“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value.”

~ Alan Greenspan, former Chairman of the Federal Reserve Bank

Market Returns & Outlook

Coming off a superlative first quarter of 2023, momentum in the global equity markets experienced the jolt of three successive US CPI reports that showed inflation readings well beyond the Federal Reserve Bank’s 2% target. Markets across the globe retreated sharply as prospects for quick reductions in the overnight US Fed Funds rate dissipated during April. YTD returns on domestic equities range now from near flat in small and mid-cap stocks to 6.04% in the S&P 500. Bond returns have started to fall once again as yields across all maturities trended higher on the cautionary inflation outlook.

| Index | YTD TR (%) | April 2024 |

|---|---|---|

| US Large Cap – S&P 500 | 6.04% | (4.08)% |

| US Large Cap – Tech Heavy NASDAQ | 4.53% | (4.40)% |

| International Equity – MSACWI ex US | 3.02% | (1.73)% |

| US Small/Mid Cap – Russell 2500 | (0.24)% | (6.70)% |

| Bloomberg Aggregate Intermediate Bond Index | (3.28)% | (2.53)% |

Chart 1. Source – Bloomberg

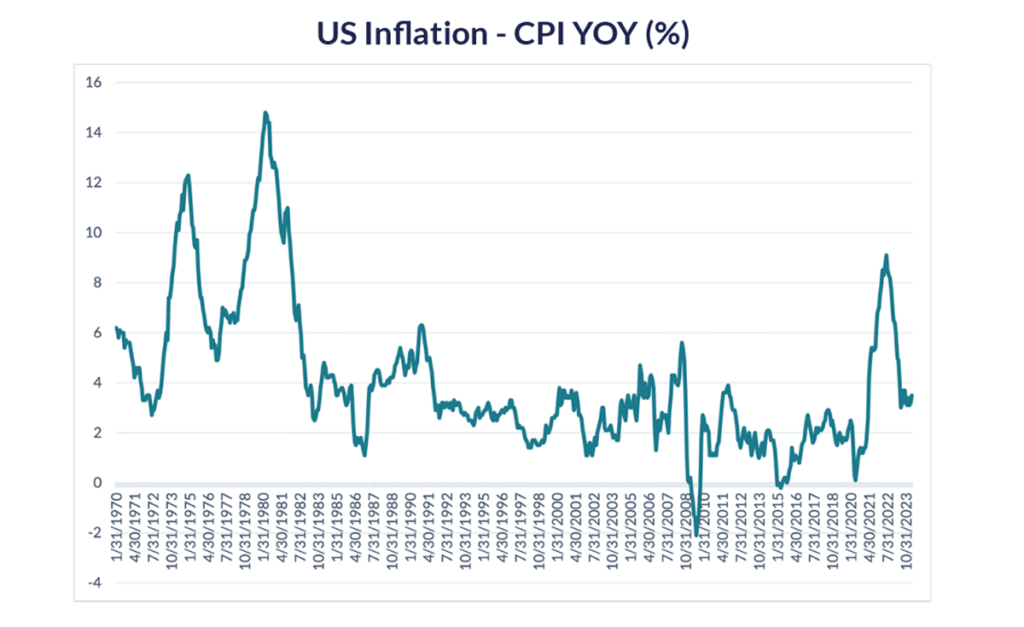

As evidenced from the chart on US Inflation, the downward trend in the Consumer Price Index seemed to stall during the first three months of 2024, the readings consistently coming in at above 3%, a full 100+ basis points above the Fed’s 2% target. Decomposing into the components of inflation, two drivers stand out – (i) housing costs and (ii) wage inflation. Housing inflation is measured by home rental costs (formally, “owners’ equivalent rent”) and wage inflation is measured by growth in the average hourly earnings of the US workforce. Sustained inflationary pressure on both metrics is not surprising – housing affordability is low due to high mortgage rates, thus the elevated demand for home rentals, and the tight labor market all but ensures strong wage growth to attract and retain workers.

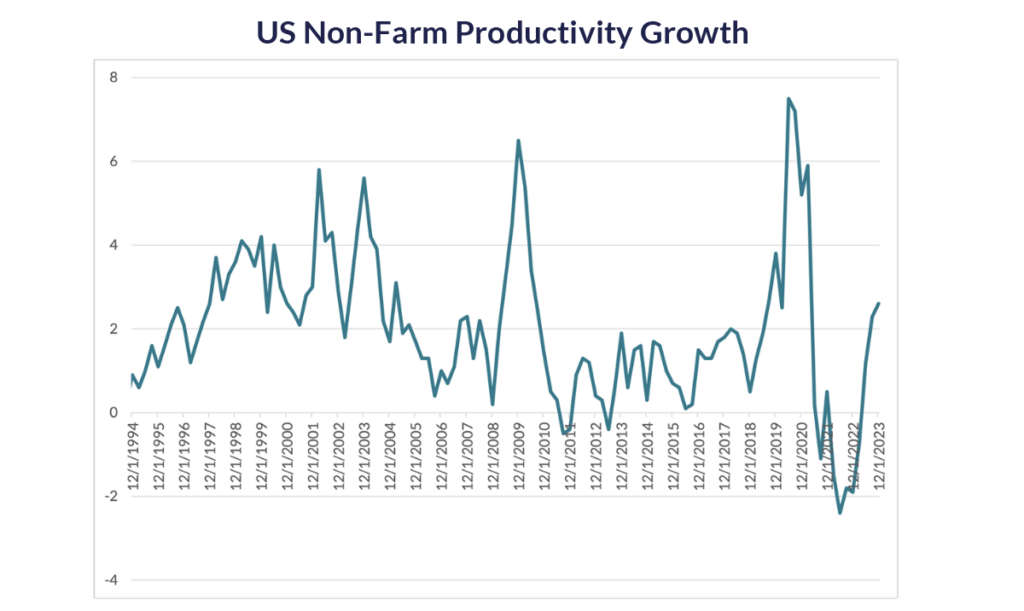

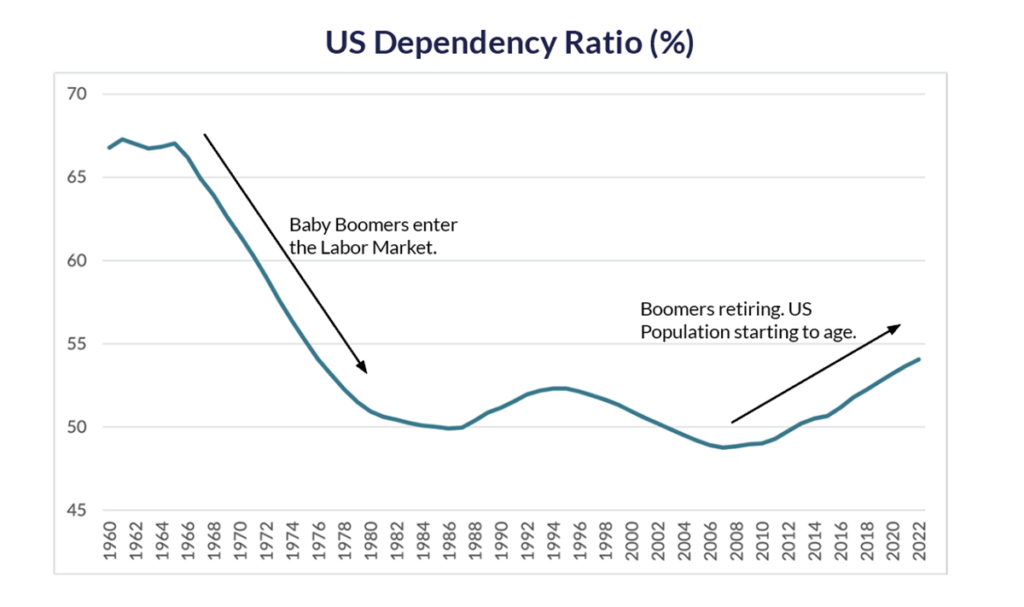

So, is the Fed’s 2% inflation target unattainable? This is an understandable question, given the aging demographics and restrictive immigration that limits the supply of eligible workers. Our answer is not necessarily – the effect of wage increases may be tempered or even offset if the workforce is more productive, creating goods and services better, faster, and cheaper. Throughout history, the key driver of productivity has been technology; and rapid developments in Artificial Intelligence (“AI”), Robotics, Digitalization, and Quantum Computing offer the prospects of decreasing unit costs because of rapid productivity growth. The chart below depicts this phenomenon – US productivity growth averaged a little over 2% since the 1990s – spiking during periods of recession (where the least productive workers are laid off) and bottoming during periods of full employment.

Chart 2. Source: Bloomberg

More recently, however, with increasing deployment of faster computing power, AI, comprehensive data science techniques, and advanced robotics, US productivity started a sharp upward spike (see US Non-Farm Productivity chart – year 2018 through 2020) to levels well higher than the 2% long-term average, before the Covid-19 related lockdowns disrupted businesses across the United States. Post the Covid-19 disruptions, productivity seems to be accelerating sharply once again as more companies deploy advanced technologies to stay competitive.

Chart 3. Source: Bloomberg

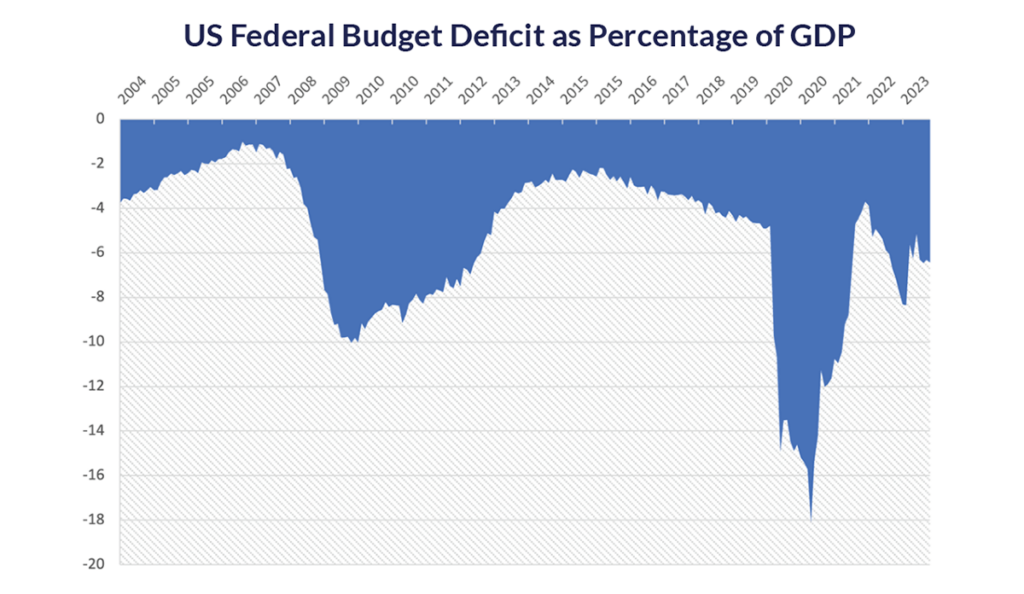

While productivity growth will help abate the inflationary effects of wage pressures, thereby helping in asset price returns, aging demographics in the US is a factor that we at Trajan Wealth build into our analysis when evaluating asset allocation and the long-term potential of client portfolios. As illustrated by the chart above, the US “Dependency Ratio,” which simply means the ratio of non-working “dependents” to active workers is increasing as the baby boomer generation starts to retire. Subsequent cohorts displayed smaller families, and the immigration spigot has been restrictive since the terrorist attacks of September 11th, 2001. The result – a larger ratio of non-workers to active workers, which translates into funding challenges for programs such as Medicare and Social Security and increasing burdens on the Federal budget. To keep the Medicare and Social Security trust funds solvent, the US government will have to either (1) raise taxes, (2) cut benefits, or (3) expand borrowing; the first two options are not positive for growth, while the third puts upward pressure on interest rates. We highlighted the growing level of US indebtedness in earlier monthly newsletters, suffice to say the federal deficits continue year after year at high levels to overall US GDP.

Chart 4. Source: Bloomberg

Implications

While we believe that inflation will eventually stabilize (perhaps at higher than the Fed’s 2% target), our assumptions for asset class returns going forward are considerably lower than what clients experienced during the “cheap money” period between the summer of 2009 through the first quarter of 2022. We expect rates on intermediate and longer maturities to remain range bound near current levels (4.5% on the US Ten Year Treasury, 4.6% on the US Thirty Year Treasury) through much of the upcoming cycle, very much in line with long-term averages if we strip the inflationary shocks of 1970’s and early 80s. Thus, compared to the past 10-12 years, we see less tailwind from cheap borrowing costs. Similarly, the prospect of higher taxes and/or rate shocks to the upside because of accelerating Federal debt paints a more sobering picture for most risk assets going forward.

Recommendations

We continue to advocate an elevated level of diversification across asset classes and develop specific asset allocation perimeters that cater to individual risk-tolerance thresholds. At the risk of sounding self-serving, we also believe that given our outlook for more moderate returns going forward, and the prospect of higher taxes, it may be prudent for clients to save and invest a greater proportion of their disposable income. For clients who are eligible, we would recommend calculated allocations to private assets – private equity, private commercial real estate, infrastructure and private credit to capture illiquidity premiums and potential manager “alpha” that comes from skill, access and club-deal networks. We will elaborate on private assets in our next newsletter.

*Private Equity investments: May require accreditation.