Just as we thought everything was coming back together again, another potentially portfolio-damaging crisis – one in the form of geopolitical tensions – has brought havoc onto Wall Street.

Staying the Course Through Geopolitical Turbulence

Just as we thought everything was coming back together again, another potentially portfolio-damaging crisis – one in the form of geopolitical tensions – has brought havoc onto Wall Street.

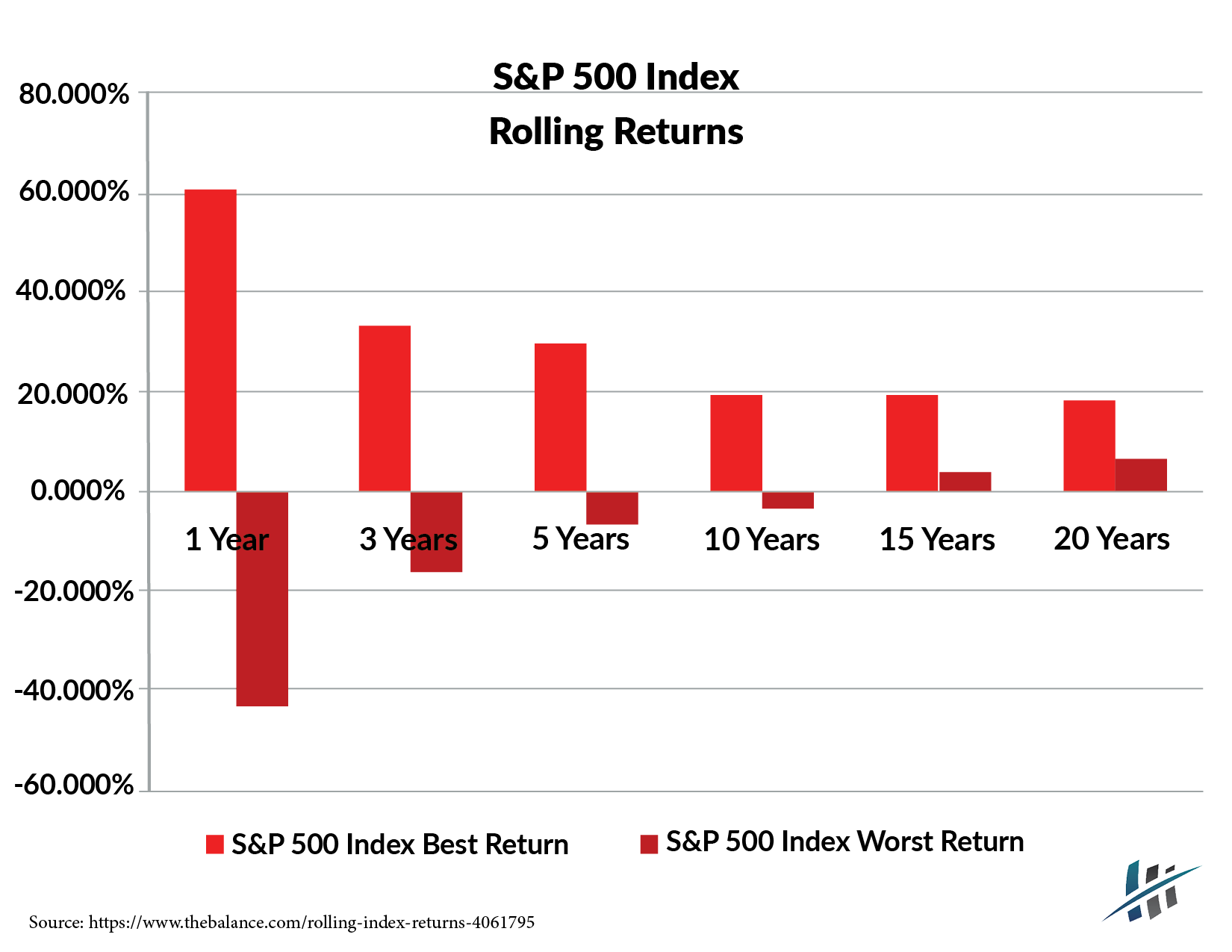

The US and global equity markets are experiencing a period of elevated volatility due to heightened geopolitical risk and tightening financial conditions. During times of elevated volatility, it is extremely important to take the long view when it comes to investing. The chart below shows the performance of the S&P 500 over rolling periods from one year to 20 years; here are some conclusions that you should take away:

- Since the inception of the S&P 500, any 15 year+ horizon has always resulted in a positive return with those returns ranging from 3% annualized to 20% annualized.

- Reacting to short-term events by selling and going to cash typically results in “locking in losses” – to earn the market returns, we need to take the bad days with the good ones.

- A large body of market research shows that market timing – going from fully invested to cash and back again results in subpar returns.

It’s difficult not to have a knee-jerk reaction and place assets into “safe havens” like cash. Remember the importance of taking the long view when it comes to investment decisions. Because at the end of the day, while volatility might seem overwhelming now – it will pass.

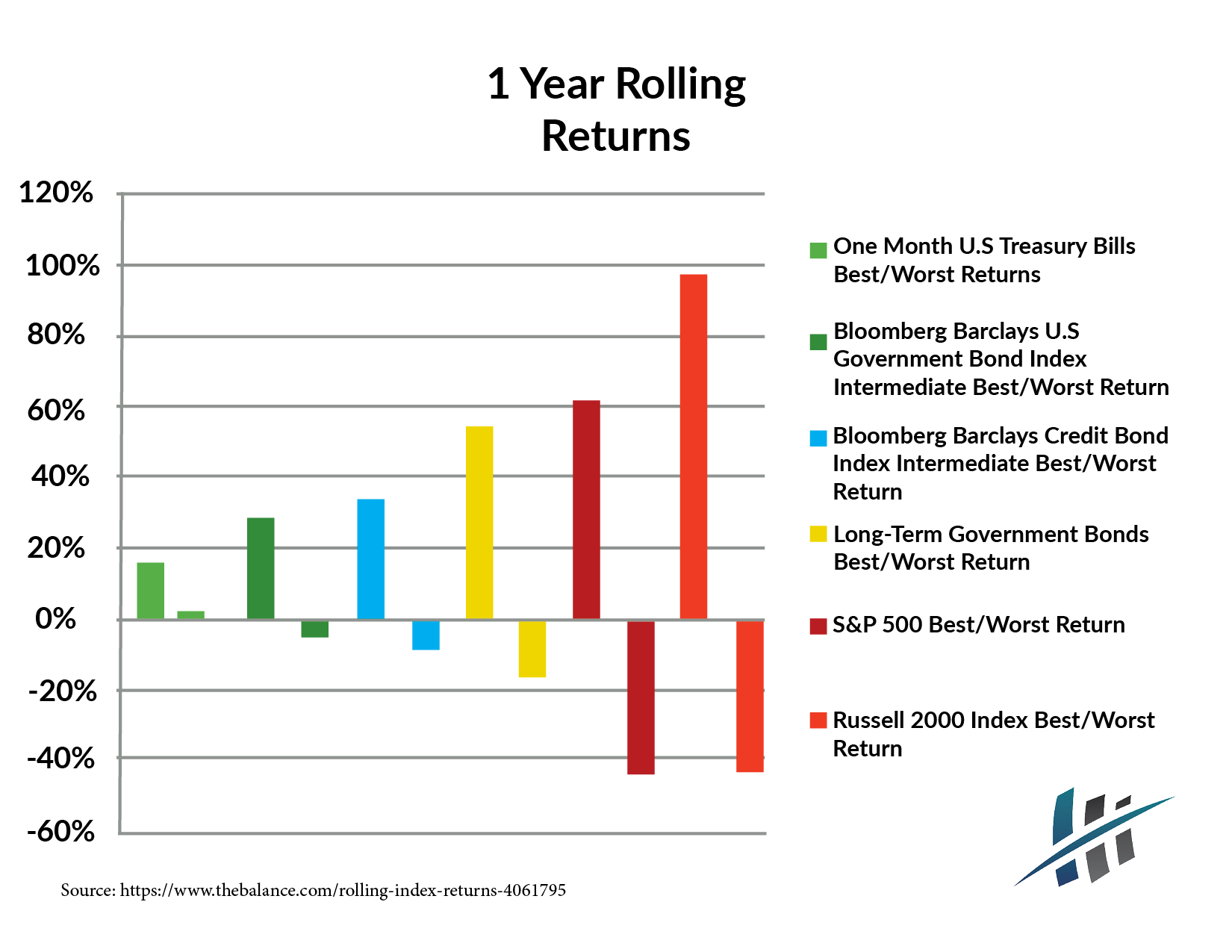

The second chart below shows the importance of a diversified portfolio by showing the best and worst one-year returns for stocks, bonds, cash. This chart illustrates the importance of a diversified portfolio and the importance of adjusting your asset allocation as your life situation changes.

Conclusions

- While wars create fear among investors, history has shown that markets tend to rebound quickly following the outbreak of a conflict – 66% of the time markets recover in 1 month or less and 82% of the time they are recovered withing 1 year.

- As such, stay the course – quality US stocks/assets are attractive and will continue to perform well over time.

- For investors approaching a life event like retirement moving to a more conservative asset mix may be appropriate but going to cash increases the prospect of retirement funding shortfalls.

Bottom line? Don’t let your emotions get the best of you. Instead, get a second opinion from an expert. Reach out to us to speak with a fiduciary advisor about your investments.