Key Takeaways:

- Diversification helps reduce risk and smooth out returns by spreading investments across different asset classes, sectors, and regions.

- In volatile markets, diversification can function as a buffer by protecting against steep losses in any one sector.

- Strategic diversification isn’t about having “a little bit of everything.” It’s about thoughtful allocation based on risk tolerance, goals, and time horizon.

Volatility Is a Normal Part of Investing

This year has been a stark reminder that markets don’t always move in a straight line. After a strong start in Q1, volatility has returned. Persistent inflation, shifting Fed expectations, and geopolitical tensions have all sparked renewed volatility in both stocks and bonds. As we’ve seen, market leadership rotates, interest rates react swiftly to data, and sentiment can shift on a dime.

In this kind of environment, investors often ask:

“How can I protect my portfolio without sacrificing long-term returns?”

One answer rises above the rest: Diversification.

What Is Diversification?

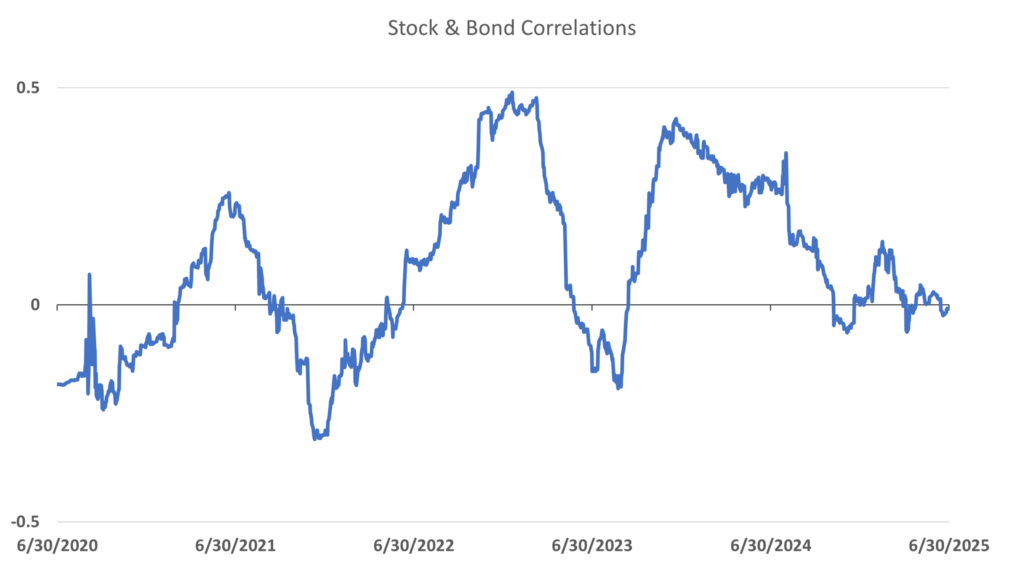

At its core, diversification means not putting all your eggs in one basket. A key principle behind diversification is correlation, which measures how different investments move in relation to each other.

- If two assets are highly correlated (close to +1), they tend to move up and down together.

- If they’re negatively correlated (close to -1), one tends to rise when the other falls.

- A low or zero correlation means their movements are largely independent.

When building a diversified portfolio, the goal isn’t just to own different sectors, it’s to own assets that respond differently to changing economic conditions.

For Example:

- Stocks and bonds often (though not always) move in opposite directions. Currently, stock and bond correlations are near zero. Low correlation, coupled with higher interest rates, means bonds can be a great tool for diversification.

Source: Bloomberg, Trajan Wealth estimates. Data as of 6/30/2020 to 06/26/2025

- Real estate and commodities may perform well during inflationary periods.

- Precious metals may rise when stocks fall during geopolitical tensions.

By combining low or negatively correlated assets, investors can reduce portfolio volatility without necessarily giving up long-term return potential.

Why It Matters in Volatile Markets

Volatility doesn’t just test your portfolio; it tests your discipline as an investor. When markets swing, emotional decision making can creep in. Benefits of Diversification:

- Reducing the impact of a downturn in any one asset class.

- Smoothing out portfolio returns, making it easier to stay invested.

- Creating opportunities as some assets rise when others fall.

- For qualified investors, private equity and private credit may offer uncorreltated returns to the public markets.

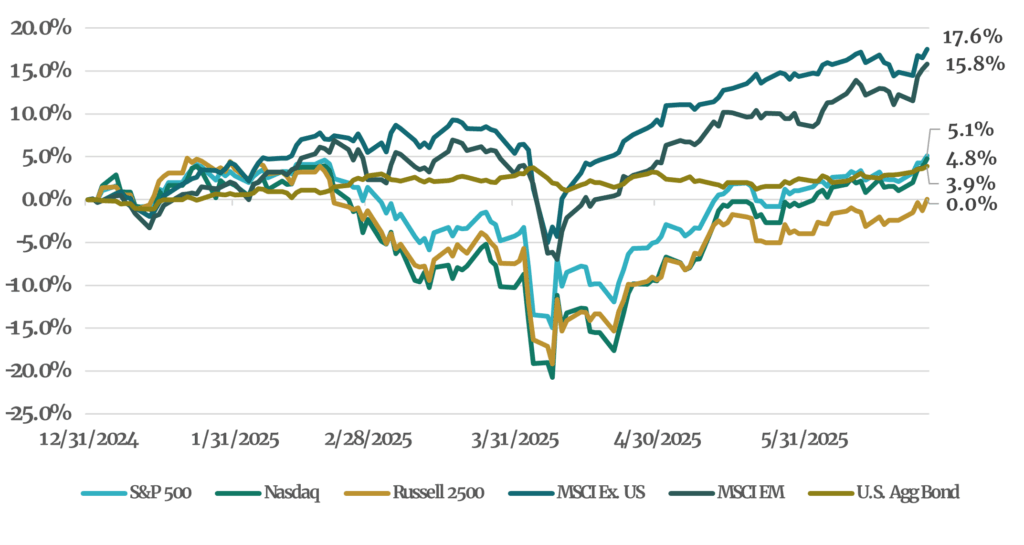

Real-World Example: First Half of 2025

- While U.S. growth stocks saw pullbacks, value and dividend-paying stocks held up better.

- International markets outperformed the U.S. in dollar terms.

Source: Bloomberg, Trajan Wealth estimates. Data as of 12/31/2024 to 06/26/2025

- Gold and commodities gained during periods of inflation anxiety.

- Short-duration bonds helped offset equity volatility.

A well-diversified portfolio would have captured upside in some of these areas even while others lagged.

It’s Not Just About Owning “More,” It’s About Owning “Right”

Some investors assume diversification means owning ten mutual funds or dozens of stocks, but if they all move in the same direction, you’re not actually diversified.

Types of Diversification:

- Asset class diversification (stocks, bonds, alts, cash)

- Geographic diversification (U.S., international, emerging)

- Sector and style (growth vs. value, cyclical vs. defensive)

- Risk profile alignment (high beta vs. low volatility)

- Location optimization (qualified vs. non-qualified accounts)

At Trajan Wealth, we take a strategic approach to diversification by building portfolios that reflect both your goals and risk tolerance.

Long-Term Focus: Your Best Defense

Market volatility is uncomfortable but it’s also normal. What matters is how you respond.

A Diversified Portfolio:

- Reduces the temptation to time the market.

- Increases the likelihood of staying invested through cycles.

- Provides a more predictable path to long-term success.

Remember: Missing the market’s best days often happens when investors sell during drawdowns. Diversification helps you stay on course and avoid costly emotional mistakes.

What You Can Do Now

Actionable Steps for Your Portfolio:

- Review your current portfolio – Are you overexposed to one sector, style, or geography?

- Rebalance if needed – Market moves can skew allocations. Periodic rebalancing helps realign risk to your long-term goals.

- Consider broader asset classes – These can include real assets, international holdings, alternatives, and bonds.

- Talk to one of our fiduciary advisors – We help tailor diversification to your specific goals, time horizon, and tolerance for volatility.

Final Thought: It’s Not About Prediction, It’s About Preparation

Markets are unpredictable, but your portfolio doesn’t have to be. The key is preparation, not prediction. Building resilience across a range of outcomes is the power of diversification. In today’s environment, this approach is more important than ever.

Ready to ensure your portfolio is positioned for whatever the second half of 2025 may bring?