“Whoever controls the volume of money in any country is absolute master of all industry and commerce.”

~ James A. Garfield, 20th President of the United States

The Fed’s Tightening Cycle & Market Returns

The US financial markets have been roaring since the start of 2023, with both stocks and bonds posting strong returns as of the end of May 2023 (see table below). Even trailing 1-year returns are in positive territory in the broad US large cap equity market, while investment grade bonds are now down only 1.80%. Recall that the S&P was down (18.65)% in 2022, and the Bloomberg Aggregate was down (12.30)% during the same period.

| Index | YTD TR (%) 5/31/2023 | 1 Year TR (%) 5/31/2023 |

|---|---|---|

| US Large Cap – S&P 500 | 9.64% | 3.66% |

| Bloomberg Aggregate Intermediate Bond Index | 2.46% | (1.80)% |

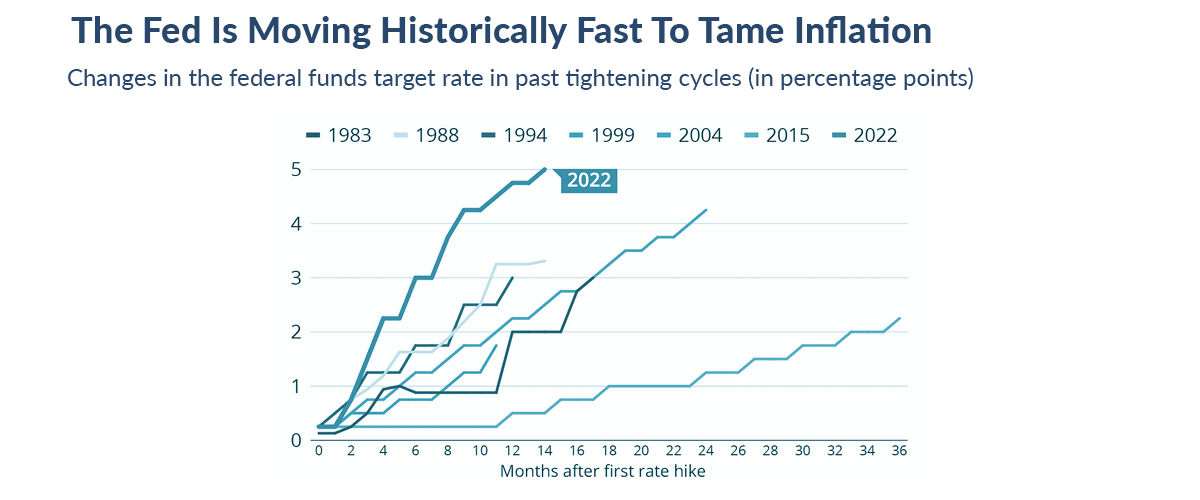

The appreciable recovery in the financial markets coincides with the severest interest rate tightening cycle implemented by the Federal Reserve Bank over the past 40+ years (see Graph 1). Remember that rising interest rates usually function as a detractor to both stock and bond performance – stocks because future corporate earnings are discounted at higher rates and corporate profitability is challenged by higher debt servicing costs, bonds because fixed coupons are discounted by higher rates. However, as the Fed progressively increased short-term overnight rates, longer-term interest rates started to fall (particularly since 4Q 2022) in anticipation of an eventual slowdown in economic growth. In essence, the bond market is now “fighting the Fed” – essentially pricing in a significant possibility of a recession.

Credit Markets

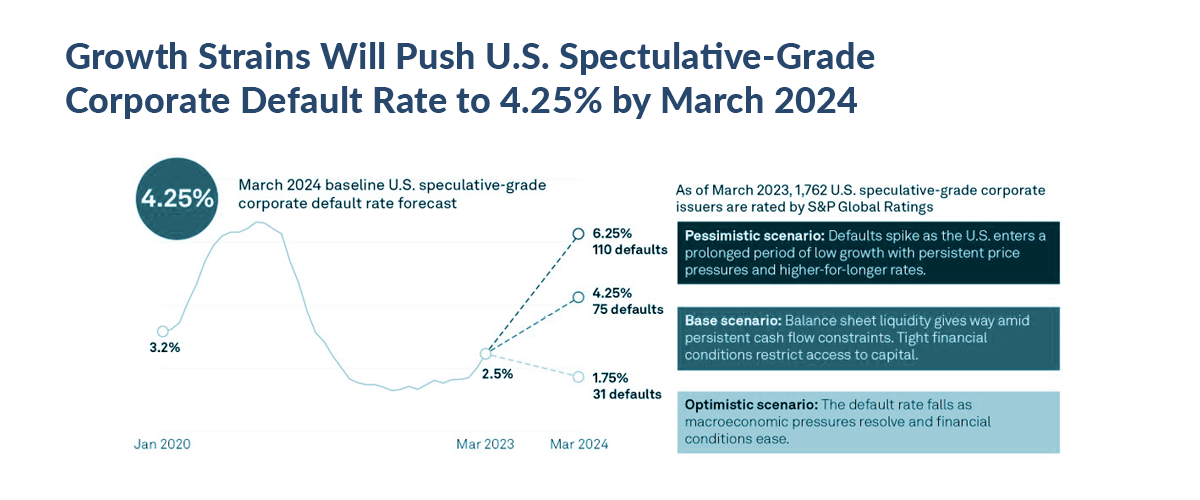

Meanwhile, the stress of higher front-end interest rates (maturities ranging between 1-5 years) is beginning to appear in the “high yield” segment of the corporate credit market. The “high yield” segment is comprised of companies with credit ratings that are “below investment grade,” implying a higher propensity of default. The largest credit rating agency, Standard & Poor’s (S&P), doubled to 4.25% from its long-term average of below 2%. Of the companies that eventually default, there may be a recovery of 40% to 45% for bondholders in the eventual restructuring that accompanies corporate bankruptcies. The stockholders of those defaulted companies will most likely lose their entire invested principal.

Some might ask, why haven’t defaults and bankruptcies happened yet, despite 500 basis points or 5% of rate hikes by the US Federal Reserve Bank? It is a valid question, given that this has been the steepest tightening cycle in half a century. Our view is that monetary policy impacts the markets with a distinct lag – companies issued long- term (5-10 year) debt during the low-interest period over much of the last decade. Over the next 12 to 36 months, a lot of the existing debt approaches maturity and will need to be refinanced at much higher costs. Lower quality companies are at risk of not being able to refinance their existing debt on commercially viable terms.

In terms of the consumers (whose non-mortgage debt tends to have shorter maturities or floating rate payments), we are already witnessing the initial signs of stress. Credit card delinquencies are rising, and it remains to be seen what default levels will occur in student loans now that repayment moratoriums imposed during Covid-19 are rescinded as part of the overall Debt Ceiling Agreement in the US Congress.

The Federal Reserve Bank is acutely aware of these looming problems. Yet Chairman Powell has repeatedly reiterated that the primary focus of monetary policy remains the fight to bring down inflation from over 4.5% to the long-term target of 2%. With a tightening interest rate policy and tighter credit standards going forward, we feel it is prudent to expect a significant economic slowdown. As the Fed raises short-term rates, bond investors are buying up longer-dated bonds in the belief that the Fed will have to reverse course as growth contracts and unemployment rises.

Recommendations

We continue to advocate an elevated level of diversification across asset classes and develop specific asset allocation perimeters that cater to individual risk-tolerance thresholds. In the context of higher yields and the prospect of slower economic growth, Fixed Income assets should command a higher weighting in most portfolios. Trajan Wealth’s investment team maintains its distinctive, high-quality bias within asset classes. We also believe that non-traditional asset classes – “real assets” such as real estate merit consideration given persisting inflationary pressures. We also expect elevated levels of market volatility going forward, if only due to rapidly rising financing costs that may adversely affect economic growth and corporate profits. As such, absolute return strategies – trend following and equity/credit market dispersion, which benefits from volatility may be appropriate for certain investors in an overall asset allocation. We continuously look for these unique sources of returns for our clients and will make recommendations as we develop additional strategies and update our asset allocation models.