Bonds. Treasury Bonds.

Bond Investing 101

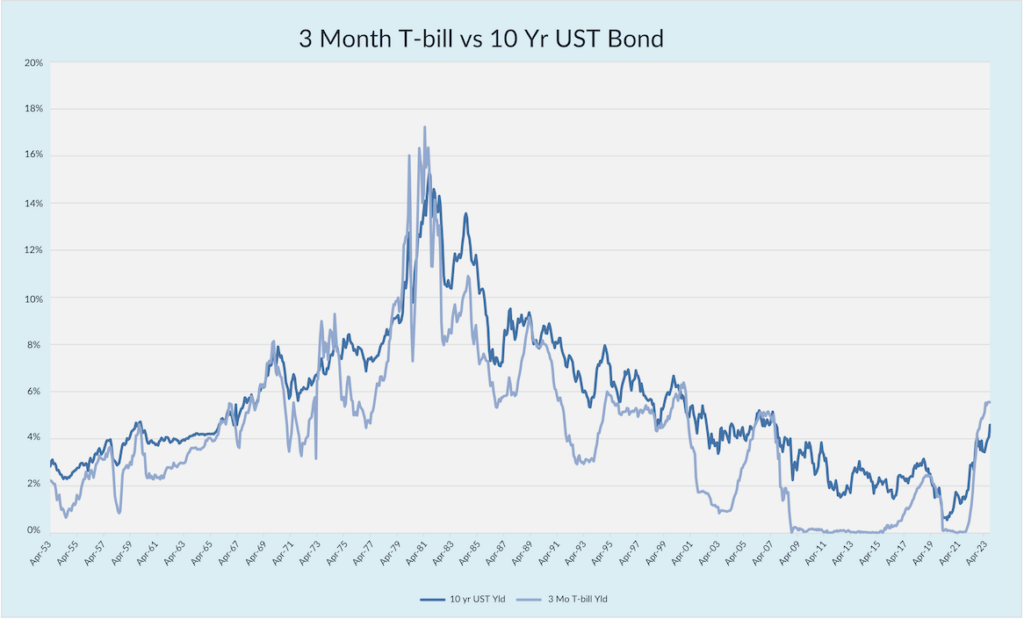

A History Lesson

During the late 1970s, when “Volcker Fed” was fighting the highest inflation this country had experienced in its history, rates on short-term US Treasuries (0-1 Year maturities) reached 20%. At that time the yield on 30-year US Treasury bonds was approximately 14%.

The FRED (Federal Reserve Database):

Stirred, Not Shaken

Where we go from here

Members of the FOMC have repeatedly stated that they do not believe the inflation fight is over and they still have work to do to bring the rate of inflation back to its 2% target, ensuring that inflation expectations are contained. While the Feds rhetoric remains hawkish, the recent price/yield behavior of the bond markets suggests investors believe the next moves by policymakers may be to reduce the overnight funds rate. If we are approaching terminal rates, investors will experience the best bond market returns by moving out of short-term instruments into intermediate and long-duration bonds.

Trajan Wealth has two fixed-income strategies that have durations in the 3–7-year range. The Trajan Short Duration portfolio has a duration of between 3 and 4 years, while the Opportunistic Fixed Income portfolio has a duration in the 7-year range. Both strategies are focused on high-quality corporate bonds and government-guaranteed debt. In addition, both strategies have performance histories that meet or exceed their benchmarks over short and long-term investment periods. We feel that this is a good time to begin moving short-term funds into either the Short Duration and/or the Opportunistic Fixed Income strategies to capture the additional return from those longer-dated securities that will happen when rates begin to decline.

Sterling Russell, CFA

Sterling has over three decades of experience in the financial services industry and is the Director of Fixed Income at Trajan Wealth. Sterling earned a BA in Political Science and an MS in Economics from Brigham Young University and completed Post graduate studies in Economics at The University of Virginia.