Historically, companies that pay a portion of their profits in dividends on their common stock have been an attractive source of income for income-oriented investors. Mutual funds and ETFs that focus on companies that have a history of paying and growing their dividends have been popular among investors, especially those who have moved from the capital appreciation phase of the investment cycle to the distribution phase of the cycle. In addition, these types of stocks have a history of providing attractive returns over time.

Growth and Value Indices:

Within the equity market universe, stocks of different companies are often segmented by various characteristics, including; Market Capitalization – small vs. large, Industry Group – these include Technology, Health Care, Industrials, and others. The S&P 500 is segmented into 11 industry groups. Another common segmentation is to separate companies into two buckets known as Growth and Value. Growth stocks are those companies who are growing revenues/sales at above market rates, while Value stocks are typically slower growing companies in terms of sales/revenues. Value stocks typically are found in industries like Transportation, Health Care, Consumer Staples, and Utilities, while Growth stocks are usually found in the Technology and Consumer Discretionary industry groups. In addition, Value stocks typically pay out a portion of earnings in dividends while growth stocks often do not pay dividends. Growth stocks usually trade at above average valuation multiples where Value stocks usually trade at or below the market averages.

Relative Performance of Growth and Value

One of the most widely used equity market indices is the Russell Indices – a series of equity market indices developed by the Frank Russell Company and launched in 1984. The main index is the Russell 3000 a market capitalization weighted index that represents 97% of the US equity market. Starting with the Russell 3000 the index is then divided into several sub-indices including large-cap, small-cap and growth and value. The chart below shows the performance of the large-cap growth and large-cap value indices since their inception in 1984.

One of the key takeaways from this chart is that, over long periods of time, the rate of return for the large-cap growth and large-cap value subsets is very similar. However, in certain periods the performance numbers can differ significantly. A good example of those performance differences was the 10+ year period from 2009 to 2021, when the returns on growth stocks significantly outpaced the returns of value stocks. For the past 12-18 months. those differences have largely been erased. We believe this trend will continue for some time as investors return to what has been the more stable subsector of the large-cap equity universe. For income investors, we believe this is a good time to take a hard look at the value universe.

Characteristics of Growth and Value Indices:

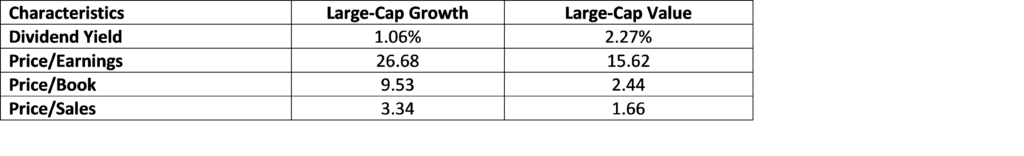

The table below shows some of the key valuation metrics of the two Large-Cap indices. As you can see from these metrics, growth stocks trade at elevated multiples to value stocks. There are several reasons for the differences, but the main driver is that growth stocks have a solid history of growing revenue and earnings at a faster pace than value stocks and, as such, command higher multiples than value stocks.

While the differences in the metrics are significant, what these numbers do not tell you is whether a particular stock – value or growth – is an attractive investment. The old adage that “a good company is not necessarily a good investment” is one investors should always keep in mind when evaluating any stock. A good investment, whether it be a growth or value stock, is one whose price is reasonable relative to its future earnings potential. The key to finding good stocks is being able to “sort the wheat from the chaff”. While investors can benefit from both growth and value stocks, the characteristics of the two types of companies are important when one is looking at their investment goals.

Conclusions

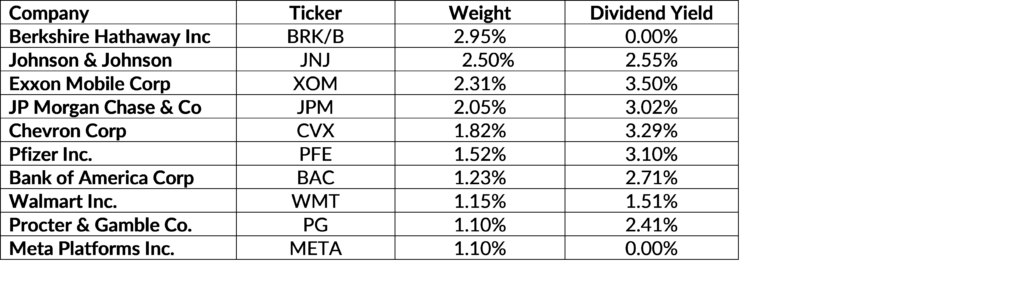

For investors seeking current income, we believe dividend-paying common stocks are a good source of income. Most stocks which meet the criteria of income-oriented investors can be found in the large-cap value universe, as opposed to the large-cap growth group. Below is a list of the ten largest members of the Russell Large-Cap Value Index and their dividend Yields.

In addition to traditional fixed-income securities and preferred stocks, we believe an excellent source of regular income are common stocks of companies that pay a regular dividend and who have a history of growing their dividends. In the current environment of rising interest rates and slowing economic growth we feel these types of stocks are even more attractive.