“The FOMC has considerable control over short-term interest rates. We have much less influence over longer term rates, which are set in the marketplace.”

- Jerome Powell. Chairman, Federal Reserve Bank

Market Returns & Outlook

The markets continued trending lower in October, with stocks and bonds once again posting negative returns for the month (see table below). Year-to-date returns across major equity indexes now range from about (2.72)% in the US Small/Mid Cap sector to a still impressive ~23.61% in the tech heavy NASDAQ, the latter still substantially outperforming its historical annual average (note, we are 10 months into 2023) spanning multiple decades. In the broader S&P 500, YTD returns of about 10.68% is in line with long-term annual averages for large cap equity returns in the United States. A lot of the tapering in risk asset performance is driven by a sharp increase in bond yields – 10-year US Treasury yields started the month at 4.57% and ended at 4.93%. The increase of about 36 basis points or 0.36% equates to a decline of about 3% in terms of the Treasury note’s market price.

| Index | YTD TR (%) | October 2023 |

|---|---|---|

| US Large Cap - S&P 500 | 10.68% | (2.10)% |

| US Large Cap – Tech Heavy NASDAQ | 23.61% | (2.76)% |

| International Equity – MSACWI ex US | 1.49% | (4.11)% |

| US Small/Mid Cap – Russell 2500 | (2.72)% | (6.07)% |

| Bloomberg Aggregate Intermediate Bond Index | (2.76)% | (1.58)% |

Our outlook for future equity and bond returns over the next cycle merits a certain level of caution. As our investors will recall, the market value of an asset is based on the present value of the discounted net cash inflows the asset is expected to generate in the future. “Discounting” future cash inflows is required to recognize that a Dollar earned today is more valuable than a Dollar earned a few years from now, since today’s Dollars can be invested to earn interest. Thus, future Dollars earned have to be discounted by the prevailing rate of interest to determine its present value. If interest rates rise, other things being equal, the present value of the asset falls. The question therefore is, what causes interest rates to rise, and will those factors be at play over the next 7–10-year cycle?

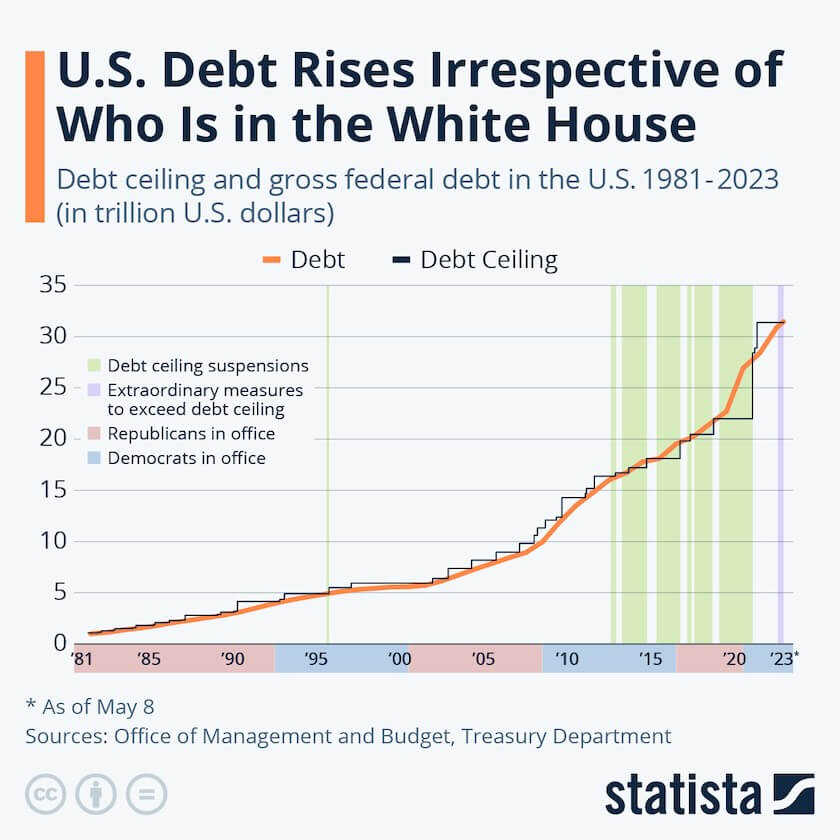

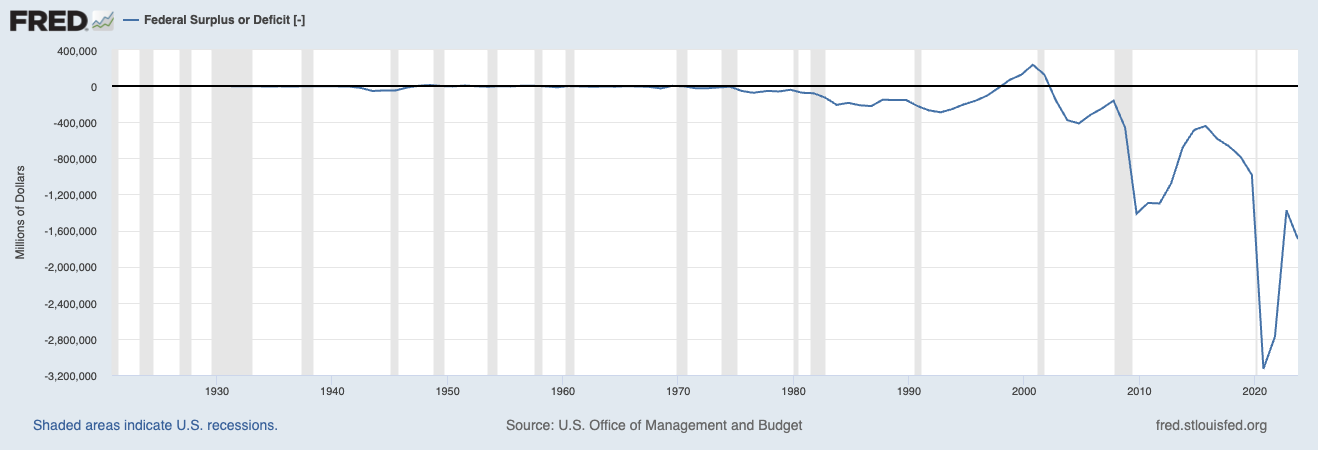

US Debt & Federal Budget Deficits

Federal Surplus or Deficit

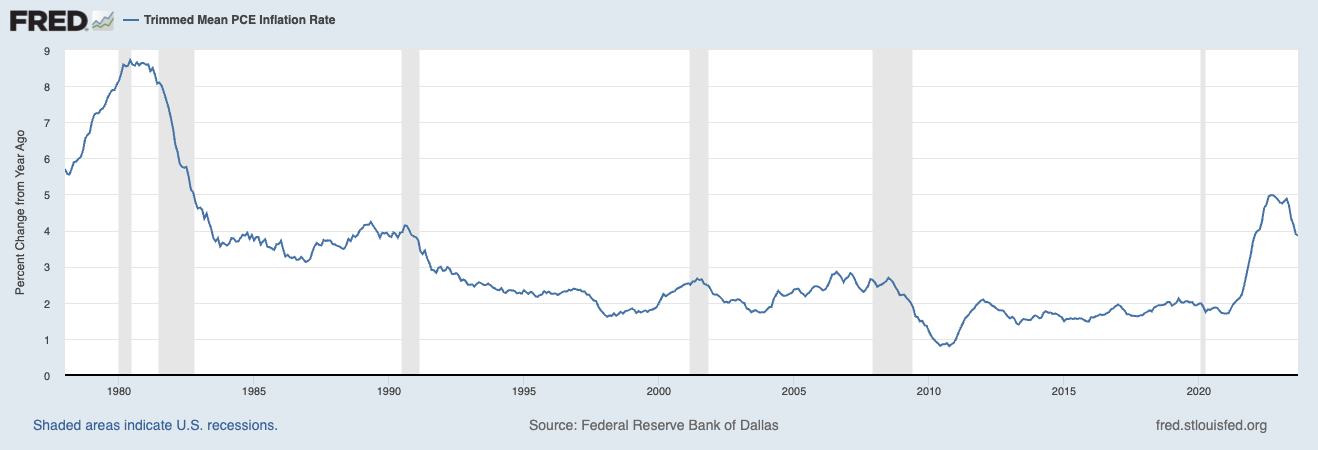

Inflation and FOMC Policy

Implications

Recommendations

*Investment in private equity may require accreditation.*

Udayan Mitra, CFA

Udayan is Trajan Wealth's CIO with over two decades of experience in the investment management industry. He earned a Bachelor of Science degree in Economics from the London School of Economics and an MBA in Finance from Rice University.