“The stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions.”

- Seth Klarman, Investor. CEO, Baupost Group

Market Returns

| Index | YTD TR (%) 6/30/2023 | 1 Year TR (%) 6/30/2023 |

|---|---|---|

| US Large Cap - S&P 500 | 16.88% | 19.56% |

| US Large Cap – Tech Heavy NASDAQ | 32.32% | 26.17% |

| International Equity – MSACWI ex US | 9.86% | 13.37% |

| US Small/Mid Cap – Russell 2500 | 8.78% | 13.55% |

| Bloomberg Aggregate Intermediate Bond Index | 2.09% | (0.94)% |

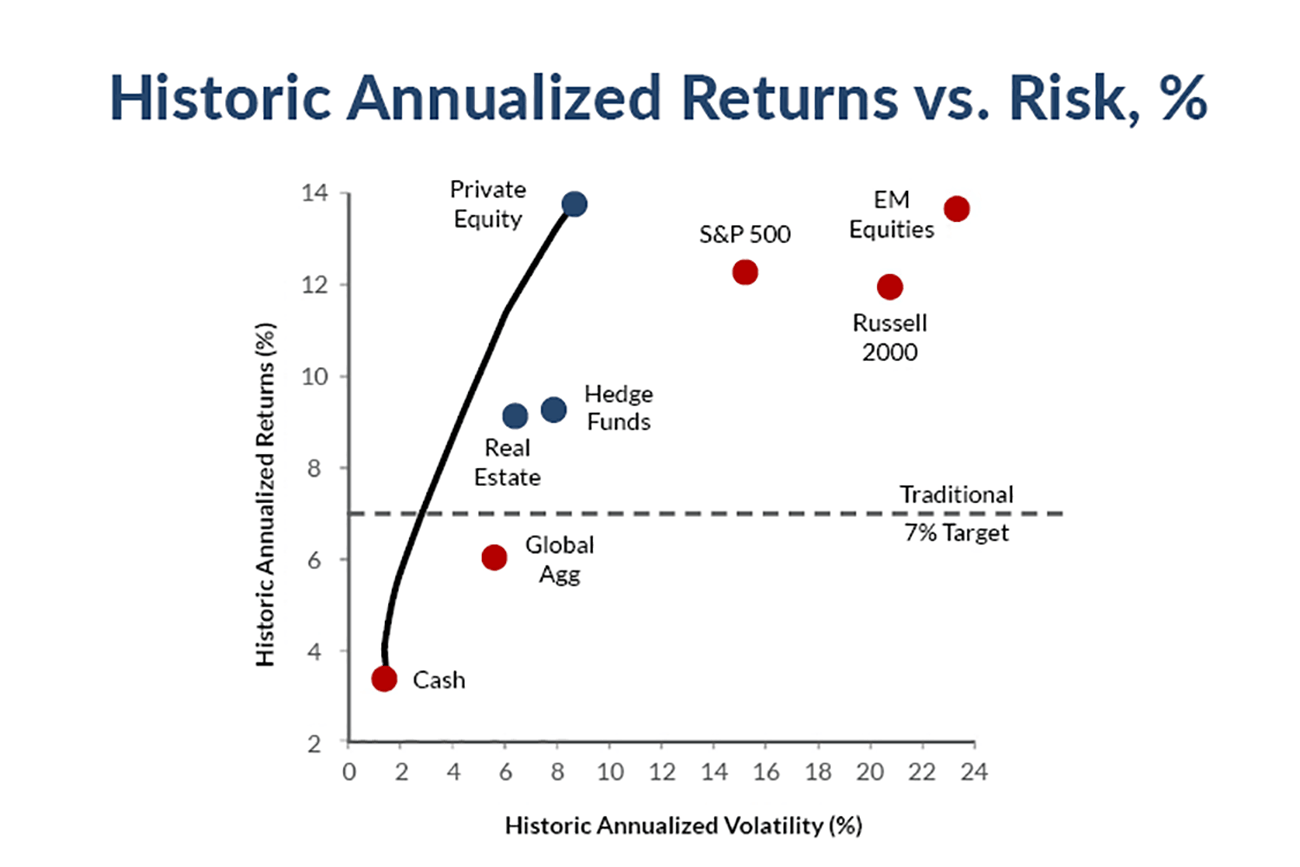

Private Markets

Note: From 1Q86 to 4Q20, where data is available, deemphasizing 2008 and 2009 returns at one-third the weight due to the extreme volatility and wide range of performance, which skewed results. Using MSCI AC World USD for Listed Equities; Barclays Global Agg Total Return Index Unhedged USD for Fixed Income; Cambridge Associates Global Private Equity for Private Equity; HFRI Fund Weighted Composite Index for Hedge Funds, and Barclays US T-Bills 3-6 Months Unhedged for Cash. Source: Bloomberg, MSCI, Cambridge Associates, KKR Global Macro & Asset Allocation analysis.

With regard to overall asset allocation, we at Trajan Wealth also believe that we can significantly enrich our clients’ investment outcomes by prudently allocating portions of their long-term investment portfolios toward private assets. Briefly, private assets are assets that are not traded in the public markets and include: Private Equity, and debt; Private Credit of private companies; Private Commercial Real Estate; and Private Infrastructure Funds (pools of capital invested in private infrastructure projects) – to name a few. Being private assets, these asset classes are significantly illiquid, taking as much as a decade for the return of and the returns on invested capital. However, they tend to command a veritable and persistent illiquidity premium, and since valuation changes only reflect changes in durable changes in earnings and cash flow (rather than machine trading, trend flowing, leveraged trading, short-interests, short squeezes, memes!), price volatility is considerably lower than assets traded in the public markets (see chart on page 2). While private assets were organized as private partnerships and previously open only to institutional investors and eligible qualifying investors, the sector is gradually getting democratized. We at Trajan are actively participating in the democratization of the Private Markets and building a portfolio of offerings for our clients.

Recommendations

We continue to recommend diversification across asset classes based on your risk tolerance and individual financial circumstances. Trajan Wealth has developed models with risk levels from conservative to aggressive, and clients should consult with their advisor and the Portfolio Management Group when choosing the appropriate asset allocation. In the context of higher yields and the prospect of slower economic growth, Fixed Income assets should command a higher weighting in most portfolios. Trajan Wealth’s investment team maintains its distinctive, high-quality bias within asset classes. We also believe that non-traditional asset classes – “real assets” such as real estate and infrastructure, as well as private equity and private credit merit consideration given the real portfolio enhancement opportunities as we transition to tightening monetary policy environment. We also expect elevated levels of market volatility going forward, if only due to rapidly rising financing costs that may adversely affect economic growth and corporate profits. As such, absolute return strategies – trend following and equity/credit market dispersion, which benefits from volatility may be appropriate for certain investors in an overall asset allocation. We continuously look for these unique sources of returns for our clients and will make recommendations as we develop additional strategies and update our asset allocation models.

Udayan Mitra, CFA

Udayan is Trajan Wealth's CIO with over two decades of experience in the investment management industry. He earned a Bachelor of Science degree in Economics from the London School of Economics and an MBA in Finance from Rice University.