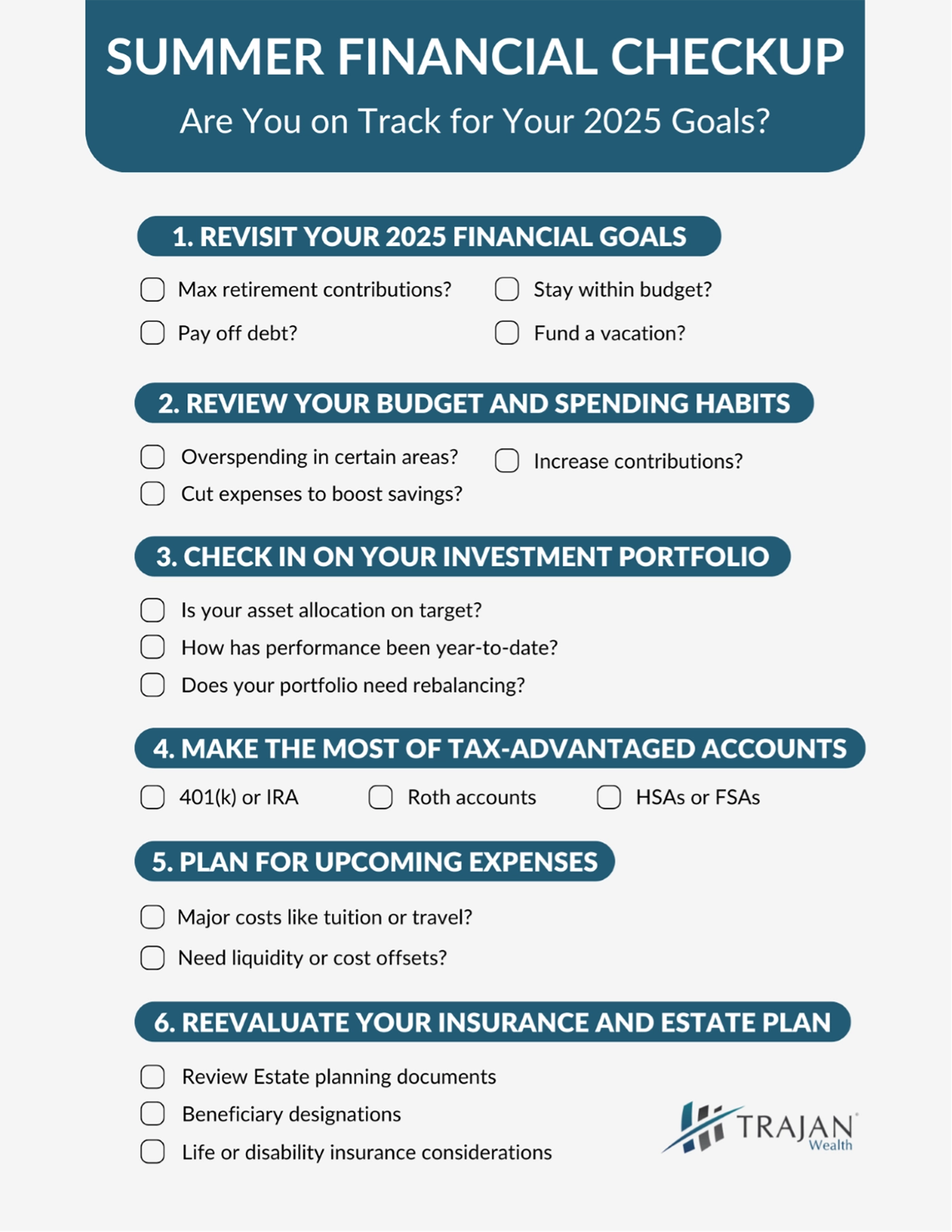

As we approach the midpoint of the year, summer is a great time to do more than relax. It’s the perfect opportunity to check in on your financial goals. Whether you’re saving for retirement, investing for growth, or managing your household budget, a mid-year financial review helps ensure you’re staying on course.

Here’s how to give yourself a quick, but powerful, summer checkup:

1. Revisit Your 2025 Financial Goals

Take a moment to revisit the goals you set at the start of the year. Are you on track to:

- Max out retirement contributions?

- Stay within your budget?

- Pay off high-interest debt?

- Fund a vacation, home project, or education savings?

If your priorities have shifted or life has thrown you a curveball, now is the time to adjust while there’s still plenty of time left in the year.

2. Review Your Budget and Spending Habits

Mid-year is an ideal time to evaluate:

- Are you spending more than you planned in certain areas (groceries, travel, subscriptions)?

- Are there expenses you can trim or redirect toward savings?

- Do you have room to increase your emergency fund or investment contributions?

Consider using a budgeting app or spreadsheet to track progress and identify where your money is really going.

3. Check In on Your Investment Portfolio

Markets move and so should your strategy. Review your:

- Asset allocation: Is your mix of stocks, bonds, and other investments still aligned with your risk tolerance and time horizon?

- Performance: How have your investments performed year to date? Are they keeping pace with your target?

- Rebalancing needs: Do you need to adjust your portfolio to stay diversified?

If you’re unsure where to start, Trajan Wealth can help you assess whether you’re still positioned for success.

4. Make the Most of Tax-Advantaged Accounts

Are you contributing regularly to:

- 401(k) or IRA accounts?

- Roth accounts (if eligible)?

- HSAs or FSAs for healthcare expenses?

Consider automating contributions or increasing them if you received a raise or bonus this year.

💡 Pro Tip: The sooner you contribute, the more time your money has to grow tax-deferred or tax-free.

5. Plan for Upcoming Expenses

Look ahead to the second half of 2025:

- Do you have big expenses like tuition, travel, or home repairs?

- Will you need liquidity or a strategy to offset costs?

- Building these into your financial plan ahead of time helps reduce stress and avoid last-minute financial strain.

6. Reevaluate Your Insurance and Estate Plan

Life events like a new job, marriage, or a new baby can impact your protection needs. Review:

- Life, disability, or long-term care insurance

- Beneficiary designations

- Estate planning documents (wills, powers of attorney, trusts)

Final Thought: A Checkup Beats a Cleanup

Doing a summer financial checkup can save you time, money, and stress down the road. Think of it like regular maintenance on your car or health; it helps you catch small issues before they become big problems.

If you’re unsure where to begin or want a second opinion, we’re here to help. Our team can walk you through a mid-year review and make sure you’re on track for a strong 2025 finish. Stay cool this summer and stay financially focused.