“The best way to measure your investing success is not by whether you’re beating the market but by whether you’ve put in place a financial plan and a behavioral discipline that are likely to get you where you want to go.”

~ Benjamin Graham

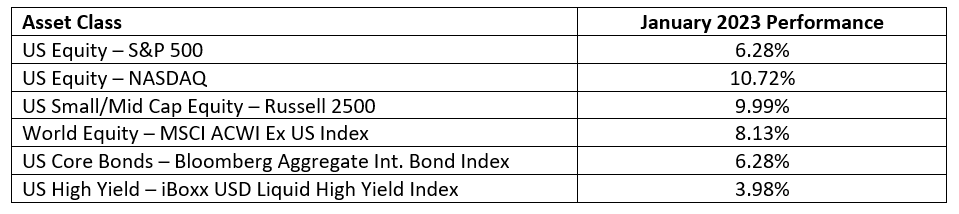

January Markets

Fig. 1 – Bloomberg

Buoyed by signs of declining inflation, a strong labor market, and steady GDP growth, risk assets rebounded from their 2022 capitulation, posting strong returns in January. The biggest driver to the rebound is unquestionably a reversal in the trend of accelerating inflation which weighed in on the markets for much of 2022. The four-decade high inflation readings caused the Federal Reserve Bank to raise overnight rates by 4.25% in 2022, 300 basis points of which came in four 75 basis point increments. Not surprisingly, the benchmark 10 – year Treasury yield increased from 1.51% at the start of 2022 to end the year at 3.88%. US Core Bonds had their worst year since the index was created posting a total return of (31.01)%.

With inflation, and by extension, interest rates being the driver of financial markets over the past four quarters, the $64 million question is “what lies ahead”? Are the recent declines in major price indexes – the CPI, PPI, and the Personal Consumption Expenditure “PCE” indicator, a temporary reprieve from falling commodity and finished goods prices as supply chain disruptions from COVID-19 shutdowns abate, or will a tight labor market keep wage pressures high and sustain inflation readings at much higher than the FOMC’s 2.0%-2.5% target.

The evidence – albeit from limited data points, is mixed. Crude prices are now about $73/ barrel, a sharp decline from the March 2022 high of ~123/barrel. Similarly, Natural Gas is $2.41 per MMBtu, markedly lower from its $9.68 per MMBtu in September 2022. Gold, considered the traditional inflation hedge is also down from $2,069 per troy oz. to $1,877 per troy ounce. Most tellingly, the US Treasury yield curve is sharply inverted – the yield on the 3-month Treasury bill is about 4.60%, while the yield on the 10-year US Treasury note is 3.50%, implying that bond investors believe interest rates and inflation will fall sharply going forward.

Against the benign inflation indicators is a robust labor market – US unemployment at 3.4% is near historical lows while wage inflation is still running at about 4.4%, as per Department of Labor data.

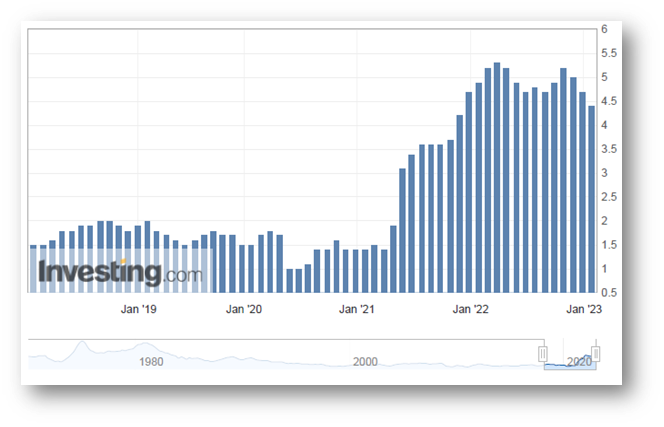

US Inflation – Core PCE Deflator

Fig. 2 – Investing.com

While future direction of inflation and interest rates is hard to predict, we believe any sharply accelerating inflation view should be tempered by the following considerations:

- Monetary policy affects the “real economy” with a lag – it is highly plausible that the full impact of higher interest rates has yet to be felt on consumer spending, business investment and overall GDP growth.

- Germane to our clients, the full impact of higher borrowing costs on corporate earnings still lies ahead of us.

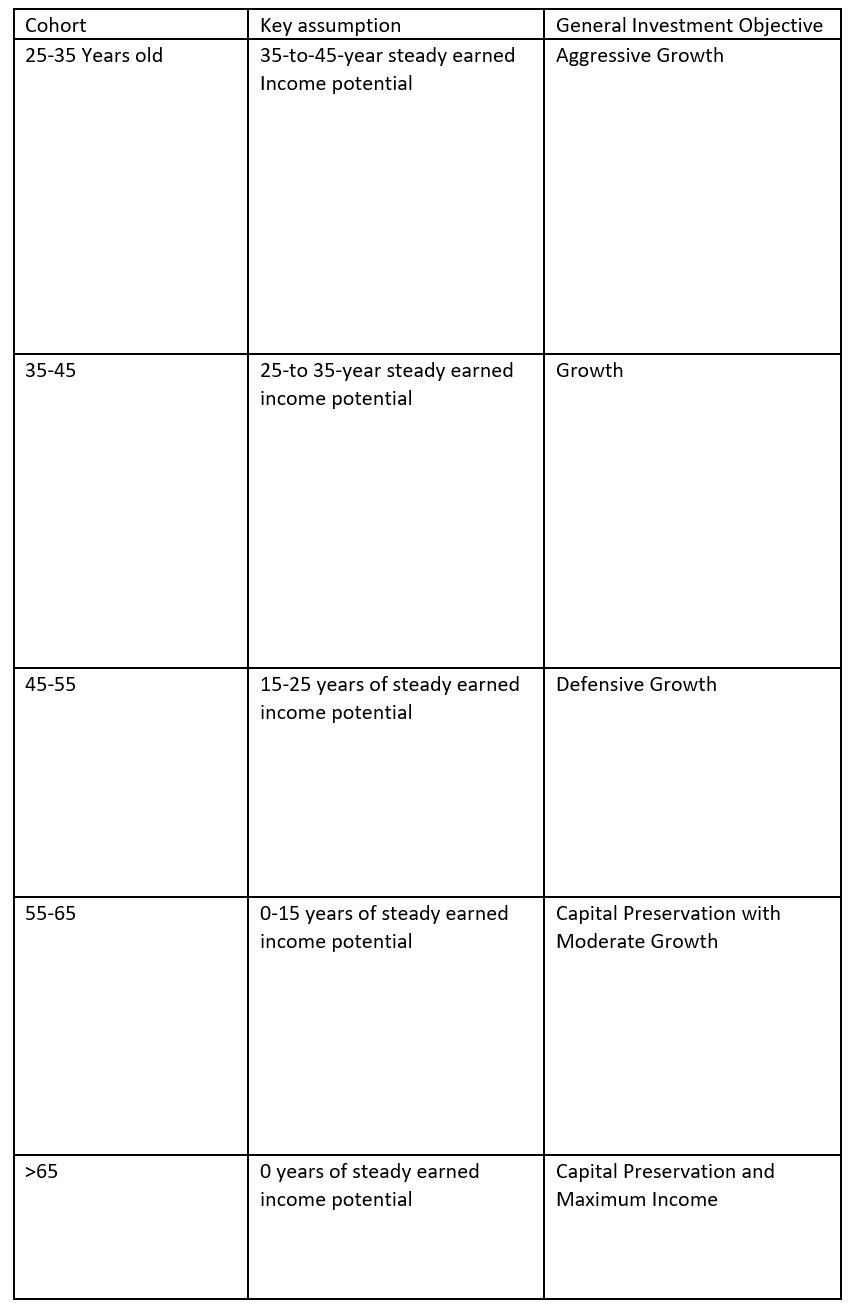

So, what does this mean for our clients and their overall asset allocation? We would argue, nothing! At the start of this new year, we would remind clients that economic and market predictions are simply just that, predictions. Predicting markets or the overall economy is a highly hazardous occupation – the track record of market predictors in particular, are abysmal. Furthermore, there isn’t any consistency – a predictable league table, of the “best” and “worst” practitioners when it comes to market predictions. As such, we continue to advocate the time – tested mantra of basing investment decisions and asset allocations on objectives and goals. No two investors are the same, but one largely common metric among our clients is that time horizons tend to compress with the passage of time, and risk appetites diminish as employment windows shrink.

Considering the evolving time horizons and risk appetites among individual investors, we feel an indicative asset allocation that serves different demographic cohorts could look as follows:

Reminder – Risk Factors Going into 2023

As discussed in last month’s newsletter, we continue to believe that high global indebtedness poses a distinct refinancing challenge for lower-quality issuers. This risk is amplified in the event of slow or receding economic growth. In addition, global geopolitical risk remains elevated, and the traditional lever of credit growth to support both consumer and investment spending in the event of a recession has been severely curtailed.

Recommendations

We continue to advocate an elevated level of diversification across asset classes following individual risk-tolerance thresholds. In this context, Fixed Income assets should command a higher weighting. However, we also believe that non-traditional asset classes – “real assets” such as real estate merit consideration in light of persisting inflationary pressures. We also expect elevated levels of market volatility going forward, if only due to rapidly rising financing costs that may adversely affect corporate profits. As such, absolute return strategies – trend following, equity/credit market dispersion, which benefit from volatility may be appropriate for certain investors in an overall asset allocation. We continuously look for these unique sources of returns for our clients and will make recommendations as we develop additional strategies and update our asset allocation models.

UDAYAN MITRA, CFA

~ Trajan Wealth Chief Investment Officer