“The big money is not in the buying or the selling, but in the waiting.”

– Charlie Munger

2024 was a remarkable year for investors, showcasing the resilience of the U.S. economy and the power of innovation. Despite a weak December, strong equity market performance, stabilizing bond markets, and evolving fiscal and monetary policies shaped an eventful year.

Key Takeaways:

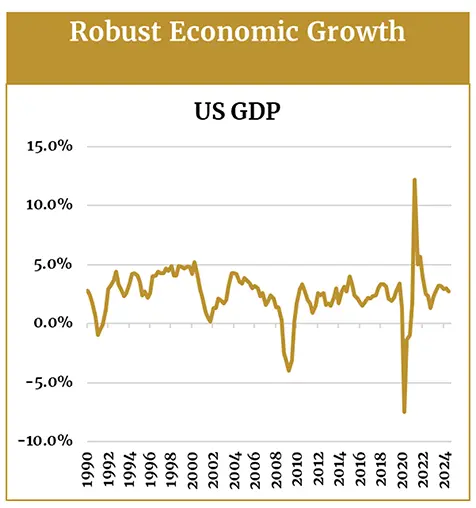

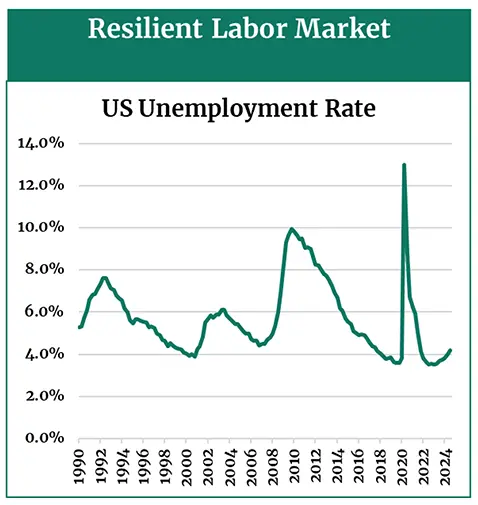

1. Resilience Amid Transition: The U.S. economy achieved steady growth in 2024, achieving a 3.1% annualized GDP growth rate in Q3, with unemployment remaining low at 4.2%.

2.The Power of Innovation: Artificial intelligence fueled stock market gains, with the tech-heavy Nasdaq posting a 29.6% return.

3. Caution in Valuations: Elevated stock valuations, particularly in mega-cap tech, warrant diversification and risk management.

4. Fixed Income Regains Relevance: Bond yields reached levels not seen in nearly two decades, offering investors a renewed opportunity for income and stability within their portfolios.

The U.S. Economy: Growth Amid Transition

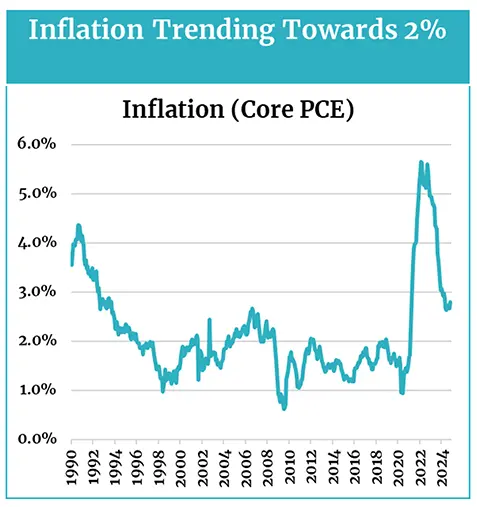

2024 marked a pivotal year for the U.S. economy. Inflationary pressures eased towards the Fed’s 2% target which prompted the Federal Reserve to shift from aggressive rate hikes to a more accommodative stance – implementing its first rate cut in September. By the year’s end, the Fed’s forward guidance signaled limited cuts in 2025. With the Fed rate cycle in its final innings, monetary policy will take a backseat in 2025 as fiscal policy moves to the forefront under President Trump.

President Trump’s administration promises a pro-growth agenda, with tax cuts, infrastructure spending, and national debt management. However, tariffs could play a significant role in reshaping trade policies. While aimed at boosting domestic manufacturing and reducing trade deficits, such measures may increase costs for businesses reliant on global supply chains and impact consumer prices.

Source: Bloomberg. Data 1990-2024.

Innovation Drives U.S. Market Gains in 2024

The S&P 500 delivered an impressive 25.0% return in 2024, marking the strongest two-year performance since 1998, driven by the innovation economy and consumer spending.

| Index | YTD TR (%) | Dec 2024 Monthly TR |

|---|---|---|

| US Large Cap – S&P 500 | 25.0% | -2.4% |

| US Large Cap – Tech Heavy NASDAQ | 29.6% | 0.6% |

| International Equity – MSACWI ex US | 6.1% | -1.9% |

| US Small/Mid Cap – Russell 2500 | 12.0% | -7.5% |

| Bloomberg Aggregate Intermediate Bond Index | 1.3% | -1.6% |

Source: Bloomberg

Sector Highlights:

- Technology: Demand for AI-driven solutions propelled mega-cap tech stocks.

- Communication Services: Strong digital ad revenues and media innovation supported growth.

- Consumer Discretionary: Resilient consumer spending, new car sales, retailer foot traffic.

- Financials: Benefited from a robust credit market, strengthening balance sheets, and M&A.

Valuations and Risks:

The S&P 500’s forward price-to-earnings (P/E) ratio closed the year at ~22×1, above the 25-year historical average of 19×1, raising concerns about the sustainability of current valuations. Concentration in a few mega-cap tech stocks amplifies risks, as their underperformance could significantly impact overall market returns.

Historical Perspective:

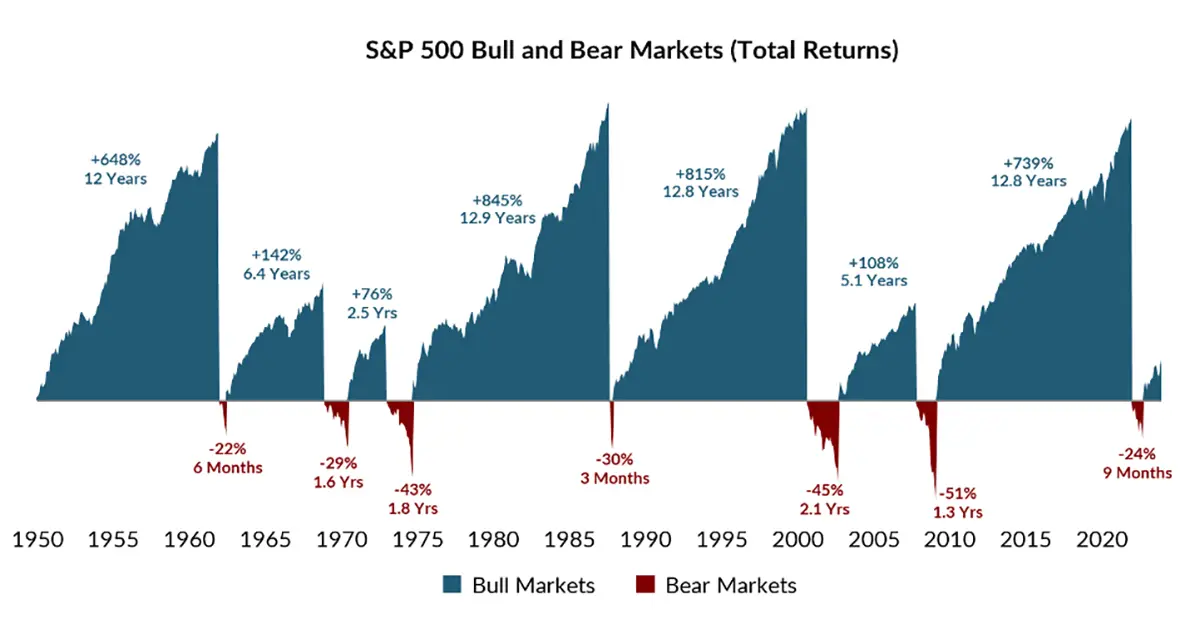

Market timing is a common pitfall. Research shows that missing just the 10 best trading days over 20 years can slash portfolio returns by nearly half. Notably, these “best days” often occur during periods of heightened volatility.

Source: Bloomberg, Trajan Wealth estimates. Data from 2004-2023.

Furthermore, the length of bull markets historically outpaces bear markets. While bear markets average around 9-12 months, bull markets tend to last several years.

Source: Bloomberg, Trajan Wealth estimates. Data from 1950-2023

Historically, staying invested during turbulent times has produced the best outcomes for long-term investors.

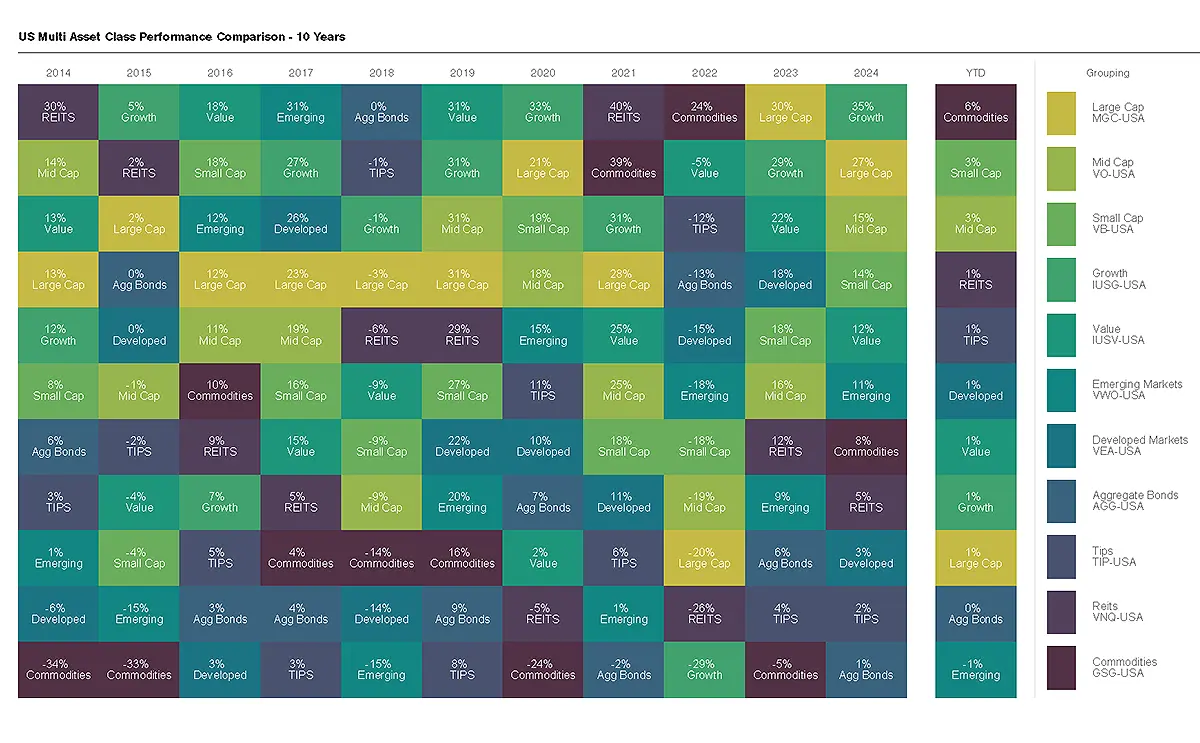

Asset Class Rotation and Diversification

2024 underscored the importance of asset class diversification. While large-cap tech-dominated, international equities and small/mid-cap stocks underperformed.

Source: FactSet. Data from 2014-2024.

Why Diversify? Diversification mitigates the risks of market concentration and can help smooth returns over time. It seeks to ensure exposure to a mix of asset classes (such as stocks, bonds, and alternatives), capturing opportunities while managing against downturns over time.

Bonds Rebound: Income and Stability in Focus

After years of low interest rates and lackluster performance, bonds offered renewed opportunities in 2024, delivering modest positive returns. Bond yields have risen to levels not seen since the mid-2000s, creating attractive opportunities for income investors.

Source: Bloomberg. Data from 1999 – 2024

With return correlations between stocks and bonds now approaching zero, along with higher bond yields, fixed income serves as an effective tool for managing portfolio volatility.

Source: Bloomberg. Data from 2019 – 2024.

Recommendations For 2025

- Stay the Course: Avoid market timing. The best days often follow the worst, reinforcing the importance of long-term investment strategies.

- Balance Growth and Stability: While equities offered strong returns in 2024, bonds play a critical role in maintaining portfolio diversification. Higher bond yields provide opportunities for the income-oriented investor.

- Reassess Risks: Align your portfolio with your financial goals by reviewing your current asset allocation and diversifying to manage risks effectively.

Conclusion

As we head into 2025, maintaining a disciplined approach, focusing on quality, and embracing a long-term mindset will be essential to capturing opportunities while managing risks. To help position your portfolio for success, contact our Portfolio Management Group at 1-800-799-3320 for a personalized portfolio review.