The world is almost unrecognizable from just 20 years ago. Smartphones. Social media. Streaming music and TV. Same-day e-commerce deliveries.

Now a new technology is ready to be added to the list: Self-driving cars. It’s the biggest change to how we move around the world since the invention of the automobile, with major implications for investors.

Key Takeaways

- Waymo has the lead in self-driving technology, but many competitors are pursuing the same opportunity.

- Tesla has a large fleet, but also serious safety concerns. Accidents have derailed a few self-driving competitors already.

- New technology can unleash both opportunities and threats for investors. Contact Trajan Wealth’s team of experts today.

Waymo in the Lead

Google was early to the self-driving car race; it started developing the technology in 2009. That skunkworks project eventually turned into Waymo, the current industry leader. Waymo offered its first fully self-driving rides to the general public in October 2020.

Waymo’s earliest rides were in the Phoenix suburbs, where the skies are clear, roads are well-marked, and traffic tends to be light. But the company has steadily expanded and now provides service throughout the Phoenix metro area, San Francisco, Los Angeles, Austin, and Atlanta. Next on the roadmap are Miami and Washington, D.C. Waymo has also started testing in what may be one of the most challenging driving conditions in the U.S.: New York City.

A big reason for Waymo’s success was its focus on safety. It developed the technology for nearly 12 years before its first commercial launch. There were many baby steps along the way: Driving on closed test tracks, logging billions of simulated driving miles, testing with a safety driver, driving on easy public roads, then testing in steadily more challenging conditions.

Waymo recently surpassed 100 million fully self-driven miles. Through March 2025, the company reports 88% fewer serious injuries and 78% fewer total injury-causing accidents compared to human drivers. That’s an enviable safety record!

Competitors Have Struggled

Waymo’s cautious approach was vindicated when several competitors were derailed by serious accidents. Tragically, in March 2018 an Uber self-driving car struck and killed a pedestrian in Tempe, Arizona. It was the first recorded case of a pedestrian fatality involving an autonomous vehicle. The car had a safety driver, but the driver was apparently distracted watching a TV show on her phone at the time of the accident (she was later criminally charged). This incident contributed to Uber eventually abandoning its in-house self-driving project and selling its technology to Aurora Innovation.

General Motors’ Cruise was similarly wrecked by an accident. Cruise took a more aggressive approach to deploying its technology than Waymo, launching in the complex, hilly conditions of San Francisco. In October 2023, a Cruise vehicle ran over a pedestrian and then dragged her 20 feet as it attempted to pull over. This also led to Cruise ending its self-driving ride service.

Other competitors are still chasing the self-driving opportunity, but most appear to be years behind Waymo, at least in the U.S. Aurora is a startup focused on self-driving trucks, and it recently started its first driverless route between Dallas and Houston. Amazon’s Zoox is planning to launch in Las Vegas later this year. Self-driving development may be farther along in China, led by Baidu’s Apollo and companies such as Pony.ai, WeRide, and AutoX.

What About Tesla?

Of course, we left off the highest-profile new entrant to the self-driving race: Tesla. The electric vehicle pioneer began rolling out Autopilot in 2014. Autopilot is considered a “level 2” automation system. It provides advanced driver-assistance features such as lane-keeping and traffic-aware cruise control, but it still requires the driver to be attentive at all times. Autopilot was followed by “Full Self-Driving (Supervised)” with features like autonomous navigation, responding to traffic signals, and self-parking.

Then in June of this year, Tesla announced a new “robotaxi” service in Austin intended to compete head-to-head with Waymo. For now, the service is invite-only and uses safety drivers, which seems to put it about where Waymo was in 2017. However, CEO Elon Musk has promised an aggressive expansion strategy. If its technology works, Tesla has a major advantage over Waymo: It already has millions of cars on the road that could potentially be turned into robotaxis. On the other hand, Musk has a long history of over-promising and under-delivering on autonomous vehicle technology, so caution is warranted.

Much of Tesla’s valuation depends on its self-driving effort. Whether the company is successful will mostly come down to safety, in our view. Autopilot and Full Self-Driving (Supervised) have already been implicated in several fatal crashes, but consumers and regulators have been more forgiving of these accidents than they were with Uber or Cruise, perhaps because there are so many more Teslas on the road.

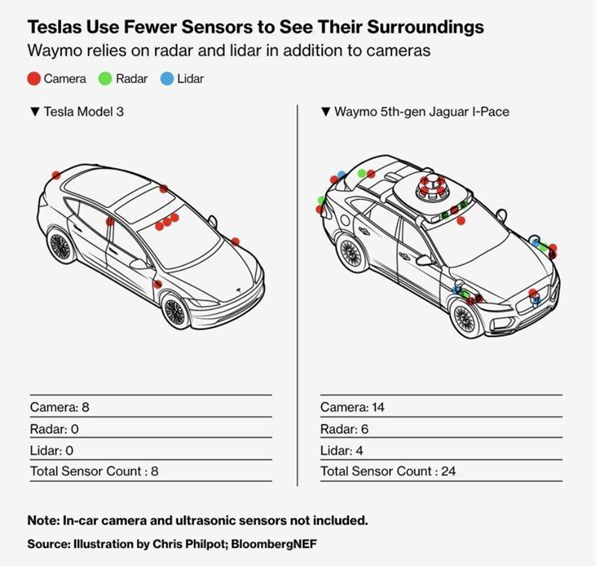

Tesla has a fundamentally different approach to self-driving than the rest of the industry. It relies entirely on cameras, using artificial intelligence to interpret what the car is seeing. This saves money on hardware, but it’s inherently more dangerous than Waymo’s approach, which uses a combination of cameras, radar, and lidar sensors to understand the world around it. For example, radar and lidar can help detect a pedestrian in the road, even when a camera might be blinded by the sun or rain.

Source: Bloomberg

What Should Be Investors’ Next Move?

So how should investors prepare for the self-driving revolution?

Several of the companies mentioned above are publicly traded, but sometimes the self-driving business is buried in a much larger company, like Alphabet’s Waymo. In other cases, it’s a speculative startup that may be too risky for most investors, like Aurora. Tesla is a possibility, but its valuation already reflects tremendous optimism about its autonomous future, and a serious accident or other setback could devastate the stock price. For now, we don’t see a great option for directly investing in the self-driving theme, but we continue to monitor the industry closely.

Another possibility is a ridesharing company such as Uber or Lyft (we own shares of Uber in our Expanding Moat strategy). On one hand, these companies could be at risk of disruption from self-driving. Waymo has several competitive advantages, including avoiding the cost of drivers and operating a cleaner and more consistent vehicle fleet. On the other hand, keeping its cars busy is critical to Waymo achieving profitability. Partnering with existing ridesharing companies, as Waymo has with Uber, may be the easiest path to market. In Austin and Atlanta, Waymo vehicles are only available through the Uber app. Uber collects a fee in exchange for finding customers, and Waymo maximizes vehicle utilization while minimizing empty miles. Self-driving could make ridesharing more appealing compared to driving your personal vehicle, greatly expanding Uber’s total addressable market.

Investors should also be on the lookout for non-tech industries that could be affected by self-driving. For example, competitive dynamics in the trucking industry could be upended by autonomous trucks. Unlike human drivers, self-driving trucks don’t sleep. Automated trucks could run 24 hours a day, seven days a week, with dramatically improved fuel efficiency, accident rates, and costs per mile. Railroads are also in the crosshairs. One of the major advantages of a railroad is that you can run a mile-long freight train with just two employees: an engineer and a conductor. If trucks start driving themselves, it will erode a key labor cost advantage for railroads.

Other industries to watch include:

- Auto manufacturers & parts suppliers: There may be fewer personal car sales if autonomous ride-hailing grows. Additionally, there could be a shift in demand toward specialized self-driving hardware and software.

- Insurance companies: Lower accident rates could reduce premium revenue. New liability models may shift coverage from individuals to fleet operators.

- Parking lot owners: There could be a reduced demand for traditional parking as self-driving cars can drop passengers off and pick them up. and reposition. This opens the opportunity for the potential repurposing of lots to be focused on fleet charging or staging hubs.

Frequently Asked Questions

If you live in the Phoenix metro area, your answer would probably be “they already are!” These days, it’s rare to stand by a road for more than five minutes without a Waymo driving by. Waymo has been accelerating its pace of expansion into new markets, though it’s still a gradual, city-by-city process with safety as the priority. Other self-driving companies appear to be at least a few years behind Waymo in the U.S. China is also witnessing an aggressive rollout of self-driving technology.

This is a difficult question. Tesla benefits from its use of cheaper hardware and the fact that it already has millions of cars on the road. However, it’s not clear if Tesla’s cameras-only approach is going to be safe enough to gain widespread acceptance. A serious accident could ruin the company’s plans as we already witnessed with Uber’s self-driving effort and GM Cruise.

As with any new technology, there will be winners and losers. A challenge with self-driving is that some of the early leaders are just a small part of a much larger parent company, such as Alphabet’s Waymo. In other cases, you’re dealing with speculative startups without a proven business model. Investors should be aware of potential risks to other industries, such as ridesharing, trucking, and railroads. Overall, it’s still early days for this technology, but we’re watching developments closely.

You Want a Team of Professionals Guiding Your Portfolio

One thing’s for sure: Technology is changing faster than ever, and keeping up with the latest developments is a full-time job for investors. For professional help navigating these shifts and positioning your portfolio for the future, contact Trajan Wealth.