They say everything’s bigger in Texas. If that’s true (and we know it is), why shouldn’t that include your savings account? As your Texas fiduciary advisors, we’re here to remind you about the importance of financial wellness and planning.

From retirement planning to private wealth management, we believe in supporting the residents of this thriving city. When it comes to Texas financial resources, Trajan Wealth is proud to be of service.

Get Savings Back on the Brain

If you’ve been focused on your investments lately, we get where you’re coming from. But investing regularly in high-yield savings in Texas isn’t something to be ignored.

Your Guide to an APY

At Trajan Wealth, we offer a savings account with over 1% annual percentage yield (APY). Considering the current average APY is hovering around .07%, we are proud to provide this rate for our clients.

Want to know more? Click here for our current rate.

This rate is ideal for those looking to maximize cash returns with Federal Deposit Insurance Corporation (FDIC) insurance protections. Our accounts are FDIC insured for up to $25 million per tax identification number and $50 million for joint accounts.

This protection means your hard-earned money is in safe hands while it continues to compound and grow for you. And having cash in this type of account means immediate liquidity in case you need to access your savings.

Learn more about starting a Trajan Wealth high-yield savings account.

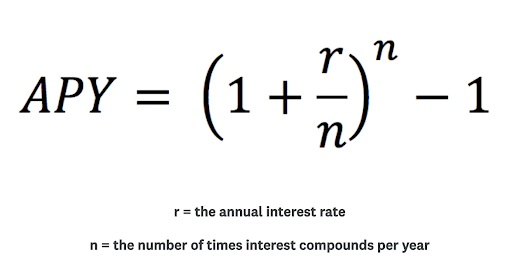

Calculating Your Own APY

You can use this formula to approximate the APY for your high-yield savings account. Otherwise, if math isn’t your strong suit, there are plenty of online calculators you can use.

But, Is This the Right Time to Contribute to a High-Yield Savings Account?

If you’re feeling anxious about the volatility of the current marketplace, consider the safety of a high-yield savings account. The cash is protected from market swings and is available whenever needed. While we always recommend having diversified investments, don’t discount the unique benefits of a high-yield savings account.

When it comes to comprehensive financial planning, we recommend multiple pots, so you can easily access cash while maximizing your potential returns.

Don’t Forget to Return to Investments

Once your high-yield savings account is up and running, it’s time to focus on your investment planning. At Trajan Wealth, we believe in creating assets that line up with your comfort levels, long-term goals, and individual circumstances. We find that to be the best way to help our clients grow!

Read more about our innovative approach to custom portfolio design.

Struggling to Find the Right Texas Financial Advisory Team?

Sure, there are plenty of financial advisors in Dallas. But Trajan Wealth approaches the world of financial planning differently from the rest. As fiduciaries, we are obligated to put our clients’ needs first and foremost. Simply put, when you grow, we grow!

We update our blog to keep you apprised about the latest financial developments, covering everything from how to stay calm during a volatile market to eight financial wellness indicators. We take our role as Texas financial advisors seriously!

Check out our Dallas locations and schedule an appointment to meet with our Texas team. You’ll be surprised by the personalized approach and our range of services.