With the election over, investors may be wondering about market volatility as we enter 2021.

Regardless of politics, short-term stock market volatility can vary depending on factors, including gridlock in the House and Senate, and a newly elected future President Biden. Tracking trends like this in the stock market tends to be easier than understanding why they occur.

After an 11-year bull run, we entered a bear market in 2020 amid the COVID-19 pandemic. Even today, it is uncertain how long the pandemic will last and how quickly we will have vaccines available. However, the stock market responds positively to the news that a vaccine will be available to the public in 2021.

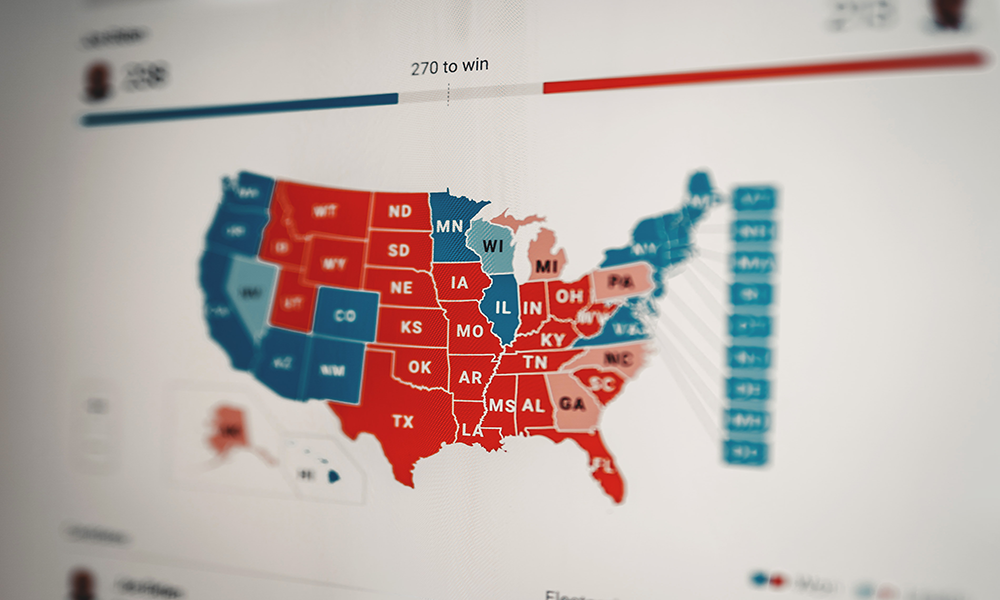

Some stock market analysts view a Democratic President and a Republican-controlled U.S. Senate as the ‘best of both worlds’ when it comes to positive stock market performance:

- The easing of trade wars.

- Increasing global trade of U.S. products.

- Pro-business policies.

- Corporate taxes and capital gains taxes remain at current tax rates.

Often leading to post-election market volatility is what is known as The Presidential Election Theory, developed by stock market researcher Yale Hirsch. Hirsch’s theory suggests that stock markets perform weakest during the first two years of a presidential term when the president tends to work on the proposed policy reform that got them elected.

During the second half of their term, presidents shift their focus to improving the economy to be re-elected. As a result, many stock indices gain in value – and the results tend to be consistent regardless of whether the president is Democratic or Republican. Now, with COVID-19 cases increasing, the top priority for our newly elected future President Biden will be the pandemic first and his proposed policies secondary.

It is important to remember that time in the market beats timing the market. Stay focused on your long-term financial strategy for stable growth in your portfolio and discuss your concerns about market volatility with your financial professional.

Need assistance? Contact us now