Recent developments in US-China trade and a significant US debt downgrade are shaping the economic landscape. From tariff reductions to fiscal pressures, these events have broad implications for economies and your financial plans. Let’s explore what these shifts mean.

Possible Tariff Relief

The US and China have agreed a truce to lower import taxes on goods being traded between the two countries. The agreement marks a major de-escalation of the trade war between the world’s two biggest economies, which has sent shockwaves impacting countless other countries.

Here’s what it all means.

Both the US and China have confirmed a reduction in the tariffs they imposed on each other following the initial escalation by President Donald Trump earlier this year. The deal involves both nations cancelling some tariffs altogether and suspending others for 90 days, which started May 14th. The result is that additional US tariffs on Chinese imports – that’s the extra tariffs imposed in this recent stand-off – will fall to from 145% to 30%, while recently-hiked Chinese tariffs on some US imports will fall from 125% to 10%. China has also halted and scrapped other non-tariff countermeasures, such as the export of critical minerals to the US, which it put in place in response to the initial escalation.

The US measures still include an extra 20% component aimed at putting pressure on Beijing to do more to curb the illegal trade in fentanyl, a powerful opioid drug.

The announcement came after the two countries held talks in Switzerland, the first between the two countries since Trump sparked the latest tariff war.

What happens after 90 days?

Trying to predict the next steps in this ongoing trade war between the US and China these past few months has been difficult to say the least.

But this is a major agreement between the world’s two powerhouse economies and has been broadly welcomed. Even if the suspended tariffs are reinstated after 90 days, because the vast majority of the tariffs that were announced after Liberation Day have been cancelled, US tariffs on China would only rise to 54% and Chinese tariffs on the US would rise to 34%. However, talks between both governments are set to continue, so a further deal might be struck.

US Treasury Secretary Scott Bessent said the consensus from both countries was that “neither side wants a decoupling”, while China’s commerce ministry said the agreement was a step to “lay the foundation to bridge differences and deepen co-operation”.

So, relations between the US and China are sounding more friendly, but as we’ve seen so far during this Trump presidency, things can change quickly.

What goods do the US and China trade with each other?

In a word – lots.

In 2024, the biggest category of goods exported from the US to China were soybeans – primarily used to feed China’s estimated 440 million pigs. The US also sent pharmaceuticals and petroleum. Meanwhile, China exported large volumes of electronics, computers and toys. The biggest category of US imports from China is smartphones, accounting for 9% of the total. A large proportion of these smartphones, Apple iPhones, are made in China.

However, the US buys much more from China ($440bn) than it sells to it ($145bn), which is something Trump has long been unhappy with. His reasoning in part for introducing tariffs, and higher ones on countries which sell more to the US than they buy, is to encourage US consumers to buy more American-made goods, increase the amount of tax raised and boost manufacturing jobs.

The escalating trade war in recent months has led to a collapse in the amount of goods being shipped across the Pacific Ocean, but investors believe the truce will lead to a rebound, with shares up for some of the world’s biggest shipping firms.

US Debt Downgrade

The US was downgraded by Moody’s Ratings on May 16th, thanks to government debt that’s approaching a mind-numbing $37 trillion. It was a dramatic move that cast further doubt on the polarized nation’s status as the world’s highest-quality sovereign borrower. Moody’s lowered the US credit score to Aa1 from Aaa, joining Fitch Ratings and S&P Global Ratings in grading the world’s biggest economy below the top, triple-A position.

The one-notch cut comes more than a year after Moody’s changed its outlook on the US rating to negative. The federal budget deficit is running near $2 trillion a year, or more than 6% of gross domestic product, and Congressional Republicans are pushing through budget legislation that could add trillions of dollars more. “While we recognize the US’ significant economic and financial strengths, we believe these no longer fully counterbalance the decline in fiscal metrics,” Moody’s wrote in a statement.

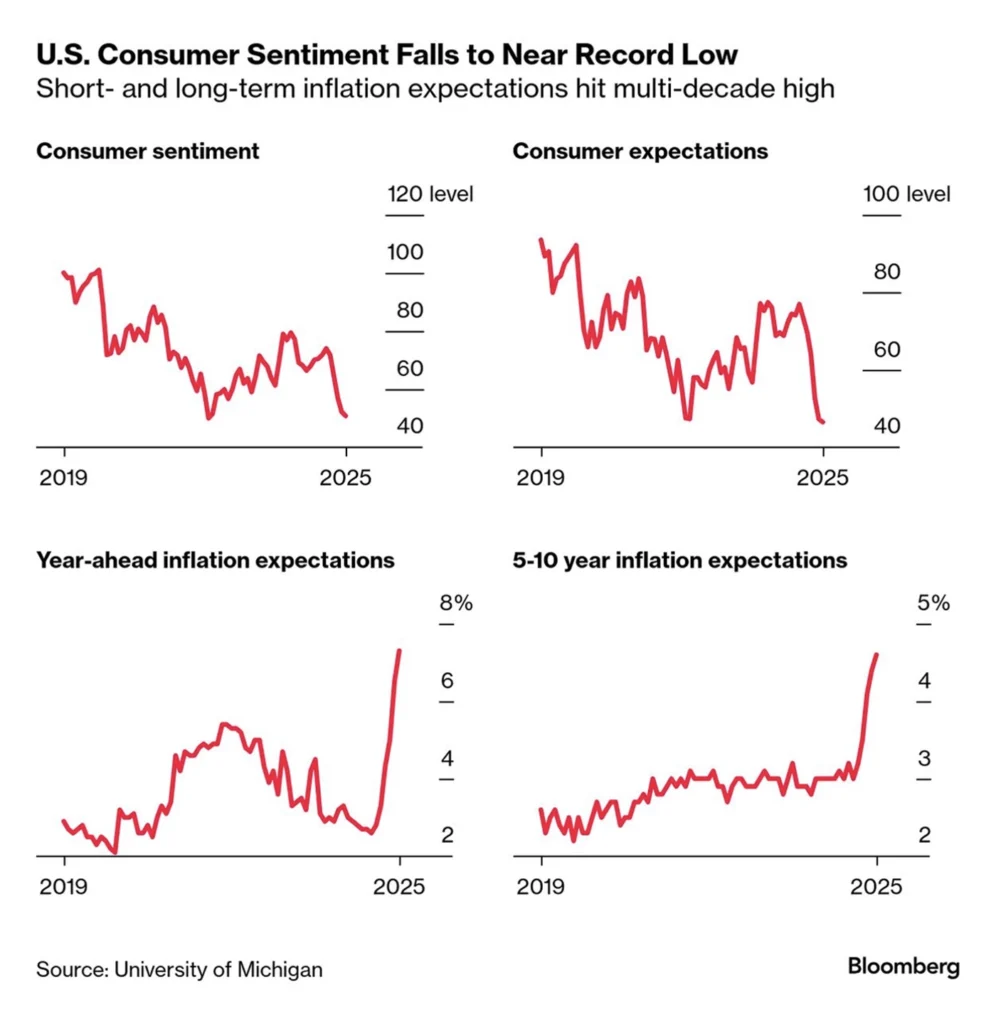

Earlier Friday, new data showed US consumer sentiment has fallen to the second-lowest level on record, and inflation expectations climbed to multi-decade highs. The preliminary May sentiment index declined to 50.8 from 52.2 a month earlier, according to the University of Michigan. That was lower than all but one estimate in a Bloomberg survey of economists. The main reason cited was President Donald Trump’s trade war.

Nearly three-fourths of respondents to the Michigan survey spontaneously mentioned tariffs. The topic crosses partisan lines, including a notable share of Republicans bringing it up. The new, sobering survey data comes as inflation data from the Trump administration’s Department of Labor has been unexpectedly upbeat, coming in softer than estimates three months in a row.

What do these mean for our strategies?

Bereft of a crystal ball gazing into the future, we have to assume the following –

- While the initial tariff agreement with China eliminates the “catastrophic” scenario of suspension of bilateral trade, US consumers and businesses will face some headwinds to growth as double digit tariffs will most likely compress consumption and business investment.

- The debt downgrade and increasing US indebtedness will keep upward pressure on bond yields.

- With growth under pressure and stimulus from lower long-term rates less likely, it is appropriate to overweight “quality” issuers across the corporate capital structure and build defensive positions in alternative asset sectors.

While the US-China trade situation shows some easing, tariffs remain a factor. The debt downgrade suggests ongoing pressure on bond yields. Given potential headwinds to growth, our strategies prioritize quality issuers and defensive positions in alternative assets to build resilient portfolios for your long-term goals.