By Sterling E. Russell, CFA

With Federal Reserve Policy Makers in the early stages of what could be an extended period of tighter monetary policy, it is time for investors to focus their attention on finding new sources of income, instead of the next Tesla. For the past 12 years, the markets have experienced a tailwind of low-interest rates, available credit, and an accommodative FOMC. That time is changing as the Federal Reserve Open Market Committee (FOMC) raises rates and reduces its balance sheet by selling bond holdings. The adjustment in short-term interest rates (the overnight Federal Funds rate) will likely occur over a 1–2 year period depending on how quickly the inflation data eases. The reduction of the Feds balance sheet will be a much longer process as it both sells bonds outright and allows others to mature. The impact of both moves is to produce tighter financial market conditions. These headwinds are a reversal of the strong tailwinds that have produced above-average equity market returns over the past 12 years.

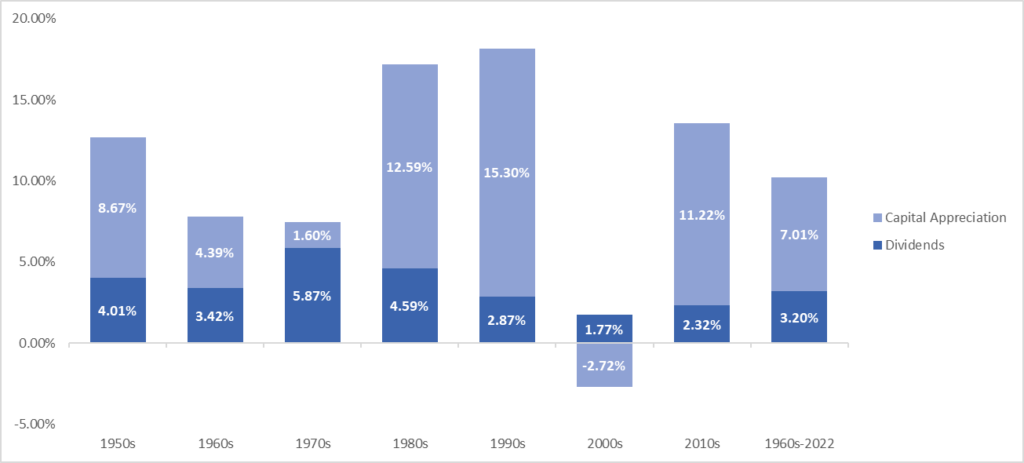

One of the primary drivers of equity market returns over the past 12 years has been expanding earnings multiples that produced above-average returns. As rates have begun to increase, we are seeing those exact earnings multiples decline, resulting in falling stock prices. The result of earnings multiples moving back toward the long-term averages is that the income component of stock returns will become more critical to the total return than it has been over the past decade. The chart below shows the breakout of equity returns by dividends vs. capital appreciation sorted by decade. Over the past 70 years, the income component has averaged 31.34%. The range has gone from 100% of the return by decade (the 2000s) to a low of 15.80% in the decade of the 90s, which was the lead up to the bursting of the “Tech Bubble” in 2000. The chart below shows the breakdown of returns for the S&P 500 from its inception in the 1950s to today.

Equity Returns: Income vs. Growth

We believe the Fed’s shift in policy from accommodative to restrictive will result in a sustained period where income-oriented/value stocks will provide superior returns to those considered growth stocks – those with low or no dividends. To give some perspective, over the past 12 months, large-cap value stocks have returned (3.70)%, while large-cap growth stocks have returned (16.16)%. Over the past decade, large-cap growth stocks have returned 14.56% annually, while large-cap value stocks have generated a 10.29% annualized return. We feel the next several years will be a period where returns experience a reversion to the mean. One result will be the more robust performance of dividend-paying stocks relative to those with no dividends and higher valuations.

In addition to dividend-paying common stocks, investors can look to bonds. Bond yields have become much more attractive, with interest rates rising sharply this year. High-quality corporate bonds yield 3-5% depending on maturity and credit quality. Another good source of income that we feel is attractive is preferred stocks.

Preferred stocks are a hybrid security with characteristics of common stocks and bonds. They are issued with a fixed coupon and have no maturity date. However, most have a 5-year call option, meaning that they can be called by the issuer five years following issuance. The coupon payments on preferred stocks are treated as dividends, so the tax treatment is more favorable than interest payments on bonds. We feel that investors who add exposure to dividend-paying common stocks, bonds, and preferred stocks will be rewarded in the years ahead.

schedule an appointment

If you’re feeling uncertain about your investment strategy, it may be time to call the professionals. Our trustworthy team at Trajan Wealth wants to support your financial goals through a holistic and personalized investment strategy.

Schedule an appointment with our team of fiduciary financial advisors today! We would be honored to help you.