Investors are grappling with a mix of good and bad news. On the positive side:

- The CPI inflation rate of 3.7%, while still uncomfortably high, is down meaningfully from a peak of more than 9% in mid-2022.

- The Federal Reserve may be close to ending its tightening cycle, with one more rate increase expected this year and rate cuts possible as soon as next year.

- The overall economy is relatively healthy. The unemployment rate of 3.8% is up modestly since the beginning of 2023 but remains close to a multi-decade low.

- Advances in artificial intelligence promise to accelerate worker productivity and economic growth. Healthcare innovation also seems to be picking up pace, with effective treatments for challenging health conditions like obesity.

On the negative side:

- Higher interest rates flow through the economy with a lag. As consumers move houses or replace their cars, and as businesses refinance debt or reconsider investment plans, we may see stronger headwinds to economic growth.

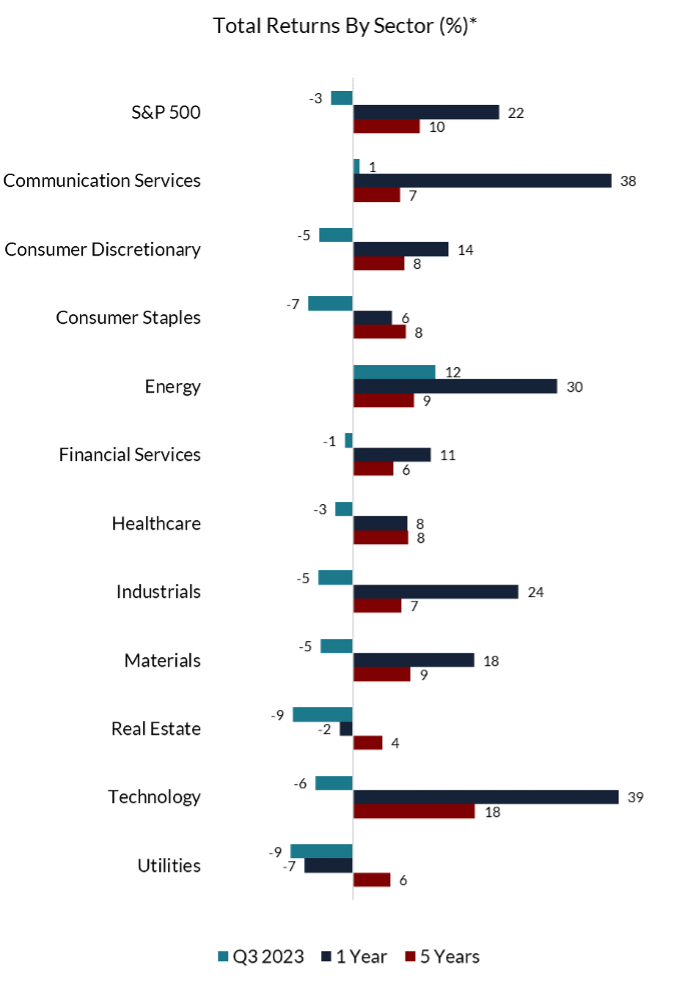

- The 10-Year Treasury yield increased from 3.81% to 4.59% during the third quarter, reflecting investor fears that rates may stay “higher for longer.” This weighed on stock prices for economically sensitive areas like industrials and materials, as well as rate-sensitive sectors like utilities and real estate.

- Stock market returns over the past year have been powered by the technology and communication services sectors, where stretched valuations could weigh on future returns.

- The Russia/Ukraine war is dragging on, exacerbating geopolitical tensions elsewhere, including China/Taiwan. Partisan fighting in Washington could inhibit the U.S.’s ability to respond to a crisis.

The Greed/Fear Cycle

Perhaps you recognize some of these feelings from your own experience? That’s perfectly normal! It only becomes a problem if you act on the emotions. Asset allocation decisions should be based on your long-term financial goals and risk tolerance, not some half-baked theory about where you think the market is headed over the next six months. Consult a Trajan Wealth fiduciary advisor to stay on track with your financial plan.

Gold Vs. Productive Assets

Clients often ask us whether they should invest in gold, especially when the markets, economy, or political situation feel uncertain. Warren Buffett’s 2011 shareholder letter provided an especially insightful take on gold investing, in our view.

To paraphrase and update some of his numbers: If you were to combine all the gold ever mined in the history of humanity, it would form a cube with a side length of about 75 feet, weighing around 206,000 tons. For perspective, that would fit comfortably inside a Major League Baseball diamond and be about a quarter as tall as the Statue of Liberty.

At current spot prices, this cube of gold would be worth about $13 trillion. What could you do with it? You could look at it. You could admire how shiny it is. You could chip off a tiny bit to make some jewelry.

What else could you buy with $13 trillion? Roughly speaking, how about all of the farmland in the United States (900 million acres!) plus 100% of Apple AAPL, Microsoft MSFT, and Amazon AMZN (generating around $200 billion in combined annual free cash flow). With the money that’s left over, you could buy all of the real estate in New York City.

Which would you rather own: All those productive assets, or the shiny cube?

Matt Coffina, CFA

Matt Coffina, CFA, is the portfolio manager for Trajan Wealth’s Expanding Moat and Defensive Moat strategies. He seeks to invest in companies with strong and improving competitive advantages, above-average revenue and earnings growth, and reasonable valuations. Matt has more than 15 years of experience as a portfolio manager and analyst. Even if it weren’t his job, he would happily spend all day learning about businesses and trying to identify stocks with a favorable risk/reward tradeoff.