It’s that time of year. Tax season. But this time, you don’t have to let taxes scare you. By utilizing some of our recommended tax planning strategies you can head into this tax season confident and organized.

Create a Filing System.

If you don’t already have a filing system, now is a great time to set one up. Organizing your receipts and documents in one central location will make tax planning easier. Physical copies can easily get lost or damaged, so create a digital copy by taking a picture!

Understand Your Tax Bracket.

The amount you owe in taxes correlates to your income. Essentially, the higher your taxable income, the higher your federal tax rate. The government breaks your income into “chunks” which get taxed at a specific percentage. Use this chart to get a basic sense of where you stand when it comes to taxes. Remember, you can use tax deductions to reduce the amount you owe.

Research Popular Tax Credits and Deductions.

Figuring out what tax credits you qualify for can make a big difference this year. From education tax credits to charitable contributions tax breaks to residential energy tax credits for making your home more energy-efficient (among many others), there are lots of ways to reduce your taxes.

Decide Your Deduction Method.

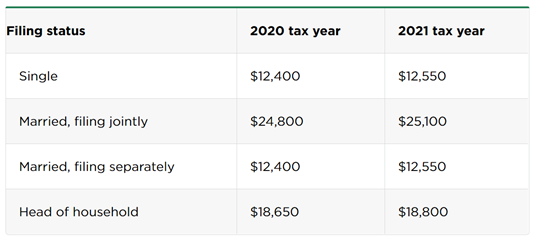

You can choose between itemized or standard tax deductions to figure out your taxable income.

- Standard deduction is a dollar amount decided on by the government.

- Standard deductions are individual, and depend on a couple key factors. Use this site to figure out how much your standard deduction is.

- Itemized refers to the individual items you’re using for deductions.

- You should itemize deductions if you can’t use the standard deduction for any reason, or if your itemized deductions are larger than your standard deduction amount.

Knowing which deduction works in your favor will help your tax planning go smoothly. Regardless of which deduction you want to use, keep those organized receipts on hand!

Start planning for next year.

Time to take all you learned about your taxes this year and use them to your advantage. By keeping an eye out for relevant deductions and utilizing your new filing system, you’re setting yourself up for success. To stay organized, schedule a monthly meeting with yourself to review your tax planning. This gives you time to sort receipts, update your deductions log, and keep on top of it all.

Trajan Wealth Makes Tax Season Simple

Whether you’re looking for help with individual, or small business tax planning, Trajan Wealth is here. We know how important tax planning is to your financial health. We pride ourselves on understanding tax laws, and how they can affect your retirement planning. Contact us to schedule an appointment with one of our fiduciary advisors today.