Federal Reserve’s Dual Mandate

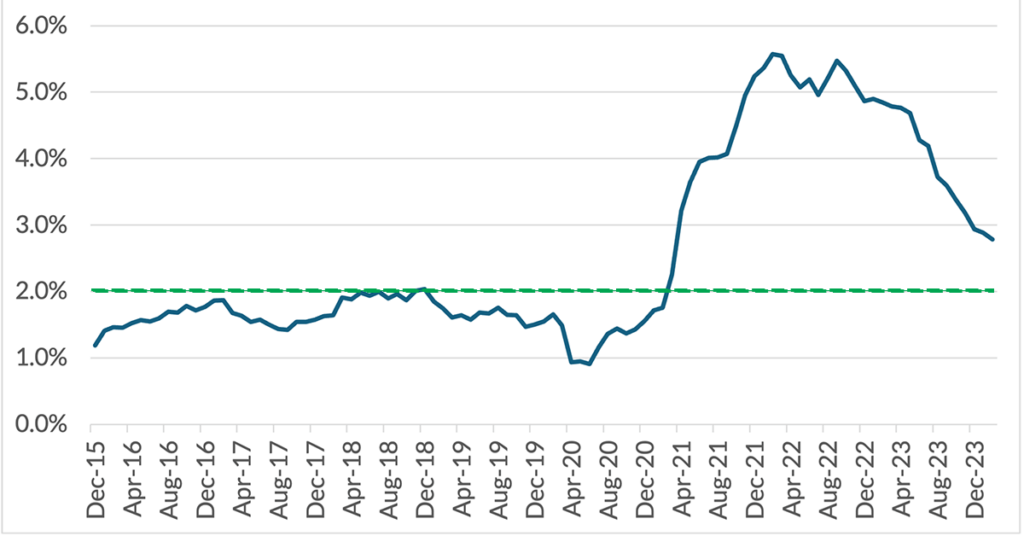

The Federal Reserve is tasked with a dual mandate, maximum employment, and stable prices. Maximum employment means that the Fed aims to achieve the highest level of employment without causing inflation. Stable prices are defined as a 2% inflation rate over the longer term. The 2% target is believed to be consistent with achieving and maintaining price stability while allowing enough room for the economy to grow. The Fed monitors three key metrics to guide its policy actions: Gross Domestic Product (GDP), unemployment, and inflation (as measured by Core Personal Consumption Expenditures or Core PCE).

Core PCE (Annualized Inflation Rate)

Source: Bloomberg

Recent Rate Hikes

In March ’22, the Fed began hiking interest rates to quell inflationary pressures. This was one of the fastest rate cycles in history, as measured by the speed and magnitude of the rate hikes. The Fed paused rate hikes in July’23 to allow their actions to permeate the economy. Interestingly, the Fed is always driving the economy using the rearview mirror. Meaning, they are always reacting to events that have already occurred. Simultaneously, there is a time lag between Fed actions and the observable impact on the economy. While the Federal Reserve has made significant progress in lowering inflation, it remains stubbornly above their 2% target.

Soft Landing?

The Fed is attempting to navigate an economic “soft landing” by cooling inflation without tipping the economy into a recession. However, we believe the fight to bring inflation back to the 2% target will be difficult to achieve, and there will be bumps along the path to that goal. As an example, recent data reveals that the U.S. is still experiencing robust economic growth as GDP rose from 3.2% to 3.4%. Meanwhile, the unemployment rate has dipped to 3.8%, and the Consumer Price Index, another measure of inflation, has increased. Consequently, the Fed is unlikely to cut rates in the near-term and we’ll likely remain in a “higher-for-longer” rate environment until inflation falls further.

On the Brighter Side:Higher Rates Are Good for the Income Investor

Higher investment yields are beneficial to income-oriented investors. For those who rely on their investment portfolio to generate a regular income, such as retirees or individuals seeking a steady cash flow, higher yields mean more money in their pockets.

Trajan Wealth offers fixed-income strategies across the curve to help clients meet their investment goals. The Trajan Ultra-Short Duration strategy has a target duration of 1-year and is designed to provide higher yields with minimal price fluctuations. The Trajan Short-Duration strategy has a target duration of 3-years, while the Trajan Opportunistic Fixed Income strategy has a target duration of 5-years. Both the Short-Duration and Opportunistic strategies are focused on high-quality corporate bonds and government guaranteed debt. For investors looking for income with some growth potential, we offer a Dividend Growth, Balance Income, and Low Volatility strategies. Given higher interest rates, we feel that this is a good time for income-oriented investors to lock-in investment yields.

Learn more about investment stategies with Trajan Wealth. Speak with a fiduciary advisor today!