Flashback to the Dot-Com Bubble

The year is 1996. It’s becoming increasingly clear that the “Internet” won’t be just a passing technology fad. You receive a CD in the mail from America Online, encouraging you to get connected. The stock market is heating up after the soaring IPOs of Netscape and Yahoo. Financial analysts debate whether an online bookstore called Amazon will soon be crushed by Barnes & Noble and Borders launching websites of their own.

As a savvy investor, you’re tempted to bet on this technology revolution. But you’re also a student of market history. You’ve read about past financial bubbles—the roaring ’20s or the Nifty Fifty—and you know that bubbles always end in a crash. Fed Chairman Alan Greenspan makes his famous “irrational exuberance” speech. You’re nervous.

Defining a Bubble

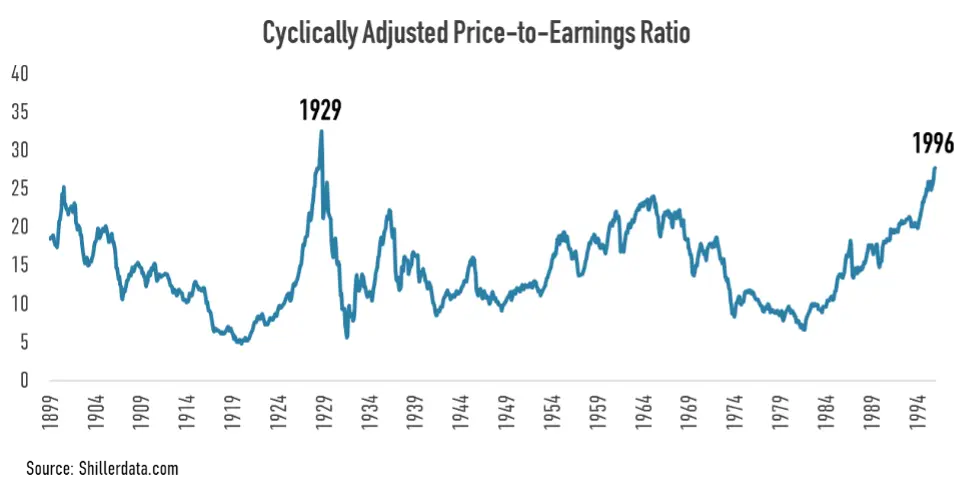

Most of all, you’re worried that stock prices are too high. You’ve read that the “cyclically adjusted price-to-earning ratio” (CAPE) can be a reliable measure of market valuations. Instead of using one year’s earnings, which can be volatile, CAPE uses a ten-year average of earnings (adjusted for inflation) in the denominator.

And CAPE is telling you there’s a bubble. By the end of 1996, this metric is nearly 28x, a level only seen once before in history: Right before the 1929 crash that led into the Great Depression!

So you decide to get out of stocks and wait for the bubble to crash. Then you can buy back into the market when prices are lower. You’re not quite sure how you’ll know when to get back in, but you figure you’ll let history be your guide. From 1900-1996, the average CAPE was 14.6x, so maybe just wait for that. Smart, right?

What Came Next: The Bubble Continues to Inflate

You were right about there being a bubble, but you were way too early. The dot-com bubble would continue to inflate for three more years! The cyclically adjusted price-to-earnings ratio eventually reached an unprecedented 44x. That’s 36% higher than the 1929 peak!

It would be challenging for any investor to maintain their discipline through those three years. You’re watching your friends and neighbors get rich while you sit on the sidelines. From the end of 1996 until the bubble finally popped in mid-2000, the S&P 500 more than doubled in value.

Market Timing is Nearly Impossible

Worse, if you were waiting for CAPE to return to its long-term average, you might never get back into stocks! After the peak, it took about three more years for the excesses of the dot-com bubble to unwind. When the S&P 500 finally bottomed in early 2003, the CAPE ratio was still north of 21x, well above its long-term average. In fact, the CAPE would only ever touch its 1900-1996 average for about two months in 2009, as investors panicked during the Global Financial Crisis. That’s a single two-month window to get reinvested, in nearly 30 years!

Perhaps you’re thinking, “maybe I never would have reinvested, but at least I would have avoided that painful crash!” But that’s no way to build a long-term financial plan. Including reinvested dividends, the S&P 500 returned 23% between the end of 1996 and the post-crash bottom in 2003. You would have been better off just staying invested through the whole thing!

And how about if you stayed invested from the end of 1996 through now? Over that time, the S&P 500 is up approximately 15-fold, enough to turn $100,000 into $1.5 million. It works out to a 10% annual total return. For a patient and disciplined investor, time is your greatest ally.

Preparing for an AI Bubble

At Trajan Wealth, we don’t believe in market timing, but that doesn’t mean we just sit on our hands waiting for the next bubble to inflate and pop. These days, investors are worried about a bubble in artificial intelligence. Here’s how we’re dealing with this risk:

Analyzing the AI Revolution

First, while it’s possible that we’re in an AI bubble, it’s far from certain. Artificial intelligence is a truly revolutionary technology, on par with the Internet, smartphones, or even electricity. It gets at the very core of how humans create economic value. Some AI experts would tell you that average people still greatly underappreciate how much the world will change from AI.

If it is a bubble, it may still be early days—analogous to 1996 for the dot-com bubble. The technology is improving at a rapid pace, with each new generation of AI models more capable than the last. We’re barely scratching the surface of how this technology could spread throughout the economy. Netscape and AOL gave way to Google and Facebook. Amazon’s online bookstore eventually became the “everything store.” And it took many more years before we got Uber, Airbnb, Zoom, or TikTok. What new businesses will AI enable, that we’re not even thinking about today?

Assessing Potential Risks and Disruption

That said, just because AI will change the world doesn’t mean the technology industry won’t over-invest in the short term, creating excess capacity and requiring a painful correction. There’s also growing disruption risk to many legacy business models, and many workers who may need to reconsider their career paths. Investors have a track record of getting overly excited about tech revolutions, driving up valuations to unrealistic heights.

Our Portfolio Management Strategy

As a portfolio manager, I’m seeking to participate in the opportunities created by AI, while protecting against the possibility of a bust. That generally means:

- Owning technology leaders with multiple competitive advantages, exceptional financial strength, and reasonable valuations;

- Avoiding the most overhyped and expensive AI stocks, where any setback could cause investors to jump ship;

- Being wary of potential long-term disruption risk to other industries, including those not traditionally seen as technology-driven; and

- Diversifying our AI exposure with businesses that have little connection to AI, such as in healthcare, infrastructure, or consumer staples.

Your Trajan Wealth Advisor Is Ready to Guide You

Technology revolutions create both opportunities and risks for investors. Your Trajan Wealth advisor is ready to guide you through whatever comes next.