothing is absolute! Exporters whose products have limited substitutes may be less impacted, companies with largely domestic revenues may still face higher input costs if inputs are subject to international supply chains, the list goes on… But if economic growth lifts all boats; the converse is also true – falling or slow growth increases the possibility of falling/stagnant corporate earnings and/or business failure. A proven way of managing through downturn is to invest in high-quality companies that generate superlative levels of free cash flow and carry little or moderate amount of debt on their balance sheets. That way, even if there is a pullback in earnings and cash flows, businesses have the wherewithal and time to make necessary adjustments. To varying degrees, our internally managed public equity strategies have done just that. Yes, many of our holdings have experienced large drawdowns over the past two days – but almost all of them have strong balance sheets and the wherewithal – both in terms of cash, time and managerial acumen, to adjust to various macro scenarios – AAPL, MSFT being illustrative examples. Others without significant global exposure, but subject to pricing pressure in the event of a downturn – UNH for example, still have low debt and tidy margins.

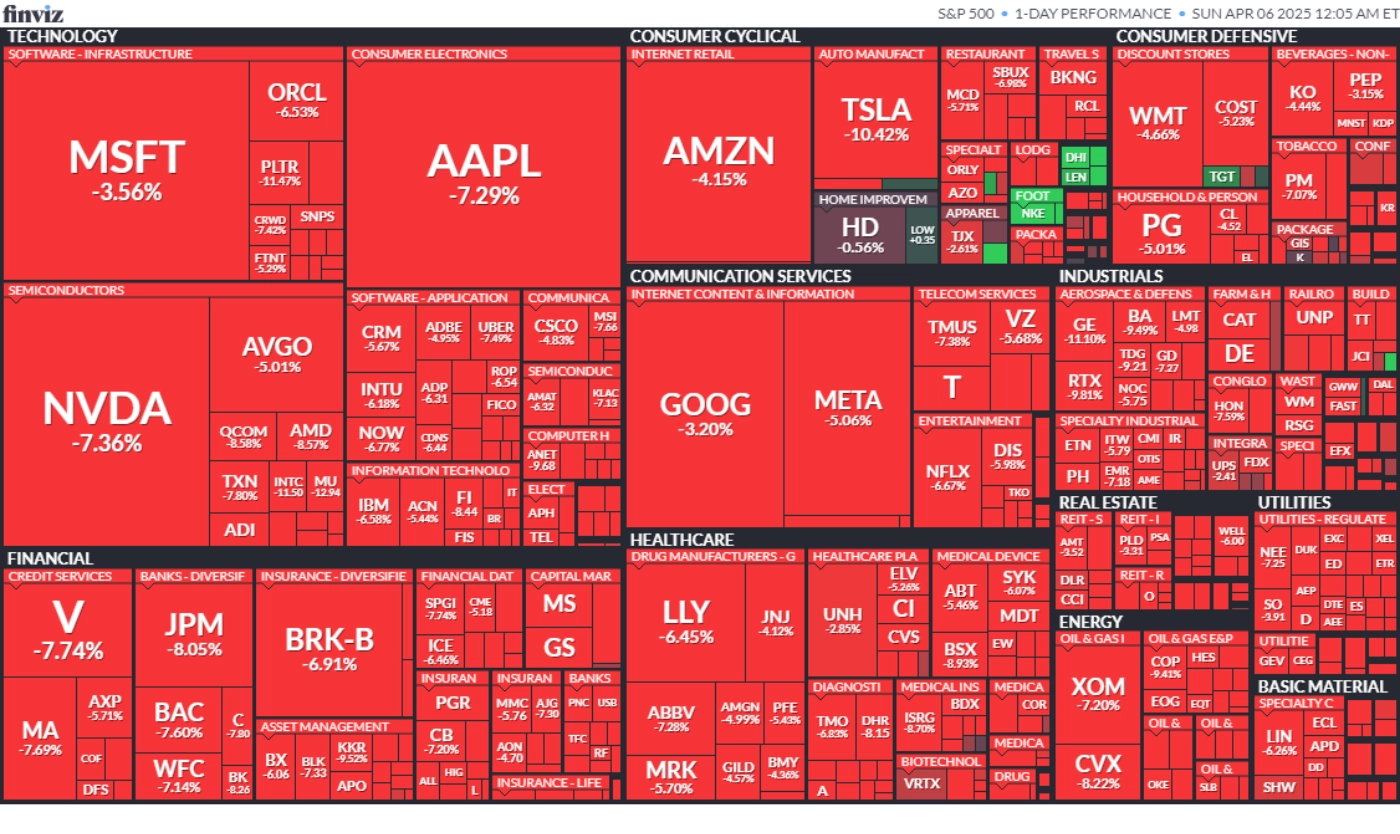

6. Shortcomings of intra asset class diversification. A well-established axiom of investing is that diversification limits portfolio volatility. The dampening of volatility is achieved by having portfolio positions that do not move perfectly in tandem with each other, which is to say, the portfolio positions are not perfectly correlated. While this is largely true, correlations aren’t stable. During periods of extreme market volatility, particularly on the downside, correlations tend to converge if the return streams – capitalized future corporate profits are exposed to the same economic forces. We are witnessing some of this correlation convergence in the public equity markets as depicted by the S&P 500 heat map below. The red boxes depict a snapshot of the direction of S&P 500 stocks – notice the overwhelming composition of stocks experiencing drawdowns during the afternoon trading session last Friday – April 4th, 2025.

Source: finviz.com

7. Asset class diversification. The current scenario, if not anything, illustrates the need for asset class diversification. Income generating assets help dampen volatility and reduce portfolio duration. For investors who aren’t qualified for alternative assets – allocations to high-grade fixed-income assets (US Treasuries, US Agency Backed Mortgages, Investment Grade Corporates) should be part of an overall allocation. Our Core Strategies give you a variety of options.

In summary, the proposed tariffs present a complex challenge that warrants careful consideration. Historical precedent suggests that significant market adjustments may occur, and recovery can be a protracted process. However, history also demonstrates the market’s capacity for eventual recovery and the potential to adapt. At Trajan, we understand the importance of preparing for potential volatility while remaining vigilant for emerging opportunities. Our approach is grounded in a thorough analysis of both historical trends and current market conditions, enabling us to provide our clients with the tools and guidance necessary to navigate these uncertainties with informed decision-making. We are committed to helping our clients understand the potential challenges, mitigate risks, and position themselves for long-term financial resilience. While the path ahead may be uncertain, we believe that a balanced and informed approach is the key to navigating these complexities and achieving sustainable financial outcomes.

- As of COB April 8th, 2025

- Courtesy – Guggenheim