With the back-to-school season in full swing, now is the perfect time to talk about saving for future education costs. Whether your children are just starting kindergarten or are already exploring college options, the sooner you start planning, the easier it will be to stay ahead of rising tuition costs.

As a father of four children, the cost of college is always on my mind. I know firsthand how much of a challenge it can be to prepare for these expenses while balancing other financial priorities. When I attended college over 25 years ago, things were different. I worked full-time while going to school full-time, and to make things more complicated, my wife and I were newlyweds, and she had the same grueling schedule! I worked Monday through Friday at a brokerage firm from 7:00AM to 4:00PM, then attended classes at night, on weekends, and online (which was brand-new technology at the time).

It wasn’t easy, but that hustle gave me financial freedom after graduation because I didn’t rely on student loans. Instead, my education was funded by a combination of employer support and my own earnings.

For today’s students and families, college costs have nearly tripled compared to two decades ago. Planning for a child’s college education, or even graduate school, can be one of the largest financial challenges families will face. Without a solid savings plan, many students graduate burdened by debt, with the average borrower now carrying around $40,000 in student loans.

The Rising Cost of Education

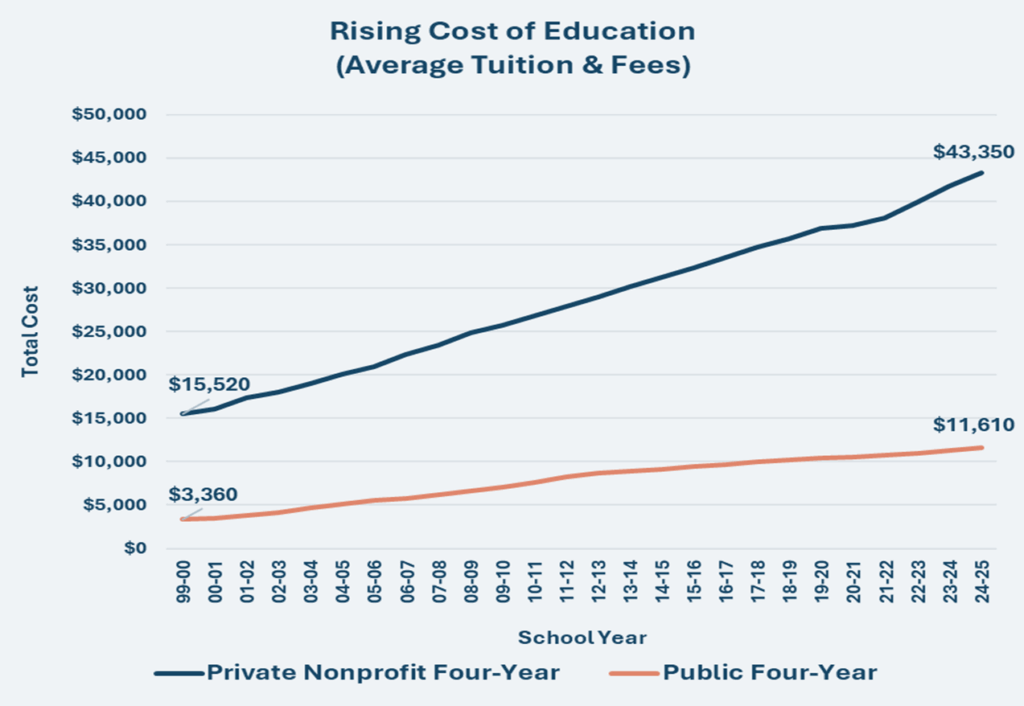

- College costs have nearly tripled over the past three decades. According to the College Board, the average cost of tuition and fees for the 2024–2025 school year is about $11,600 per year for in-state public universities and $43,350 per year for private universities.

Source: College Board Research: Trends in College Pricing 2024. Current Dollars. Not adjusted for inflation.

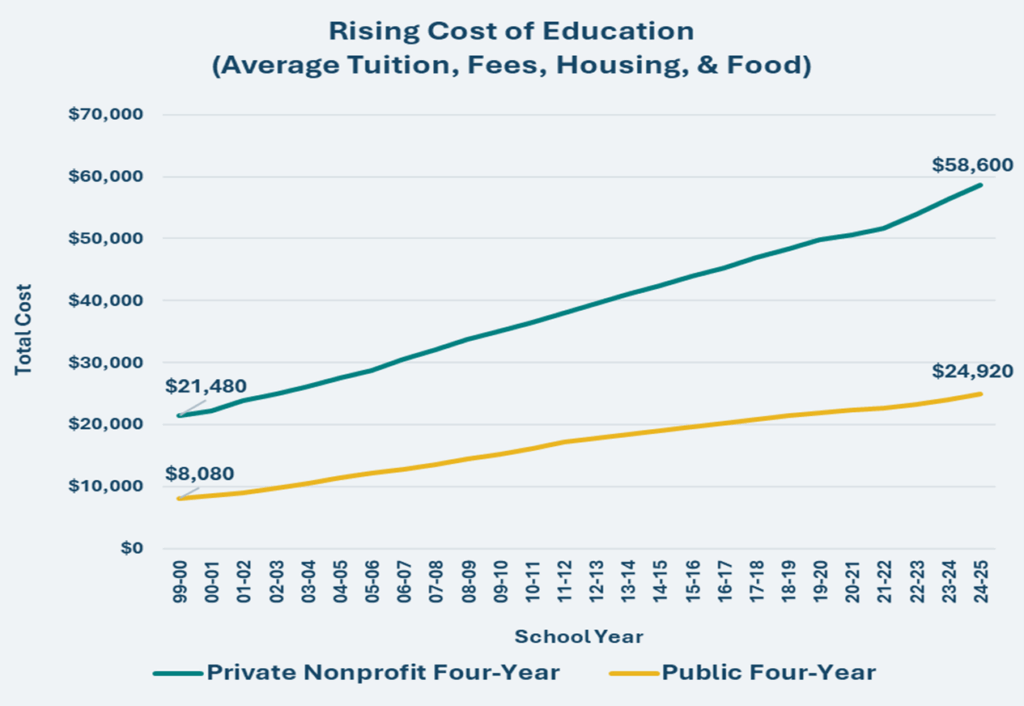

- When you factor in room, board, books, and other expenses, the total cost of a four-year private university degree can exceed $250,000.

Source: College Board Research: Trends in College Pricing 2024. Current Dollars. Not adjusted for inflation.

- Student loan debt continues to be a major burden for graduates. The Federal Reserve reports that as of Q2’25, outstanding U.S. student loan debt topped $1.8 trillion!

These statistics highlight why early planning is critical: every dollar saved today is one less borrowed tomorrow.

How to Start Saving for Education

1. 529 College Savings Plans

- 529 plans are tax-advantaged accounts specifically designed for education expenses. , and are tax-free.

- Qualified education expenses typically include tuition, fees, room and board, books, supplies, and equipment used primarily for school, K-12 tuition, certain apprenticeships, and may even be used for student loan repayment.

- You can open a 529 plan at any age for the beneficiary as long as they have a Social Security number.

- Many states also offer tax deductions or credits for contributions to 529 plans, providing an additional incentive to start saving early.

- The IRS considers contributions to 529 plans as gifts, so be sure to check with your tax advisor as to the amount you can gift without incurring gift tax.

- Most states set a maximum limit on the total amount that can be contributed to a 529 plan for a single beneficiary across all plans in that state. These limits can vary widely from state to state. If the 529 plan funds are not used for qualified education expenses, then you can simply change the beneficiary to another qualifying family member.

- Withdrawing funds for non-educational purposes may trigger federal and state income taxes on the tax deferred growth.

Pro Tip: Ask grandparents and other family members to contribute to a child’s 529 plan instead of gifting toys or clothes for birthdays or holidays. Over time, those small contributions can have a big impact. See our video on the Power of Compounding.

2. Coverdell Education Savings Accounts (ESAs)

- ESAs allow for tax-free withdrawals for both K-12 and college expenses, though are lower than 529 plans.

- ESAs have a $2,000 annual contribution limit and income restrictions for contributions, but they offer greater investment flexibility and cover a broader range of K-12 expenses.

- ESAs must be opened before the beneficiary turns 18 and the funds must be used by age 30.

- Qualified education expenses typically include tuition and fees for K–12 or higher education, room and board, books, supplies, equipment, computers and internet access used primarily for school, certain tutoring costs, and special needs services for eligible students.

- If ESA funds are not used for qualified education expenses, then you can simply change the beneficiary to another qualifying family member under the age of 30.

- Withdrawing the funds for non-education purposes may trigger tax consequences.

3. Custodial Accounts (UGMA/UTMA)

- These accounts allow assets to be transferred to a child, but .

- The account is legally owned by the child from the moment it is funded, but it’s managed by the custodian (often a parent) until the child reaches the “age of majority” which is typically age 18 or 21 depending on the state.

- Once the child reaches the age of majority, they then gain full control and can use the funds for any purpose, like purchasing a vehicle or paying other non-education expenses not covered in 529 or ESA plans.

- These accounts do count as the student’s asset when applying for financial aid, which can significantly reduce eligibility because student-owned assets are weighted more heavily in aid calculations.

- Remember the funds belong entirely to the child and there is no option to change the beneficiary.

Pro Tip: These accounts offer complete flexibility and can hold almost any type of investment. Because they allow for irrevocable gifts to a child, they can be part of an estate planning strategy to reduce the donor’s taxable estate.

4. Automated Savings Strategies

- Consider setting up automatic transfers into a dedicated education savings account. The key is consistency.

- For example, saving just $250 per month for 18 years at an average 6% annual return could grow to nearly $90,000, significantly reducing the need for loans.

- Alternatively, saving $250 per for month for 10 years at an average 6% annual return could grow to almost $41,000.

- While parents could use a regular savings account for education, this is generally less efficient because there are no tax advantages. However, the parents maintain control over the funds, even after the child reaches the age of majority.

Final Thoughts: Take Control of Your Education Savings

The cost of education may feel overwhelming, but with a clear plan and consistent savings, you can make it manageable. The key to building an education fund is starting early, staying consistent, and using the right tools. At Trajan Wealth, we help clients create a savings strategy that incorporates education planning into their overall financial roadmap. Remember the earlier you begin, the more flexibility and peace of mind you’ll have when those tuition bills arrive.

Take the next step today and schedule a complimentary consultation with our team to build a savings and investment plan tailored to your goals. With the cost of education continuing to climb, the time to start planning is now.

Sources:

College Board, Trends in College Pricing and Student Aid 2024: https://research.collegeboard.org

Federal Reserve, Consumer Credit – Student Loans: https://www.federalreserve.gov/releases/g19/current/

Education Data Initiative, Average Student Loan Debt: https://educationdata.org/average-student-loan-debt