“Interest rates are to asset prices what gravity is to the apple. When there are low interest rates, there is a very low gravitational pull on asset prices.”

- Warren Buffett

Market Returns & Outlook

| Index | YTD TR (%) | November 2023 |

|---|---|---|

| US Large Cap - S&P 500 | 20.79% | 9.13% |

| US Large Cap – Tech Heavy NASDAQ | 37.01% | 10.84% |

| International Equity – MSACWI ex US | 10.66% | 9.02% |

| US Small/Mid Cap – Russell 2500 | 6.02% | 8.99% |

| Bloomberg Aggregate Intermediate Bond Index | 1.64% | 4.53% |

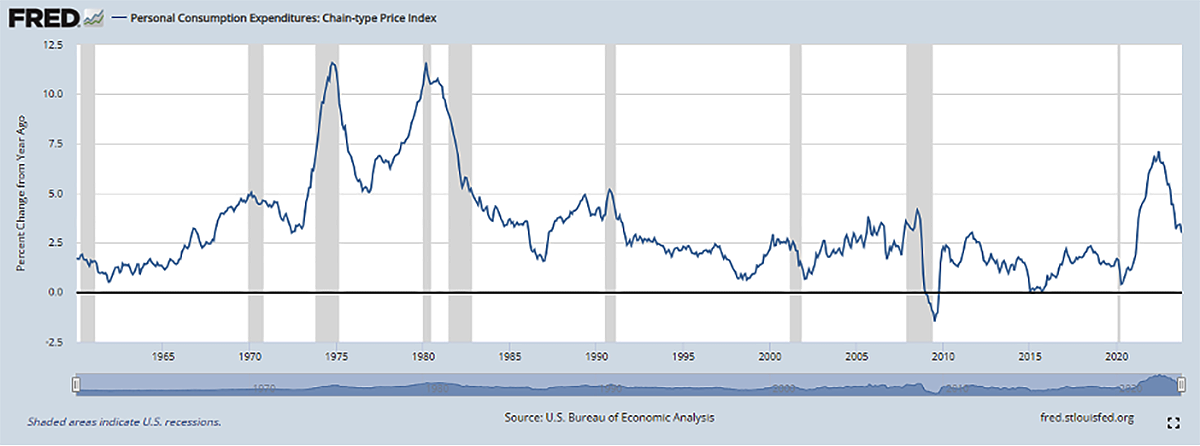

Chart 1

US Inflation

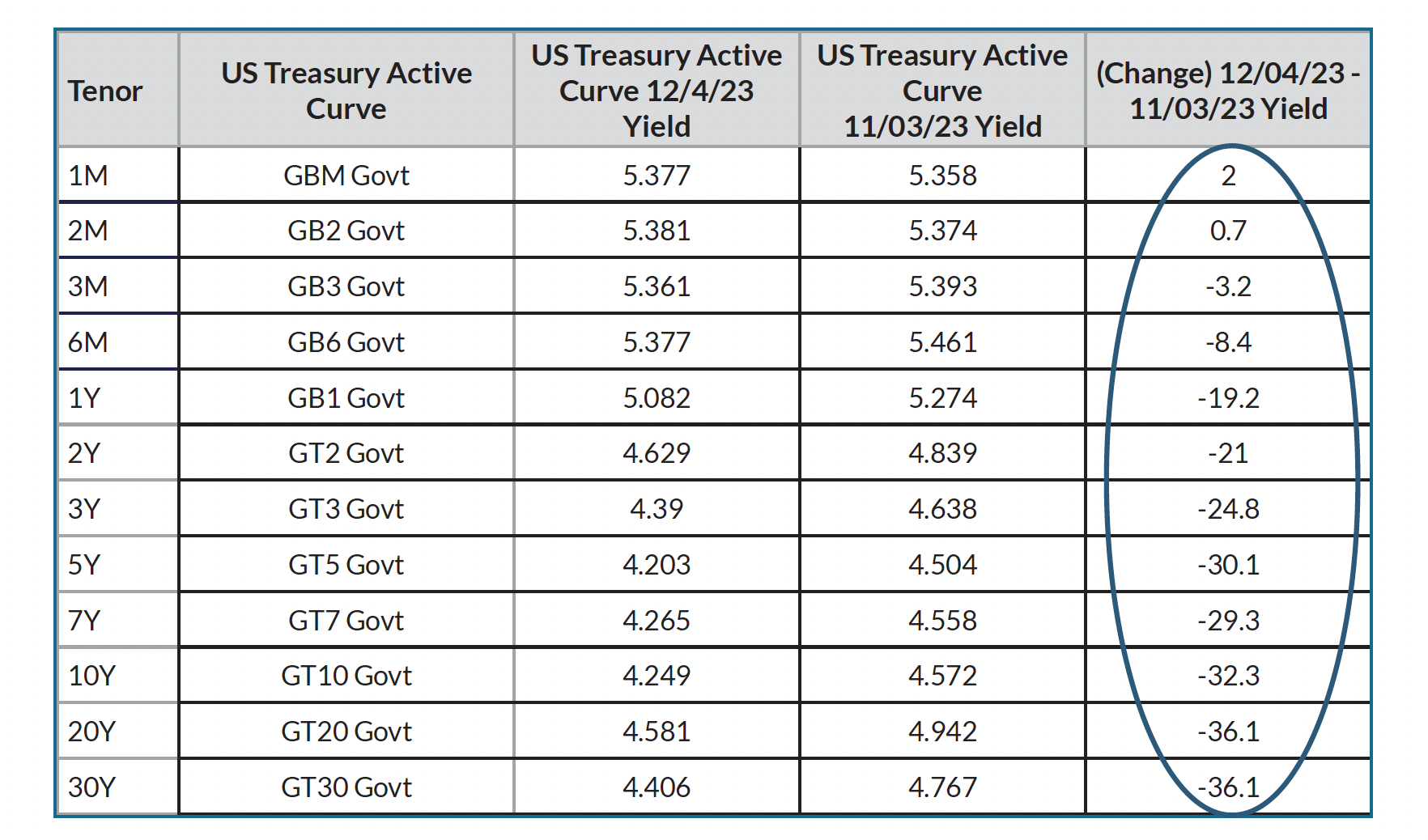

US Treasury Yields – Changes in November

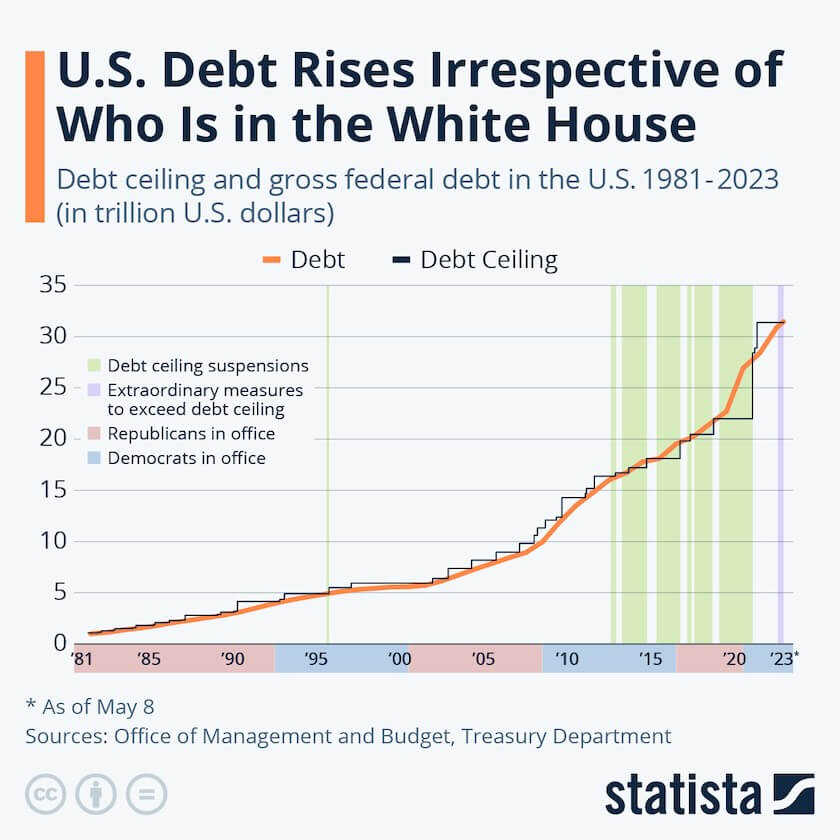

US Debt & Federal Budget Deficits

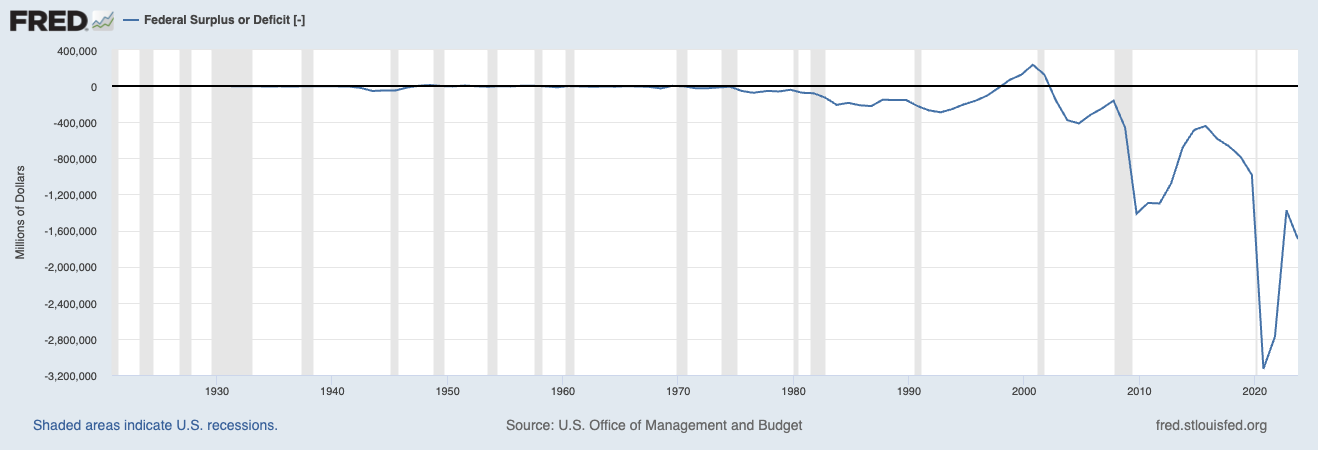

Federal Surplus or Deficit

Implications

Recommendations

We continue to advocate an elevated level of diversification across asset classes and develop specific asset allocation parameters that cater to individual risk-tolerance thresholds. In the context of higher yields and the prospect of slower economic growth, Fixed Income assets should command a higher weighting in most portfolios; we would highly recommend our clients to reach out for a portfolio review if one has not been done over the course of the last 24-36 months. We also believe that non-traditional asset classes – “real assets” such as real estate and infrastructure, as well as private equity and private credit merit consideration given the real portfolio enhancement opportunities as we transition to a potentially lower growth and earnings environment. For investors with a long-term investment horizon, the illiquidity premium in private assets is an attractive source of additional returns.

*Investment in private equity may require accreditation.*

Udayan Mitra, CFA

Udayan is Trajan Wealth's CIO with over two decades of experience in the investment management industry. He earned a Bachelor of Science degree in Economics from the London School of Economics and an MBA in Finance from Rice University.