“The financial crisis was linked to the fact that banks had excessive leverage and too many risky assets. The solution is not to try to dictate to banks what they can do or not do, but to require them to strengthen their capital to absorb potential losses and hold less risky assets.”

~ John Paulson, Former Treasury Secretary

Market Returns & Outlook

Buoyed by strong earnings releases for 2023 and the perception that the FOMC’s next move will be to reduce short-term interest rates, the equity markets posted a strong February – see table below. YTD returns on domestic equities range from 2.68% in small and mid-cap stocks to a whopping 7.33% in the technology-laden NASDAQ. Bond returns continue to languish as strong growth/employment data gives the FOMC the wherewithal to take a “wait and see” approach on inflation trends before cutting rates.

| Index | YTD TR (%) | February 2024 |

|---|---|---|

| US Large Cap – S&P 500 | 7.11% | 5.34% |

| US Large Cap – Tech Heavy NASDAQ | 7.33% | 6.22% |

| International Equity – MSACWI ex US | 1.55% | 2.55% |

| US Small/Mid Cap – Russell 2500 | 2.68% | 5.43% |

| Bloomberg Aggregate Intermediate Bond Index | (1.68)% | (1.41)% |

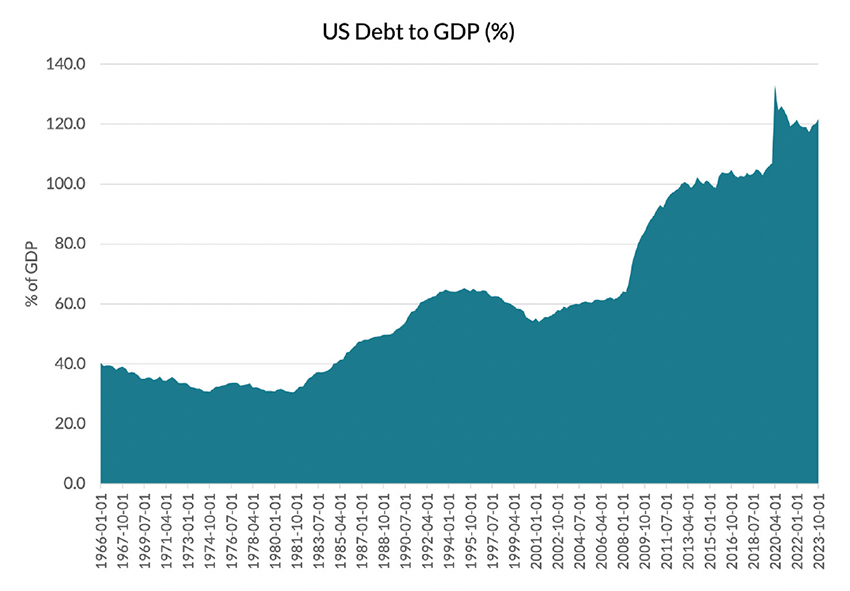

US Debt Interest Payment as a Percentage of GDP

Chart 1. Source: US Federal Reserve Bank

Now, while we certainly welcome the commencement of a “goldilocks environment”; which is to say, strong growth, employment, and corporate earnings data in the midst of decelerating inflation, there is a significant looming risk factor that makes us more nuanced in the future trajectory of returns across most risk assets. US Federal Debt is rapidly rising to alarming levels and consuming an ever-increasing percentage of the Federal budget.

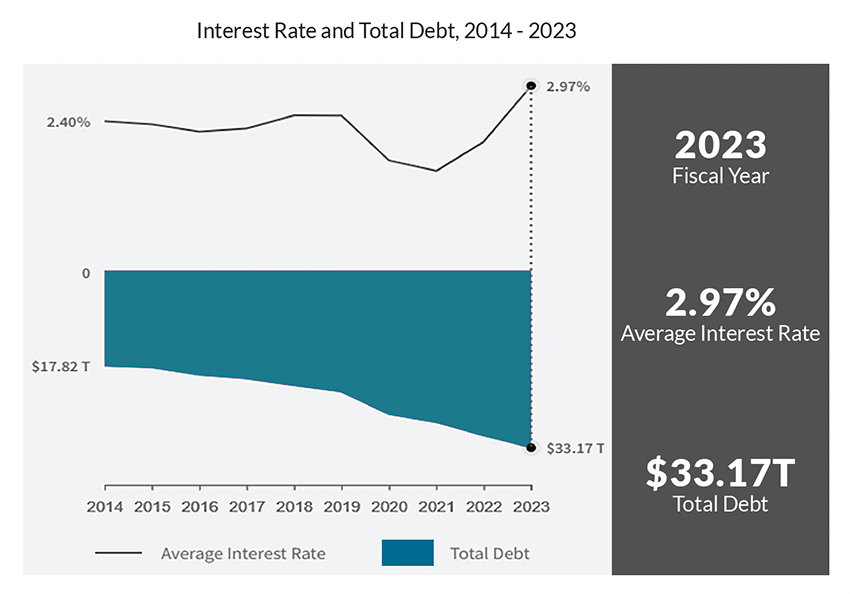

US Federal Debt Servicing Costs

Chart 2. Source: US Treasury

Implications

The combination of rapidly growing debt at the Federal Government level makes Trajan Wealth cautious on the level of intermediate and long-term interest rates, the benchmark for borrowing costs across much of Corporate America and, equally significantly, for the commercial and residential mortgage markets. At this juncture it is worth repeating that while the Federal Reserve Bank’s Open Market Committee (“FOMC”) has control and indeed discretion over overnight money market rates (commonly known as the Fed Funds Rate), yields in the bond market are determined by investors, partly based on the supply and demand of debt. In my last write-up, I cautioned our clients on the trajectory of our nation’s Federal budget deficits, suffice to say, in years when employment and growth have been strong, our policymakers have still been running up $1+ trillion deficits. As a result, increasing levels of US Treasury bonds are being issued to finance the deficit and the nation’s debt to GDP ratio (a measure of solvency) is rising at a rapid rate. Thus, it is prudent to assume that long-term interest rates across wide sectors of the credit markets may remain elevated (much like mortgage rates) since every credit instrument is priced at a risk premium to US Treasury notes and bonds. In summary, even while the FOMC cuts short-term rates, we do not expect commensurate declines in the rates that determine corporate borrowing or indeed our household mortgage rates. The increased debt servicing costs, both at the government and the private sectors, act as headwinds to business investment, consumer spending and government spending to stimulate the economy going forward relative to the past few decades. As such, we have a cautious outlook for the performance of risk assets and would like to remind our clients of the projections we derived last month – please see the table below.

Chart 3.

Recommendations

We continue to advocate an elevated level of diversification across asset classes and develop specific asset allocation perimeters that cater to individual risk-tolerance thresholds. In the context of higher yields and the prospect of slower economic growth, Fixed Income assets should command a higher weighting in most portfolios. With interest rates projected to be higher in the next cycle compared to the past, we believe there is a large possibility of “repricing” in certain interest rate sensitive sectors. High quality income-producing assets like commercial real estate and perhaps certain infrastructure-type assets may be available at dislocated prices offering attractive entry opportunities. We are actively seeking out these opportunities as they help reduce the duration of client portfolios through higher cash flow while dampening overall volatility. We would highly recommend our clients to reach out for a portfolio review if one hasn’t been done over the course of the last 24-36 months and discuss the opportunities in our alternative investment offerings, particularly real estate and infrastructure.

*Investment in private equity may require accreditation.*