The Difference Between a Financial Template and a Partner for Life

If your advisory relationship feels like you were dropped into one of a few pre-set strategies, you’re not imagining it. You’ve probably seen TV ads from national firms offering “clearly different money management”. Some large firms, due to their operational model that prioritizes scale and efficiency, may funnel clients into a narrow selection of pre-defined strategies. It’s efficient for them. But your life isn’t a template. Your taxes, legacy goals, retirement needs, concentrated positions, and risk tolerance are uniquely yours.

At Trajan Wealth, we’re built for investors who want a partner for life, not a number in a database. That means custom portfolios, a broader financial toolkit (including annuities and private markets when suitable), and coordinated services that extend well beyond investment selection like tax, estate, insurance, retirement income engineering, and more, delivered by one coordinated team.

| Trajan Wealth | Large “One-Size-Fits-All” Advisor | |

|---|---|---|

| Wealth Management | ||

| Retirement Strategies | ||

| Client Education | ||

| Annuities & Life Insurance | ||

| Private Markets Investing | ||

| Tax Planning & Preparation | ||

| Estate Planning & Coordination | ||

| Business Owner Solutions |

Bottom line: We start with you, not a pre-set model. We don’t believe in “set it and forget it”. Your financial plan evolves as your life does, and we evolve with you.

Portfolio Diversification Strategy:Quality Over Quantity

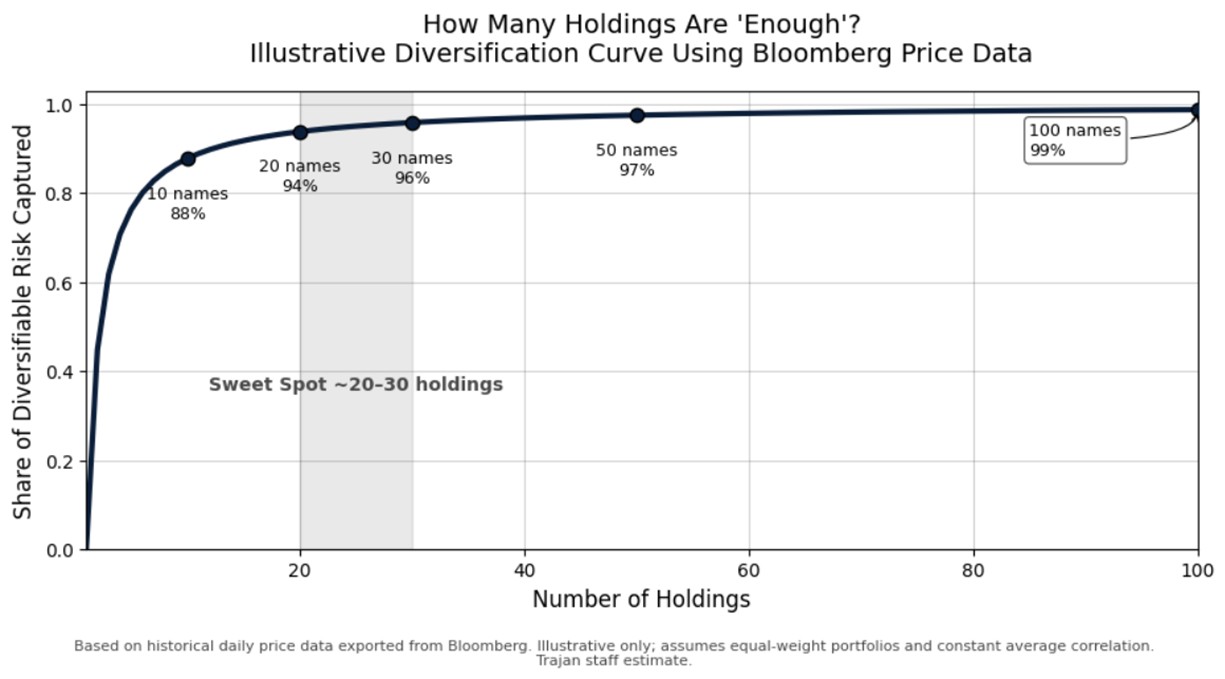

Have you noticed how many of the big-brand RIA “model portfolios” cram in 100+ stocks? That’s not precision, that’s a parts bin. There’s a myth that more holdings automatically means better diversification. In reality, over-diversification dilutes conviction and adds complexity. Think of it this way, when every idea is a small sliver, you’re basically paying active management fees for index déjà vu.

How many stocks do you really need?

- With sensible sector, style, and factor balance and by avoiding redundant, highly correlated names, 20 to 30 stocks can capture the vast majority of diversifiable risk for a core equity sleeve.

- The key isn’t the ticker count; it’s how those stock returns are correlated to the rest of your portfolio.

The Risks of Over-Diversification

Why an overstuffed, 100+ name list can backfire:

- Closet Indexing and Fee Inefficiency: You pay active fees for an index-like result. Any true “edge” gets diluted across too many tiny positions.

- Signal-to-Noise Ratio Drops: Good ideas become rounding errors; low conviction names tend to accumulate.

- Operational Friction & Oversight: More trading, taxes, and monitoring complexity rise, while accountability falls.

- Unintended Risk Profiles: Too many overlapping exposures can leave you with an unintended risk profile or none at all.

Trajan’s Targeted Investment Approach

Why our targeted approach wins:

- Quality over quantity: We build 20–30 high-conviction positions sized for impact, not for decoration.

- Two engines, one portfolio:

- Quantitative research screens for durable factors that have mattered over time (quality, profitability, valuation, leverage, stability).

- Fundamental, bottoms-up analysis validates business durability, management discipline, and realistic forward cash flows.

- True diversification by design: We engineer intentional differences across sectors, factor tilts, and revenue drivers, so each holding actually adds something.

- Tax and trading aware: Fewer, better positions reduce needless turnover and support tax-smart rebalancing.

Bottom line: A thoughtful, targeted portfolio of 20 to 30 well-researched companies can deliver ample diversification and a clearer path for value-add than a scatter-shot list of 100+ names. If you want index-like exposure, buy the index. If you want conviction with accountability, buy a portfolio built to matter.

Annuities as a Strategic Risk Management Tool

Some big-name RIAs treat annuities as something to be avoided. If your advisor’s entire annuity policy is “never,” that’s not a plan; it’s a bias. Used thoughtfully, annuities can be a powerful component of a real-world plan: income flooring, longevity insurance, and tax-deferred growth features that can help address sequence-of-returns risk when retiring from volatile portfolios. (Source: SSRN)

At Trajan Wealth, annuities are never one-size-fits-all. We evaluate them alongside other solutions, disclose costs and trade-offs, and use independent carrier comparisons through our licensed insurance affiliate. If an annuity doesn’t improve your plan, we won’t recommend it.

Bottom line: We see annuities as a tool, not a doctrine. When the tool fits, it can meaningfully improve cash-flow reliability and reduce behavioral mistakes during periods of heightened volatility.

Private Markets: Enhancing Returns and Reducing Volatility

Public stocks and core bonds are the foundation, but they’re not the whole house. We offer curated access to private markets as a strategic sleeve of a modern plan. Private equity for potential value creation via active ownership, and private credit for contractual income from secured lending. (Source: McKinsey Institutional Investor)

When sized and selected thoughtfully, private markets can raise expected return potential and lower reported volatility, which can reduce correlation to public markets and improve overall portfolio efficiency. Results vary by manager, strategy, and cycle, so due diligence is required.

How Trajan Wealth Accesses Private Markets:

- Curated, not a marketplace:Deep due diligence on team, strategy edge, track record, and terms.

- Lower minimumsVia platform relationships to diversify across vintages and strategies.

- Negotiated economics (where possible)With full fee-stack transparency.

- Built for sophisticated investors:Right-sized allocations and tax coordination for eligible clients.

Bottom line: Used thoughtfully and sized appropriately, private markets can raise expected return potential while reducing overall portfolio volatility as part of a coordinated plan. (Source: McKinsey Institutional Investor)

Comprehensive Wealth Management:The Whole-Balance-Sheet Approach

Most investors don’t lose wealth because of a “bad mutual fund.” They lose it to uncoordinated decisions; missed tax opportunities, outdated beneficiary designations, or avoidable estate friction. That’s why Trajan Wealth integrates:

- Tax Planning & Preparation:Year-round strategy development plus evaluating your options to reduce your tax liability.

- Estate Design & Coordination:Beneficiary mapping, trust and titling guidance, and coordination with attorneys via our estate affiliate, so documents reflect your wishes, and your portfolio knows how to implement them.

- Insurance & Annuities:Independent comparisons for risk transfer and income planning, integrated directly into your financial plan.

- Retirement Income Engineering:Multi-account withdrawal sequencing, Social Security strategy, RMD management, and guardrails to help reduce sequence risk.

- Business Owner & Executive Solutions:401(k)/cash balance plan design, liquidity/exit planning, concentrated equity strategies, and philanthropic frameworks.

One Team. One Plan.Fewer vendors, fewer blind spots, faster decisions.

Evaluating Your Current Wealth Advisor

For a simple test of your current advisor, ask these five questions:

- 1. How will you lower my lifetime tax bill, not just this year’s?

- 2. Who prepares my taxes and coordinates with my portfolio team?

- 3. How do you mitigate sequence-of-returns risk in retirement?

- 4. Do you offer independent annuity comparisons and explain when to use them?

- 5. Who is responsible for my estate design and beneficiary map, and how often is it reviewed?

If the answers are vague or outsourced with little coordination, you’re likely in a product lane, not a true household plan.

Conclusion: Personalized Financial PlanningReady for Advice That Matches Your Life?

If you’re tired of feeling like “just another account,” let’s build a plan that reflects your actual goals and constraints without limitations. At Trajan Wealth, we are one coordinated team, accountable to your outcomes. Get started today!

Sources:

• Model Portfolios Surge as Financial Advisors Focus on Scaling Business. (2025, August 12). InsuranceNewsNet. insurancenews.net

• Pfau, W. (2019/2021). Research and white papers on sequence-of-returns risk and retirement income frameworks (buffer assets/annuities among solutions). SSRN

• Edlich, A., Croke, C., Dahlqvist, F., & Teichner, W. (2025, May 20). Global private markets report 2025: Braced for shifting weather [Report]. McKinsey & Company. McKinsey

• Robard, Y. (2025, March 24). Why private equity wins: Reflecting on a quarter-century of outperformance [Report]. Institutional Investor