Economy & the Markets

What a difference a month makes!!! The November 5th US Presidential elections produced a decisive result, and the GOP captured both houses of Congress. The Federal Reserve Bank’s preferred gauge of inflation – the Personal Consumption Expenditure Deflator, posted a benign reading at 2.3% in the month of October. The Fed, for its part, reduced the overnight Fed Funds rate by 25 basis points – 0.25% – at its November 7th FOMC meeting. And annualized GDP growth for the third quarter of 2024 came in at a strong 2.7%.

| Index | YTD TR (%) | Nov. 2024 Monthly TR |

|---|---|---|

| US Large Cap – S&P 500 | 28.06% | 5.87% |

| US Large Cap – Tech Heavy NASDAQ | 28.88% | 6.30% |

| International Equity – MSACWI ex US | 8.20% | -0.88% |

| US Small/Mid Cap – Russell 2500 | 27.11% | 9.83% |

| Bloomberg Aggregate Intermediate Bond Index | 2.93% | 1.06% |

With all the good news – decisive election results, robust growth, steady inflation; US equity markets provided superlative returns in the month of November. Ranging between 5.87% on the S&P 500, to a whopping 9.83% in small/mid cap stocks as represented by the Russell 2500. However, the real star performer in November proved to be Bitcoin – registering a whopping monthly return of 34%!!!

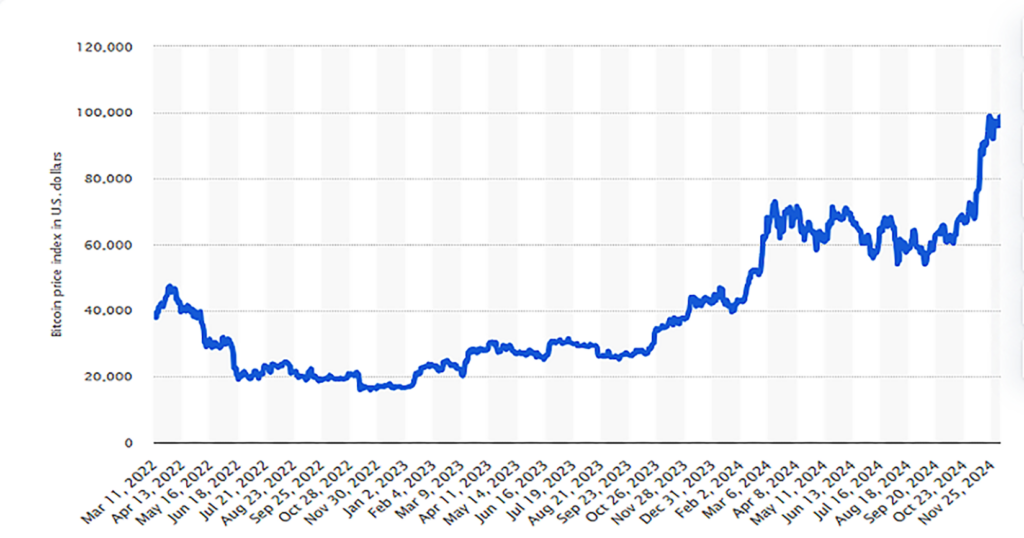

As most of our investors are aware, Bitcoin has been on a tear since the end of the FOMC’s rate hike cycle in 2022. Indeed, the cryptocurrency has rallied from a level well below $20k to about $98k at the time of this writing. The question many of our clients and prospects ask us is why, as a professional money manager, does Trajan Wealth not have any investment strategies centered around Bitcoin or cryptocurrencies more broadly?

Let me be clear, we do not see anything egregious about Bitcoin, much less view it as some sort of nefarious financial Ponzi scheme. The technology backing Bitcoin, Blockchain, has valuable applications including creating immutable records for sensitive data. We also acknowledge that Bitcoin serves as a wealth storage solution in regions where governments devalue their currency through overspending or restrict citizens from accessing stable foreign currencies and assets. Furthermore, the finite nature of the quantity of Bitcoin tokens that can ever be mined ensures a credible degree of scarcity.

The reason we do not invest client money in Bitcoin, and other crypto currencies, is that we have no way to underwrite the asset and determine a price level that constitutes “fair value.” To do that analysis, we would need to understand what earnings/cash flows Bitcoin would generate in the future and discount that future cash flow stream by an appropriate discount rate to arrive at a defendable present value. Rest assured, it’s not just us at Trajan Wealth that face this problem – the absence of an identifiable cash flow stream is a problem every investment analyst faces when trying to value Bitcoin. Yet, investors across retail and institutional segments are increasingly investing in Bitcoin, speculating that other investors will offer them a higher price sometime in the future for the asset. We would posit that this is speculative trading rather than investing, and Trajan Wealth is not in the business of speculation. Can we say that the products we offer will outperform Bitcoin over the long term and thus foregoing Bitcoin and investing in our strategies will result in better outcomes for our clients? Here too we make no such claims. Suffice to say, we believe that investing rather than speculating is a more sustainable way to meeting one’s financial goals. Because investing is based on information (earnings/cash flows) and projections (estimated growth of earnings and cash flows) that we can observe, handicap, and underwrite. Speculating, by contrast, is guessing. And prolonged confidence behind guesses can drive bubbles until the confidence dissipates. In the immortal words of George Soros – “Every bubble has two components: an underlying trend that prevails in reality, and a misconception relating to that trend.”

Perspectives on long term returns

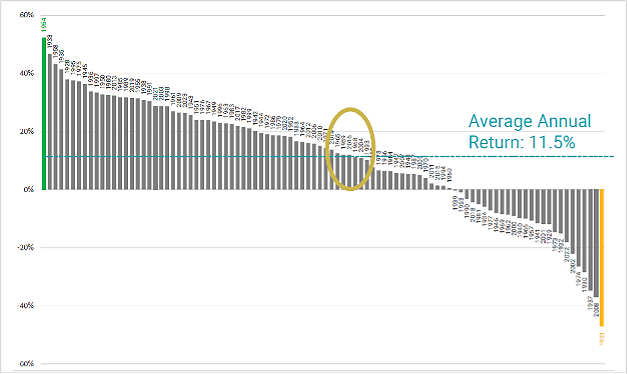

Amidst the buoyancy in the financial markets during this holiday season, it may sound unbecoming to add some cautionary notes in terms of return expectations as we go forward into the new year. At the time of writing, the S&P 500 has returned a cumulative 62.9% since the start of 2023, culminating in an annualized equivalent return of 28.7%. We would caution that ~28% type annual returns are the aberration rather than the norm in broad, large cap domestic equity. And any asset allocation assumption that projects these types of returns over the long term is overly optimistic.

As depicted by the chart; annual returns deviate substantially year by year in the public equity markets, and caution should be exercised when baking returns assumptions in the decision of how much to save to fund retirement and/or other long-term liabilities.

In essence we would urge our clients to assume that their equity allocations will grow at a level that is consistent with the long-term averages, rather than extrapolate from the more recent 28% levels. To be sure, that entails saving more to meet financial targets, but we would rather err on the side of caution and ensure our clients have a surplus to fund retirement rather than a shortfall.

In a similar vein, we also would like to take this opportunity to remind our clients of some of the risks to the markets and the economy going forward.

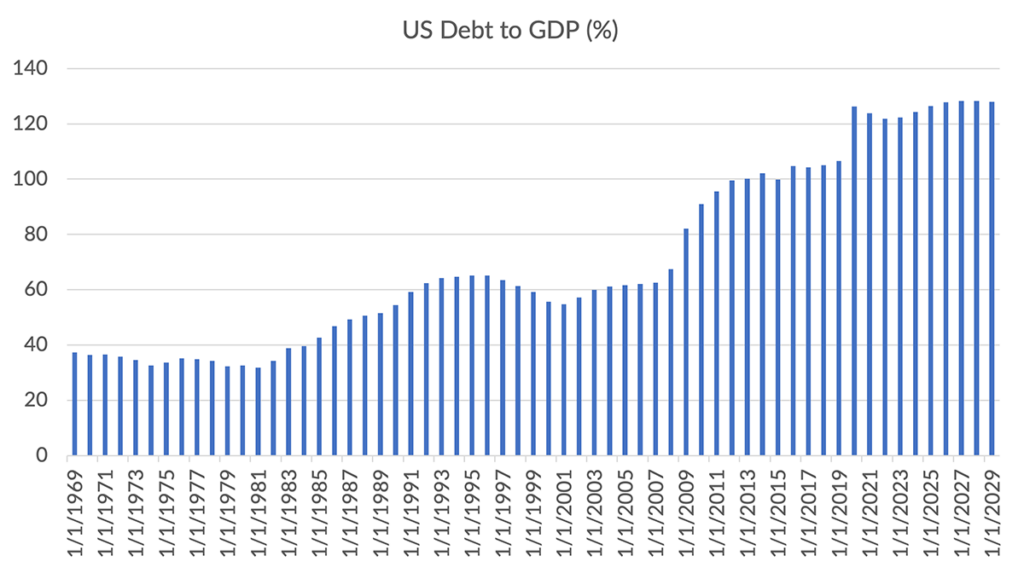

Risks: US Debt to GDP

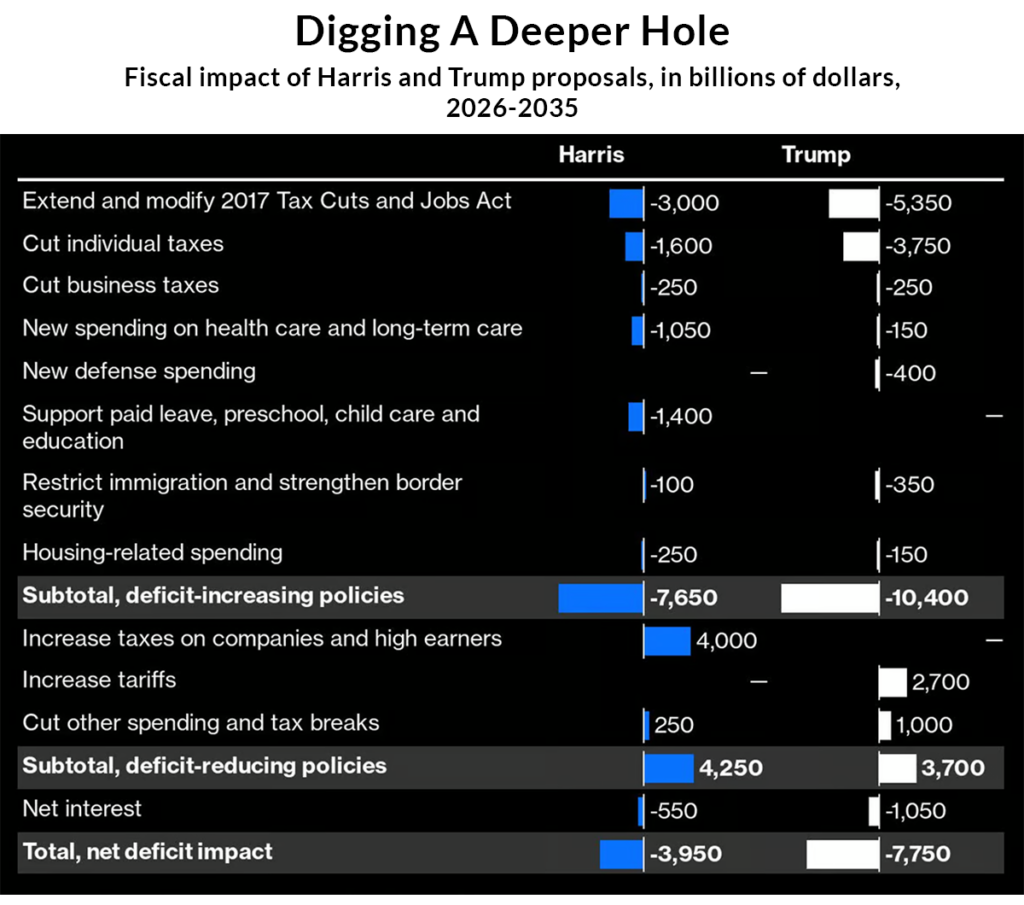

While advocating that our clients stay disciplined and focused on their financial goals, it would be irresponsible for us not to point out some of the looming risks that we see over the next 7 to 10-year cycle. As mentioned in previous letters, we see the growing levels of our nation’s fiscal indebtedness – see US Debt to GDP chart – as a source of potential systemic risk, especially since neither party at the 2024 election laid out credible plans to tackle the problem. On the contrary, both candidates laid out expansionary fiscal programs, which, according to the Congressional Budget Office, would lead to sustained deficits over the next 10-years – see chart marked “Digging a Deeper Hole” below.

Implications

While it is admittedly difficult to predict how the growing fiscal indebtedness will play out, we feel it is prudent risk management to make some precautionary adjustments to mitigate tail-risk in our clients’ strategic asset allocations. In the investment realm, a bias towards higher quality stocks with strong balance sheets seems appropriate given that corporate borrowing costs may come under pressure with elevating Treasury bond yields. Similarly, in the fixed income markets a bias towards short and intermediate duration and gloating rate coupons provide protection without significant diminution of annual interest receipts. And finally, allocations to “real assets” such as Infrastructure and certain types of real estate leases backed by high-quality properties could be part of the overall asset allocation of qualifying clients.

Beyond risk mitigation measures in the investment portfolio, we urge our clients to plan for the prospect of higher taxes as we navigate past the next few years. In addition, the prospect of frozen or diminished levels of benefits from entitlement programs (such as Social Security and Medicare) should also be factored into saving/investing and spending habits.

Recommendations

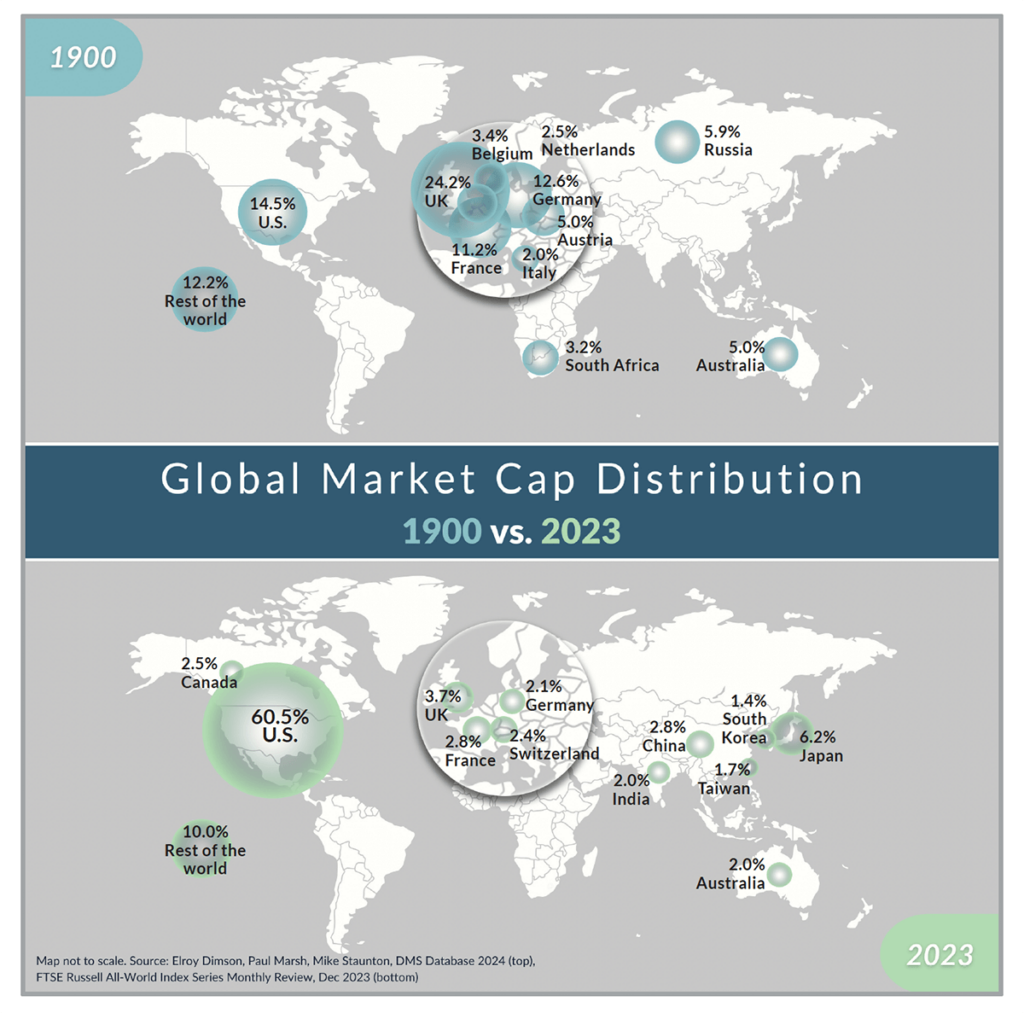

Besides focusing on long-term goals and taking some pre-emptive risk management steps, our other recommendation for client investment portfolios is to prevent large mismatches between assets and liabilities. Most of our clients are US-based, investing to fund long-term liabilities that are likely to be incurred within the United States. As such, having a “home country” bias in the investment portfolio may be a prudent alignment. It follows that overweighting US assets entails underweighting foreign assets. However, the weight of history suggests that overweighting US assets may be a winning strategy. The chart shows the composition of global public equity market capitalization since 1900 (note the tremendous expansion of the value of US businesses- and, by extension, equity returns relative to that of other countries). If the United States maintains the best legal, governance, and institutional frameworks and maintains its commitment to private property rights, we do not see any reversal in our country’s dominant position in the global marketplace.

For help in reviewing your portfolios and making any necessary changes, please contact our Portfolio Management Group at 1 (800) 799-3320.