The Trajan Wealth difference rests on two simple words: patience and discipline. Throughout our history of managing investor capital, we have consistently implored clients to focus on long-term investment outcomes rather than short-term price movements. The key distinction in our approach is our unyielding belief that investing in sustainable commercial enterprises which compound cash flow over time increases the odds of adequately funding long term liabilities, and sometimes a residual surplus that can be endowed to the next generation.

The alternative approach is investing in assets with a view that other market participants will offer a higher price, usually within a relatively short period, the proverbial “get rich quick” philosophy. The first approach, if managed prudently and incorporating a holistic spending and estate planning strategy, can deliver a measure of permanent capital for you and your progeny. It truly requires an investor mindset, underpinned by sound investing, lifestyle, and estate management; the results of which may take decades to bear.

The second approach, based on attempts to predict short-term price movements, is speculation, the results of which are subject to vagary of chance. As with most short-term bets, the odds are stacked up overwhelmingly against the speculator, quite possibly detracting from the desired outcome of financial security and intergenerational wealth transfer possibilities.

Taken together, the question is not simply how to grow wealth, but how to build something durable enough to support life over decades, and possibly across generations.

Beyond Investing: Lifestyle, Savings, And Discipline

As a comprehensive wealth management firm, Trajan Wealth offers investment solutions to match the financial circumstances and investment objectives of a wide range of clients and prospects. On the investment side, besides advocating for sound portfolio construction incorporating the ambits of asset valuation, time horizon, risk tolerance, and diversification; we are strong advocates for incorporating the “Endowment Model” for eligible individuals and families.

Put simply, the Endowment Model led by the late Yale CIO, David Swensen, entails incorporating less crowded “alternative investments” to a portfolio of public stocks and bonds, which traditionally constituted the classic 60/40 stock-bond portfolio that practitioners used to fund long term retirement obligations. The intuition behind the Endowment Model is that adding private assets – private corporate equity, commercial real estate, private loans along with the trading acumen of market makers/arbitrageurs in the publicly traded markets (often called the “hedge fund” industry) into the traditional 60/40 mix should not only help diversify investment portfolios but potentially enhance overall returns.

The Yale Model and Institutional Performance

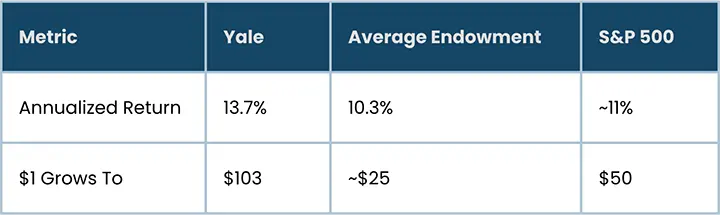

Over time, alternative asset allocations also incorporating investments in venture capital and expansive array of natural resources ranging from farmland and agricultural commodities to energy and mining rights helped provide further optimization of permanent capital portfolios. More recently, infrastructure projects have also entered the spectrum of alternative assets. The efficacy of the endowment model – widely deployed by large, institutional sized “family offices” – has proven itself over time. Swensen’s investment track record is incomparable. Over those 36 years, Yale produced an annualized gain of 13.7% per annum, outperforming the average endowment (as measured by Cambridge Associates) by 3.4% per annum. In dollar terms, outperformance during Swensen’s tenure represented over $50 billion in value added relative to the average endowment. Without spending, a single dollar invested at the start of his tenure would have grown to nearly $103 by the end of the 36 years. By comparison, a dollar invested in the S&P 500 index would be worth slightly more than $50.

When Swensen began his career as Yale’s chief investment officer, the typical institutional fund was invested in a traditional “60/40 portfolio” comprised of 60% domestic equities and 40% bonds. Swensen, alongside long-time collaborator Dean Takahashi, took principles of modern portfolio theory espoused by his mentor, Nobel laureate James Tobin, and his fellow Nobel laureate Harry Markowitz, and established an approach to endowment investing that transformed the institutional investment landscape and became known as the “Yale Model.”

Emphasizing diversification and equity orientation to take advantage of Yale’s long-time horizon, Swensen expanded Yale’s portfolio into alternative assets such as hedge funds, real estate, timber, and private equity long before such an approach became standard. The pioneering work paid off. Measured relative to the traditional 60/40 portfolio, Yale outperformed by 4.0% per annum under Swensen’s watch.

Yale Endowment vs. Benchmarks (36 Years)

Sources:

https://news.yale.edu/2021/05/06/self-confident-yet-selfless-yales-david-swensen-dies-67

https://news.yale.edu/2021/10/22/david-swensens-coda

We at Trajan Wealth are comprehensively building our investment offerings suite to empower clients to exploit the portfolio enhancement possibilities that more institutional sized family offices have been able to achieve by deploying a bespoke version of Yale’s Endowment Model framework.

The Second Leg: A Disciplined Savings Strategy

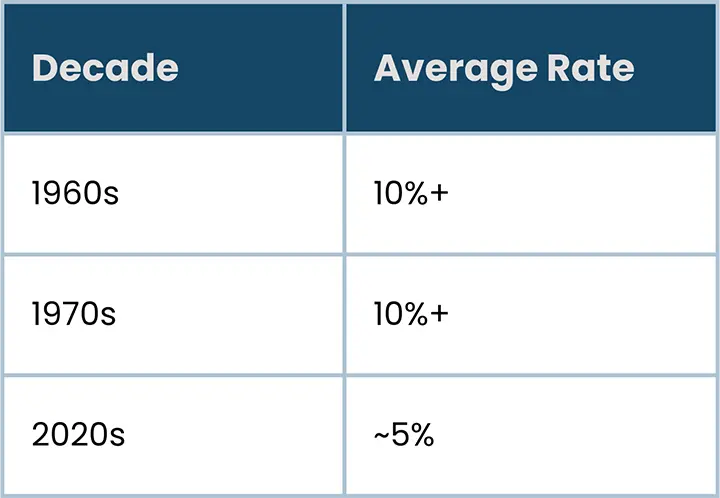

Unfortunately, the desired outcome of building financial security and quite possibly inter-generational wealth, is not simply predicated on sound investment strategies. To be sure, patience and compounding are essential levers to pull, but the second leg of the stool is a disciplined savings strategy. This is where most Americans fall abysmally short. Data from the US Federal Reserve clearly demonstrate this shortcoming. The double-digit US savings rate of the 1960s and 70’s has progressively trended lower, amounting to just 5% annual income as we pass halfway of the current decade.

U.S. Personal Savings Rate Trend

Source:

https://fred.stlouisfed.org/graph/?g=1P9XY

Without consistent saving, most Americans can’t really benefit from compound interest because they simply don’t have enough money left over from their income to invest. Clearly, some of this is not by choice – the cost of living has increased sharply over the past half decade, but we at Trajan still implore delayed gratification as a measure to limit unnecessary consumption, if the overall objective is to adequately fund long-term retirement liabilities. There is an increasing bifurcation in the nation’s populace between the investor class and the “have nots”; and our mission as fiduciaries must include wealth education to promote healthy savings.

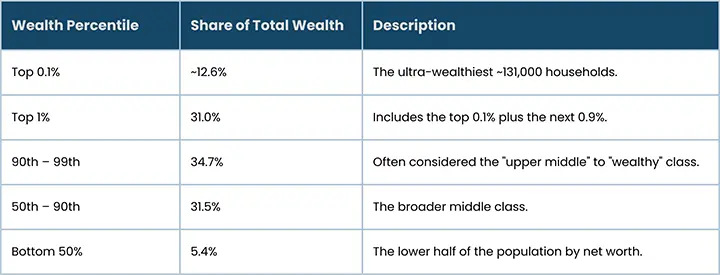

Data from the Federal Reserve highlights the distribution of total net worth across different wealth tiers:

Source:

https://fred.stlouisfed.org/release/tables?eid=813804&rid=453

Building intergenerational wealth with a David Swensen mindset, and funding those investments with a disciplined savings strategy, increases the likelihood of achieving the “North Star” of wealth management outcomes – namely, the building of permanent family capital.

Turning Life’s Certainties into Strategic Choices

Three certainties shape every financial life – death, illness, and taxes. There is not much that can be done to counteract the first two certainties, but there is much that can be done to mitigate the destructive effect of taxation and to prepare thoughtfully for what cannot be avoided. This is where Trajan Tax & Trajan Estate come in to work hand in hand:

Trajan Tax: Minimizing Erosion

- Wall Street researchers are bullish on the outlook for “manager alpha” – durable excess returns for a unit of market risk.

- However, as the Yale Endowment experience articulates, even the best “alpha allocators” generate consistent excess returns of about 2%-4% per year. While the compounding effects of excess returns of such magnitude can indeed be game changing, it pales in comparison with the compounding effects of avoiding or deferring investment returns that are subject to the slippage of income or capital gains taxes. It’s worth noting that marginal income tax rates are as high as 37%, while taxes on long term capital gains range from 15% to 20% after a relatively modest exemption.

- Working together with Trajan Tax, Trajan Wealth’s Advisors help “quarterback” investment and tax planning strategies to maximize after tax investment returns which then can be deployed by the Investment team to maximize compounding opportunities.

- It’s crucial to have a reliable resource that keeps up to date with all the tax law changes year over year to ensure that the tax strategy is still applicable and efficient.

- It’s also important to know that if you have businesses, rentals and trusts, you’ll have special considerations for your taxes, and that if not all provisions are considered, many deductions and credits will be forgone. Forfeiture of tax concessions effectively increases an investor’s tax burden.

Trajan Estate: Preserving Wealth for Generations

- Dynasty trusts give family offices a way to structure distributions with care, using tools like discretionary distributions or incentive clauses, so heirs are protected from impulsive spending that could erode the principal. With a corporate or professional trustee overseeing the assets, wealth flows out deliberately for clear needs like education or health, rather than vanishing into one generation’s lifestyle choices.

- Assets in a well-structured dynasty trust aren’t owned outright by beneficiaries, creating a firm legal barrier. This shields family wealth from an heir’s personal creditors in bankruptcy, blocks seizure in civil lawsuits, and keeps it separate from marital divisions in divorce.

- A dynasty trust’s core strength lies in sidestepping federal estate tax, gift tax, and generation-skipping transfer (GST) tax across multiple generations. By capturing the GST exemption from the start, assets (and all their growth) pass to great-grandchildren and beyond untouched by the 40% federal tax bite at each transfer.

- More than protection, dynasty trusts carry forward a family’s deeper strength: its values and purpose. Through a Letter of Wishes or embedded mission statements, family offices can steer wealth toward philanthropy, entrepreneurship, or community service, ensuring the legacy endures as something meaningful, not just spending power.

Viewed through a family office lens, these certainties become planning opportunities. Thoughtful tax, estate, and fiduciary investment coordination can reduce slippage, protect more of what has been built, and align resources with deeply held priorities around family, responsibility, and legacy.

Trajan’s Family Office Under One Roof: The Strategic Advantage of a Unified Approach

The path to achieving the “North Star” of wealth management, permanent capital or intergenerational wealth, is paved with myriad complexities. Trajan’s holistic approach incorporating advice on lifestyle and savings, disciplined and efficient investing and estate planning can help investors like you navigate the landscape with ease and confidence.

In practical terms, that means a coordinated plan built by a unified team with integrated capabilities under the Trajan brand to reduce hand-off risk and reinforce performance: Fiduciary-only financial advising, proactive tax planning and preparation offered through the Trajan Tax team, and Estate planning through our internal law firm, all handled together inside one trusted firm, in alignment, and under one roof.

Instead of piecing together advice from disconnected professionals, your Trajan Family Office framework helps:

- Turn a savings strategy into consistent fuel for long-term investing.

- Apply an institutional-style Endowment Model, where appropriate, to pursue more resilient, diversified growth.

- Coordinate investment, tax, and estate decisions so that more of what is earned and built is available to fund your lifestyle and legacy.

Click below or call your Trajan Wealth Advisor at (866) 518-1306. Let’s align your plan to reinforce financial security and residual capital that can be passed on to your next generation.

Talk with Your Trajan Wealth Advisor

The opportunity is not only to grow assets, but to bring order, discipline, and coordination to every part of your financial life – so that you are better prepared, more resilient, and positioned to win over the long arc of your wealth-building story.

Thank you for reading and for the opportunity to help you ‘Plan Smarter. Dream Bigger.’