With interest rates on the rise and equity prices falling, one of the financial markets’ sectors that has become increasingly attractive is preferred stocks. Preferred stocks are a combination of a fixed income security and a bond. This is true both in terms of their characteristics and where they fall in the capital structure of an issuer. In addition to their place in the capital structure, income from preferred stocks share characteristics of both bond income and stock dividends. Preferred stocks are typically less followed by analysts and trade at lower volumes than either a company’s common stock or its bonds. This combination of characteristics makes preferred stock attractive as an income producing alternative to both bonds and dividend-paying common stocks.

Characteristics of Preferred Stock

Preferred stock is considered a “hybrid security”, meaning that the asset type has characteristics of both common stock and bonds. Like a bond, preferred stock is issued with a par/redemption value – typically $25. Like a common stock, most preferreds are issued with no maturity date – in perpetuity. Like a bond, most preferreds have a fixed coupon, but like a common stock, the dividends are paid quarterly. Preferreds typically have a call date five years from the date of issuance, which means the issuer has the option of calling the preferred any time five years after the date of issuance. Preferred stocks are below bonds on a company’s capital structure but ahead of the common stock both in terms of dividends and any terminal value. Another attractive feature to many holders is that the income from preferred stocks is dividend income, which receives favorable tax treatment, as opposed to bond interest, which is treated as ordinary income.

Who Issues Preferred Stock

Traditionally, issuers of preferred stock have been banks and other financial firms, including insurance companies and Real Estate Investment Trusts (REITs). Recently firms from other industries, including shipping companies, energy companies, and others, have begun issuing preferred stock. Issuance of preferred stock by banks and insurance companies was historically driven by the capital treatment and the financial flexibility that preferred stock provides. Unlike bond interest which must be paid in a timely manner, preferred dividends may be suspended during difficult times without forcing the company into a default. The financial flexibility of preferred stock stems from their position in the capital structure, as well as the treatment of the income from preferred stock.. This stems largely from the same reasons – position of preferred stock in the capital structure and the resulting flexibility they offer.

The Benefits of Preferred Stock in a Portfolio

We look at preferred stock as an attractive income option in income-oriented portfolios for the following reasons:

- The preferred stocks’ yield is often at or above similar-quality high-yield bonds.

- When adjusted for the favorable tax treatment of preferreds – dividend income vs. ordinary income – preferred stocks often have better yields than equivalent rated high-yield bonds.

- For many issuers, the flexibility of preferreds results in less risk to the issuers than issuing senior or subordinate debt.

- For high-quality issuers, we feel being down the capital structure is often less risky than a position in a high-yield bond of a weaker issuer.

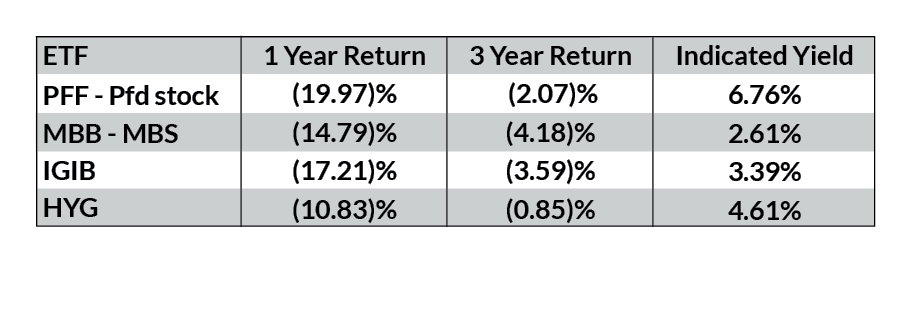

The table below shows the yields and other characteristics of preferred and bond ETS, including yields and performance:

Source: Trajan Analytics

In conclusion, we feel preferred stocks are an attractive income-producing vehicle that makes sense as part of an aggressive fixed income portfolio. As a result of rising rates and falling stock prices, many preferreds are currently trading at discounts to their par/redemption value. This discount means that buyers can, in addition to the regular income, participate in a limited amount of price appreciation when those preferreds return to their par value.