A Data‑Backed Perspective from Trajan Wealth

At Trajan Wealth, we don’t just believe in putting clients first, we build portfolios rooted in data, evidence, and long term conviction. For many investors, private markets remain misunderstood. The reality is: with the right strategy and fiduciary discipline, private assets can deliver differentiated returns and sector diversification that enhance long term wealth. Below we unpack why private markets deserve a well considered place in a diversified portfolio, and how we at Trajan Wealth evaluate and integrate them for client success.

The Case for Private Markets: Historical Performance & Return Premium

One of the strongest arguments for private markets lies in their long‑term track record. Peer‑reviewed and institutional research has consistently found that private equity (a major segment of private markets) has outperformed public equities over multi‑decade periods.

- For example, a broadly diversified private equity portfolio over the 2000–2023 period has delivered an annualized net return of approximately 11.0%, compared with roughly 6.2% for a comparable global public equity benchmark, representing an annualized outperformance of about 4.8%. (CAIA Association, 2023)

- Supporting this, MSCI’s analysis of global buyout funds shows that, after adjusting for risk and fund vintage, private equity outperformed public equity by roughly 3.8% annually. (MSCI, 2024)

- For long‑term investors (such as retirees or those building a retirement nest egg) this premium compounds significantly over decades, often translating into a noticeably larger final portfolio value.

Diversification & Risk Management: More Than Potential Higher Returns

Beyond returns, private markets offer investors exposure to a different “slice” of the global economy. That slice tends to behave differently than public markets, which offers diversification benefits which helping smooth total portfolio volatility and reduce drawdown risk. At Trajan Wealth, we view this as a core strength, especially for clients with long‑term horizons.

- Research from well‑established asset managers shows that many private‑capital strategies have significantly lower correlation to public‑market equivalents. In one study, the majority of private‑capital strategies had correlations below 75%, and many well below that threshold. (MSCI)

- Lower correlation arises because private equity and private credit often invest in companies or assets not captured by public indexes, employ active ownership (operational improvements, restructuring, etc.), and are subject to different liquidity and valuation dynamics. (Brookfield Oaktree Wealth Solutions)

- As a result, combining public equities with private assets can meaningfully reduce portfolio risk (especially in turbulent markets) while still preserving, or even enhancing, potential returns.

Why Active, Fiduciary Led Guidance Matters And Where Big Institutions Fall Short

Investing in private markets is not plug‑and‑play. There are no tickers, no daily price feeds, and no easy “index fund” to buy. Instead, success depends on manager selection, asset‑level underwriting, timing, liquidity management, and disciplined allocation. This is where the value of a fiduciary‑led, independent firm like Trajan Wealth comes in.

- Large institutional firms and “mega‑funds” often focus on scale, fees, and access, which can limit flexibility. They may shy away from middle‑market opportunities where value is often greatest.

- Trajan Wealth’s boutique, nimble structure allows us to thoughtfully pursue middle‑market and differentiated private opportunities, the kind that are often overlooked by large institutions, and tailor them to client needs.

- A diversified “private allocation” is rarely one-size-fits-all. For some clients, exposure to private equity makes sense; for others, private credit or real assets (infrastructure, real estate) may be a better fit. We construct portfolios based on risk tolerance, liquidity needs, and long‑term planning goals.

Evaluating the Tradeoffs: Illiquidity and Long Term Mindset

Private markets come with tradeoffs, the most obvious being illiquidity. Once you commit capital, you usually can’t get it back quickly. For investors requiring short term access to funds, this can pose a problem. That’s why we only recommend private market allocations where capital can remain committed for the long haul (5–10 years or more).

At Trajan Wealth, we stress that private market exposure is not about chasing quick wins, but about patient, disciplined investing.

The Trajan Wealth Difference: How We Approach Private Markets

- Client‑first mandate. As a fiduciary advisory firm, our loyalty is to clients, not to assets under management or corporate quotas. We only recommend private allocations when they align with a client’s unique goals, timeline, and liquidity needs.

- Curated access & selective diligence. We focus on middle‑market or niche private opportunities often ignored by large institutions. Each potential investment undergoes rigorous due diligence.

- Active portfolio construction. We build diversified allocations across different private asset types (equity, credit, real assets) to optimize risk/return. We rebalance and revisit allocations over time as goals and market conditions evolve.

- Long‑term discipline. We set expectations realistically; private investments require patience. We manage the illiquidity tradeoff with care, ensuring clients understand the time commitment and potential upsides.

Bottom Line: With the Right Framework, Private Markets Can Be a Strategic Advantage

Private markets are complex: less liquid, less transparent, and sometimes slower to react than public markets. But with those tradeoffs come distinct structural advantages: a long term return premium, diversification benefits, and access to a broader universe of companies and assets. For investors with the right horizon and goals, private assets (thoughtfully selected and carefully monitored) can enhance both return potential and portfolio resiliency.

At Trajan Wealth, we view private markets not as a trendy add on, but as an essential component of a modern, diversified, long term wealth building strategy. We believe in bringing access, due diligence, and fiduciary discipline to a space that can otherwise feel hard to navigate. In doing so, we help clients navigate complexity and build wealth that lasts.

Postscript

Private Markets in Practice: David Swensen’s Endowment Model at Yale

David Swensen, Yale’s chief investment officer from the mid-1980s until his death in May in 2021, unfailingly emphasized the importance of measuring success not by single-year returns, but instead by returns over much longer periods. Still, it is fitting to note his career’s staggering coda: during Swensen’s last year heading the Yale endowment, it notched a 40.2% gain — one of the highest in the university’s history.

David Swensen, Yale’s chief investment officer from the mid-1980s until his death in May in 2021, unfailingly emphasized the importance of measuring success not by single-year returns, but instead by returns over much longer periods. Still, it is fitting to note his career’s staggering coda: during Swensen’s last year heading the Yale endowment, it notched a 40.2% gain — one of the highest in the university’s history.

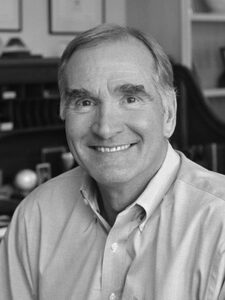

(Image: David Swensen, Yale’s Chief Investment Officer. Source: Yale News)

Swensen’s investment track record is incomparable. Over those 36 years, Yale produced an annualized gain of 13.7% per annum, outperforming the average endowment (as measured by Cambridge Associates) by 3.4% per annum. In dollar terms, outperformance during Swensen’s tenure represented over $50 billion in value added relative to the average endowment. Without spending, a single dollar invested at the start of his tenure would have grown to nearly $103 by the end of the 36 years. By comparison, a dollar invested in the S&P 500 would be worth slightly more than $50.

When Swensen began his career as Yale’s chief investment officer, the typical institutional fund was invested in a traditional “60/40 portfolio” comprised of 60% domestic equities and 40% bonds. Swensen, alongside long-time collaborator Dean Takahashi, took principles of modern portfolio theory espoused by his mentor, Nobel laureate James Tobin, and his fellow Nobel laureate Harry Markowitz, and pioneered an approach to endowment investing that transformed the institutional investment landscape and became known as the “Yale Model.” Emphasizing diversification and an equity orientation to take advantage of Yale’s long-time horizon, Swensen expanded Yale’s portfolio into alternative assets such as hedge funds, real estate, timber, and private equity long before such an approach became standard. The pioneering work paid off. Measured relative to the traditional 60/40 portfolio, Yale outperformed by 4.0% per annum under Swensen’s watch.