“Despite some severe interruptions, our country’s economic progress has been breathtaking. Our unwavering conclusion: Never bet against America.”

~ Warren Buffett

Inflation & Fed Policy

Speaking shortly after the annual Jackson Hole Economic Symposium, FOMC Chairman Jerome Powell stated – “We are moving our policy stance purposefully to a level that will be sufficiently restrictive to return inflation to 2 percent. At our most recent meeting in July, the FOMC raised the target range for the federal funds rate to 2.25 to 2.5 percent, which is in the Summary of Economic Projection’s (SEP) range of estimates of where the federal funds rate is projected to settle in the longer run. In current circumstances, with inflation running far above 2 percent and the labor market extremely tight, estimates of longer-run neutral are not a place to stop or pause”.

The chart below illustrates trendlines in the FOMC’s preferred gauge of inflation, the Personal Consumption Expenditure (“PCE”) Deflator. Note that while showing some signs of stabilizing, the headline readings seem firmly anchored in the 6% to 7% range, implying that FOMC will continue raising the overnight Fed Funds rate while instituting further monetary tightening by reducing the accumulated US Treasury and Agency Mortgage-Backed Securities from its balance sheet.

Fig 1: Bloomberg– US Personal Consumption Expenditure Deflator

Both of these monetary tightening tools will drain liquidity from the financial systems and put downward pressure on goods and asset prices.

The immediate question for market practitioners is how far the FOMC will have to raise overnight rates to be sanguine that the PCE Deflator, among other inflation gauges, start convincingly trending towards the Federal Reserve Bank’s 2% target. While the FOMC will necessarily be “data dependent,” it appears that inflation curtailment, rather than growth, is the Fed’s pressing priority. Accordingly, by year-end, the fixed income market is pricing in a 3.50% – 3.75% type overnight rate. The chart below depicts the December 2022 Fed Funds contract trading at $96.425, reflecting a probability-weighted rate of 3.575%. It implies a total of 1.25% to 1.50% of further rate increases at the September, November, and December FOMC meetings. The risk that hasn’t yet been priced in is the prospect of persistently high inflation going into 2023, which could force the FOMC to tighten beyond 3.50%-3.75% and substantially accelerate its balance sheet reduction program. In our opinion, this risk is not negligible and could pose a real detractor for both economic growth and financial market performance.

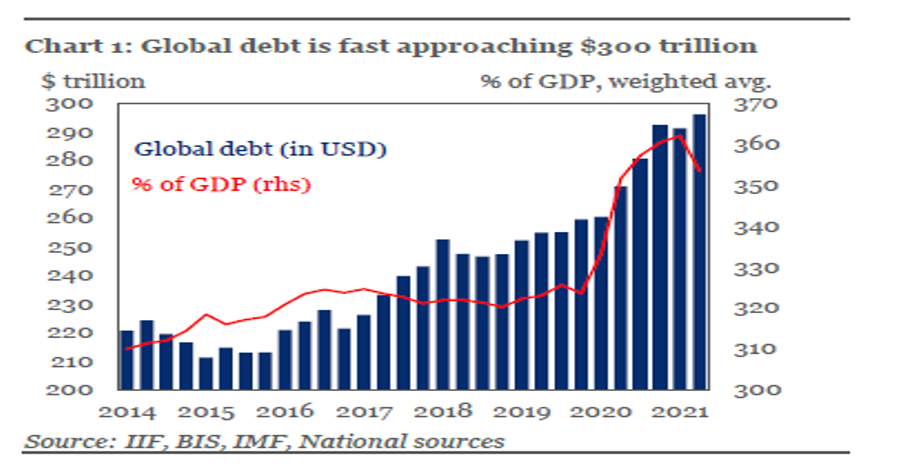

Longer term, we believe that rates will stabilize at the 3.50%-4.0% levels due to two developing macroeconomic trends. Firstly, the inflation problem is widespread and global, forcing most central banks in the developed and developing world to tighten monetary policy concurrently. The second and more pertinent trend is that international indebtedness is fast approaching unsustainable levels, given the higher cost of debt servicing brought about by global monetary tightening. Global debt, measured by debts owed by governments, non-financial corporations, consumers, and state and local government agencies, was estimated at $220 trillion in 2014, accounting for about 320% of global GDP. The 10-year US Treasury yield at the time was between 2.00% to 2.50%, and monetary policy was generally accommodative to help promote the conditions for sustained recovery from the 2008/2009 Financial Crisis. Fast forward to current times, the global debt has expanded to almost $300 trillion, and the world’s Debt/GDP ratio has risen to an alarming 370% driven by fiscal profligacy and stimulus programs instituted to combat Covid-19. To make matters worse, inflationary pressures and the rise in interest rates and debt servicing costs will almost certainly trigger a wave of debt restructuring and issuer defaults. This would drive contractionary pressures on consumer credit, business investment, corporate profits, and government spending.

Fig 2: Bloomberg– Fed Funds Futures Contract

Global Indebtedness…

Fig. 3 – IMF, BIS, IIF, National Sources – Global Indebtedness

…And Submerging Markets

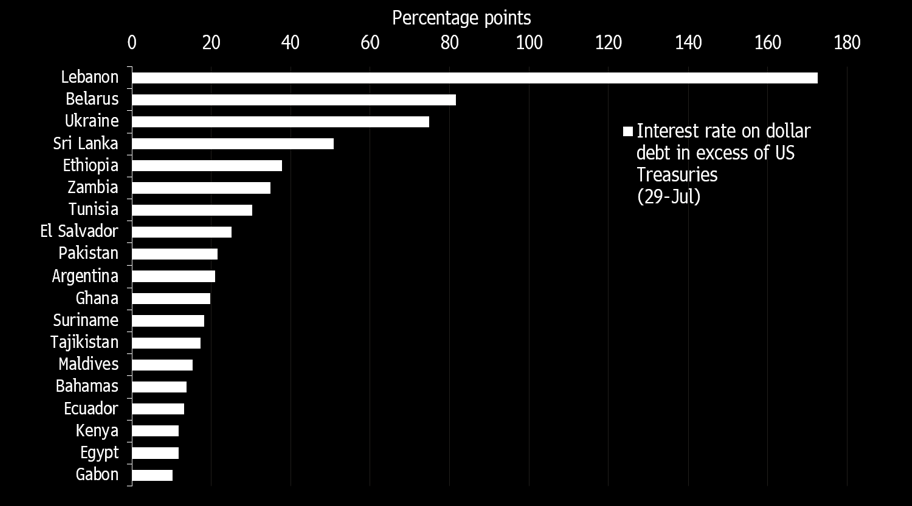

Fig. 4 – Bloomberg – Interest Rate Spreads on Sovereign EM US Dollar Denominated Debt

Early signs of a global wave of sovereign defaults are looming in the Emerging Markets. Inflated costs of essential imports – primarily food and energy commodities, are rapidly depleting the foreign exchange reserves of many large developing countries. Consequently, the external debt of these countries is being priced at yield premiums over US Treasury debt that imply a high probability of defaults – ranging from a 20% premium in Egypt to 30% in Pakistan and about 80% in Ukraine and Belarus. The International Monetary Fund (“IMF”) is facing a wave of bail-out requests, which cannot be extended simultaneously without additional injection of equity by the developed world. As such, cascading defaults across much of the developing world cannot be ruled out, and the knock-on effects of credit contraction could certainly hamper global GDP growth.

Implications

Elevated levels of global debt will most likely raise borrowing costs across the world, generating headwinds for corporate profits and consumer spending. Unlike previous cycles, when the US Federal Reserve Bank was able to support growth with large scale injections of market liquidity, we are now experiencing quantitative tightening on a substantial scale. Relatedly, the lever for fiscal stimulus (government spending) is also limited by unprecedently high debt burdens. As such, we expect a tempered return environment in the financial markets going forward and a considerable level of dispersion between highly indebted and lowly leveraged issuers. In terms of geographical regions, with emerging markets in turmoil, and anemic growth prospects in the non-US developed world, we foresee bouts of “flight to quality” to US assets in the upcoming cycle. The “fight to quality” prospect is also underpinned by elevated geopolitical uncertainties that show little possibility of immediate resolution.

Recommendations

As investment practitioners, we continue to advocate an elevated level of diversification across asset classes in accordance with individual risk-tolerance thresholds. However, we believe that non-traditional asset classes – “real assets” such as real estate merit consideration in light of persisting inflationary pressures. We also expect elevated levels of market volatility going forward, if only due to rapidly rising financing costs. As such, absolute return strategies – trend following, equity/credit market dispersion, which benefit from volatility may be appropriate for certain investors in an overall asset allocation. We continuously look for these unique sources of returns for our clients and will make recommendations as we develop additional strategies and updated asset allocation models.

In summary, with higher financing costs, lower projected growth, and an uncertain geopolitical environment, we would advocate a distinctive “quality bias” in overall portfolio management, overweighting issuers with low debt and discernible pricing power. Furthermore, history has proven the efficacy and regeneration capacity of the US economy and US financial markets in periods of economic and market distress – the self correcting mechanisms of capitalism and free enterprise have decisively delivered better outcomes than its alternatives. As such, we are maintaining a measure of “home country bias” in our portfolio construction strategies.

UDAYAN MITRA, CFA

~ Trajan Wealth Chief Investment Officer