A Guide for Owners and Heirs

Understanding the guidelines surrounding Required Minimum Distributions (RMDs) is crucial for both account owners and beneficiaries. The “10-year rule” introduced under the SECURE Act and clarified by later IRS guidance, is now a pivotal part of estate and retirement planning. Whether you are preparing to take your own RMDs or you’ve inherited an account, here are nine things you need to know about it.

1. What are RMDs?

RMDs, or Required Minimum Distributions, are the minimum amounts you are required to withdraw annually from your tax-deferred retirement accounts once you reach a certain age, typically 73 with the current law. The RMD amount for a given year is calculated by using an IRS worksheet. It essentially involves dividing the previous year’s account balance by a life expectancy factor.

2. The Purpose Behind the Laws

Congress designed both the RMDs and the 10-year rule to prevent indefinite tax deferral. They apply to accounts where contributions and earnings have grown tax-free, such as traditional IRAs, SEP IRAs, SIMPLE IRAs, 401(k)s, 403(b)s, and 457(b)s. Your first RMD is due by April 1 of the year after you turn 73, your second RMD is due by December 31 of the same year, with subsequent RMDs required by December 31 each following year.

3. The Origin of the 10-Year Rule

The 10-year rule was enacted in 2020 with the Setting Every Community Up for Retirement Enhancement (SECURE) Act. Then SECURE 2.0 passed in 2022, which later raised the RMD starting age for account owners and clarified several beneficiary rules. For beneficiaries, these laws mean they must deplete inherited accounts within ten years, ensuring the government collects deferred taxes.

4. When the 10-Year Rule Can Apply

The 10-year rule generally applies to non-spouse beneficiaries of IRAs and defined contribution plans (401(k), 403(b), etc.).

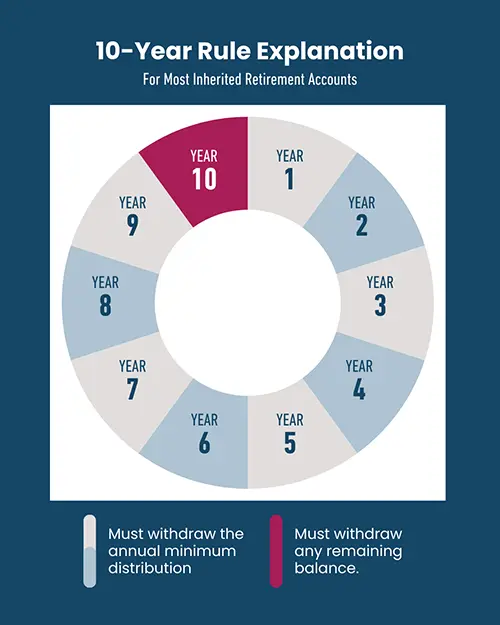

If the original owner died before their Required Beginning Date (RBD), only the 10-year deadline applies. But if they died on or after their RBD, non-spouse beneficiaries must take annual RMDs in years 1–9 and empty the account by year 10. (The IRS waived penalties for missed annual RMDs in 2021–2024, but this requirement applies going forward.)

Source: IRS.gov

For owners, this highlights why tracking your own RBD is critical. Whether you pass away before or after that date will change how your heirs are required to distribute the funds.

5. Tax Implications for Heirs

Distributions from inherited retirement accounts are taxable as ordinary income (except for qualified Roth distributions). Beneficiaries often spread withdrawals over the ten years to avoid a sudden tax spike. That’s why strategic timing is key. Owners should be mindful that the size of their accounts at death will influence heirs’ future tax burdens.

6. Exceptions to the 10-Year Rule

Certain “Eligible Designated Beneficiaries” can stretch distributions over their life expectancy:

- Surviving spouses

- Minor children of the decedent (only until majority, then the 10-year rule kicks in)

- Disabled or chronically ill individuals

- Beneficiaries less than 10 years younger than the decedent

7. Multiple Inherited Accounts

Each inherited account has its own distribution schedule based on the original owner’s death. Beneficiaries inheriting from multiple individuals must track each account separately.

8. Roth IRAs and Roth 401(k)s

Owners: Roth IRAs have never had lifetime RMDs. As of 2024, Roth 401(k) and 403(b) accounts also have no lifetime RMDs.

Beneficiaries: The 10-year rule can apply to inherited Roth accounts. If the decedent died after their RBD, annual RMDs may also apply. The good news is that Roth distributions are generally tax-free, if the 5-year rule is met. To qualify, the money must have been in the Roth account for five years, including the years it was in the Roth account during the IRA owner’s lifetime, before it’s withdrawn.

9. The Rules are Still Evolving

The IRS provided penalty relief for missed annual RMDs in 2021–2024 as rules shifted, but the new framework is now enforced. You should always speak with a tax professional and check the plan’s documents, which may impose stricter timelines than federal law.

Quick FAQs

As of 2025, owners must begin RMDs at age 73. Starting in 2033, the RMD age rises to 75 for certain birth years.

Failure to take your required distribution can result in a significant penalty, often 25% of the amount not withdrawn. This can be reduced or waived if you correct the error and meet certain IRS conditions.

Not always. If the decedent died before RBD, only the 10-year clean-out applies. If they died after RBD, you must take annual RMDs plus clear the account by year 10.

Typically the answer is yes. Beneficiaries of Roth IRAs and Roth 401(k)s must still follow the 10-year rule (and possibly annual RMDs if death occurred after RBD), but distributions are typically tax-free if the Roth was open for at least five years.

Bottom Line

With the complex rules continuing to evolve, professional guidance is critical to avoid penalties and optimize tax outcomes. However, getting that advice doesn’t need to be difficult. Speak with a Trajan Wealth fiduciary advisor to learn about the rules and strategies that apply to your situation.