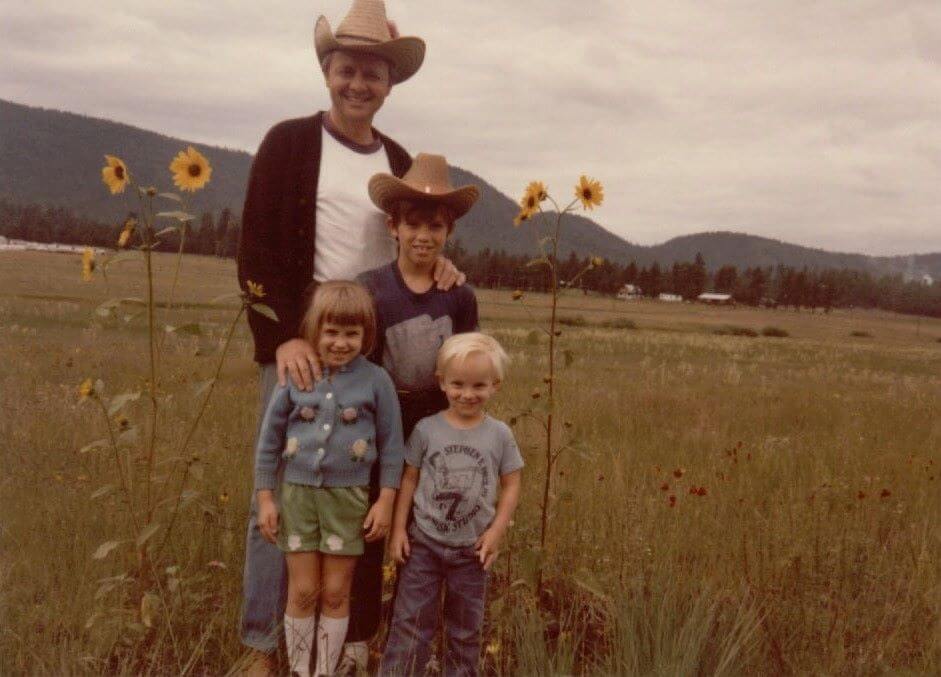

While my dad’s firm was slow in the summer, most summers at our firm were busy. If getting our estate planning done has been in the back of our minds, it often comes to the forefront as we contemplate traveling for an extended period of time. This is especially true when we are traveling with our spouse and leaving other loved ones such as our children behind.

As we plan our vacations, whether near or far, it’s crucial not only to consider the destinations and activities but also to recognize the importance of having an estate plan. While it may seem unrelated at first, knowing our affairs are in order can bring peace of mind and enhance the enjoyment of our travels.

When we head off on our summer travels, we often leave behind our responsibilities and worries, seeking enjoyment and relaxation instead. However, this doesn’t mean that we can completely disregard our future and the well-being of our loved ones. Just as we take steps to plan our vacations meticulously, we must also take steps to plan our estates properly.

One of the main reasons why having an estate plan is crucial is to ensure that our loved ones are well taken care of in the event of our untimely demise. While contemplating our mortality can be uncomfortable, acknowledging the possibility and preparing for it can bring a sense of relief and control. Having an estate plan allows us to make decisions about asset distribution, guardianship of minors, and other important matters, ensuring that our loved ones are provided for according to our wishes.

Just as we plan our summer travels to familiar or unfamiliar destinations, an estate plan can help us navigate through unfamiliar legal territory. Estate planning involves understanding complex laws and regulations, tax implications, and factors that could affect the distribution of our assets. Seeking professional advice and guidance, such as that of an estate planning attorney or financial advisor, can provide us with the necessary expertise to make informed decisions and avoid potential pitfalls.

As we embark on our summer adventures, taking the time to reflect on the need for an estate plan can be a valuable exercise. Just as we plan our vacations to maximize enjoyment and minimize stress, an estate plan allows us to live our lives to the fullest, knowing that we have taken care of our loved ones and secured their future. While it may not be the most exhilarating topic, estate planning provides peace of mind and ensures that our legacies are preserved long after our journeys end.

Kent Phelps

Attorney, CEO and cofounder of Trajan Estate