Stock Market Update for Q2 2023

The S&P 500 (as measured by the SPDR S&P 500 ETF SPY) delivered an 8.7% total return in the second quarter, capping a strong first half and leaving the benchmark up 19.4% over the past year. That came despite a long list of investor fears, including inflation, interest rate hikes, a short-lived banking crisis, threats of breaching the government debt ceiling, and a weakening economy. It’s yet another example of why we don’t believe in market timing. No one knows what the market will do in the short run, but stocks have delivered exceptional returns over the long run.

The reason is simple: Companies generate cash flow over time, some of which they reinvest for future growth, with the rest typically returned to investors through dividends, share buybacks, or debt reduction. Betting against the market means betting against this powerful tailwind.

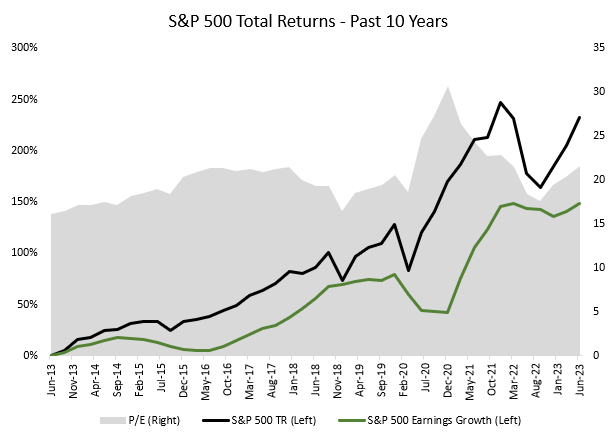

Over the past ten years, the S&P 500 has delivered a total return of 12.8% per year. About 9.5 percentage points came from earnings growth and reinvested dividends; we consider this the index’s “fundamental” return. The other 3.3 percentage points came from an expansion in the price/earnings multiple, which could be fairly characterized as the “speculative” return. We wouldn’t count on P/E expansion continuing indefinitely, but even with flat valuations, earnings growth and dividends would have delivered a very attractive return.

Sources: S&P, Trajan Wealth estimates.

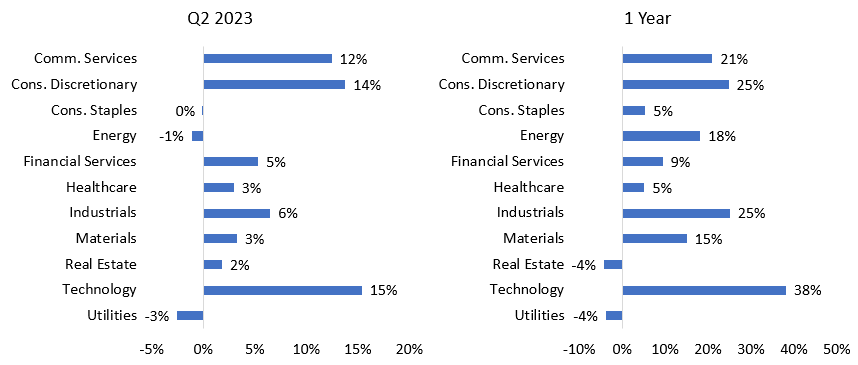

Sources of Return in Q2

Recent returns for the S&P 500 have mostly been of the “speculative” variety, i.e., caused by P/E multiple expansion. Index earnings have been flat over the past 18 months, with challenges from higher interest rates, cost inflation, and soft consumer demand. However, investors are optimistic about future growth potential, especially in the technology sector. Tech delivered a 15% return in the second quarter and 38% over the past year. By comparison, utilities and real estate were both down 4% in the past year; these are typically viewed as the most rate-sensitive sectors.

Investor enthusiasm for tech has been heightened by recent advances in artificial intelligence, especially generative AI applications like ChatGPT. We suspect AI will be among the most transformative technologies of our lifetimes, with the potential to impact a wide range of industries. For example, artificial intelligence could greatly increase demand for semiconductors and cloud-computing services, accelerate the pace of software development, and displace jobs in fields like customer service and transportation. On the other hand, it’s too early to determine winners and losers, and the hype may be getting ahead of the technology in the near term.

Source: Bloomberg. SPDR sector ETFs used as a proxy for each sector.

Checking Your Accounts Frequently Can Hurt Long-Term Returns

One of the best things you can do as an investor—both for your sanity and your long-term financial success—is to not check your account balance too often. This is true in bear markets, but perhaps even more so in bull markets, according to a Wall Street Journal article. Here are a few of the reasons they give:

- Investors get a “dopamine hit” when they see a big account balance, similar to winning in gambling. This can cause you to take excessive risk in the future. You might also develop a habit of checking your account more frequently, which can backfire when the market is down.

- Seeing a big account balance can make you feel wealthier, increasing the temptation to overspend and under-save.

- Most people have “loss aversion,” meaning you feel the pain from losses more intensely than the pleasure from gains. Since 1929, the S&P 500 has delivered a negative return on 46% of trading days, but only 26% of one-year periods and 6% of 10-year periods. By definition, checking your account more frequently means you’re going to see a greater proportion of losses.

The article cites a couple of behavioral economics studies that showed the more frequently an investor checks their account, the lower their long-term returns tend to be. Checking your account once per year should be plenty—perhaps set a calendar reminder to reinforce the discipline. And, as always, please reach out to your advisor or the Portfolio Management team any time you have questions about your financial plan.