The stock market has enjoyed an incredible run over the past five years. The S&P 500 is up more than 17%/year during that time (through Oct. 30), recovering from the COVID pandemic and helped by optimism surrounding artificial intelligence. Unfortunately, this has also left stocks relatively expensive, with fewer opportunities for the future.

Big Tech stocks get most of the attention these days, but investors may be wise to seek diversification in other, unloved corners of the market. For example, telecom has mostly sat out the bull market. This industry is characterized by economic defensiveness, high free cash flows, low valuations, and generous dividends, but also intense competition and a shifting competitive landscape. Could it be a good place to hide in a frothy stock market?

In this blog post, we explore the pros and cons of the United States’ three dominant wireless carriers (Verizon VZ, AT&T T, and T-Mobile TMUS) and two biggest cable companies (Comcast CMCSA and Charter CHTR).

Understanding the Telecommunications Business Model

Telecommunications firms are in the business of connecting people. They provide wireless phone and data plans, broadband Internet, pay TV bundles, and fixed-line phone service to both consumers and businesses. Pay TV and fixed-line phones are both in secular decline because of the shift to streaming video and mobile phones. But practically everyone depends on their wireless plan and home Internet.

Telecom Moats and Competitive Advantages

The first thing I look for with any investment is an “economic moat”: A structural advantage that protects a company’s profits from competitors. Telecom’s competitive advantages come from high barriers to entry and customer switching costs.

It costs many billions of dollars to build a wireless network, between acquiring spectrum rights, setting up antennas all around the country, building a backhaul data network, and establishing a retail store footprint. Wired networks are similarly expensive, requiring digging up streets and laying cables across a huge geographic area. New entrants usually find there’s no way to earn a reasonable return on their investment, especially if a neighborhood is already well-served by incumbents.

Customer switching costs are less of a hurdle, but it can be challenging to get consumers to change phone or Internet providers. Telecoms reinforce switching costs by bundling multiple services, requiring specific hardware, or offering incentives (such as discounts on a new smartphone) that can only be collected over time.

Telecom is Economically Defensive

Another reason to like the telecom industry is its essential nature. After water, gas, and electricity, the Internet and phone bills are usually next to get paid, even in times of economic stress. People have only become more dependent on the Internet over time: We use it for work, school, entertainment, shopping, transportation, and so much more.

Technological advances promise to accelerate the need for more data bandwidth and wireless connections. Streaming TV series on Netflix, short videos on Instagram Reels, or video games on Roblox requires a lot of data. So does artificial intelligence. In the future, every self-driving car or truck, and perhaps even autonomous robots, may need a dedicated wireless connection.

Convergence and Competition in the Sector

You would think an essential service like telecom would have pricing power, but there’s one problem: Competition is intense. The industry’s latest buzzword is “convergence,” which is a nice way of saying “encroaching on one another’s territory.” All five companies mentioned above are seeking to increase customer stickiness by bundling wireless service with broadband Internet.

Broadband: Cable Losing Market Share to Wireless

Cable companies used to have the upper hand in broadband. Their coaxial cable networks provided faster speeds than the DSL service sold by phone companies using legacy copper wires. But now the wireless companies are striking back with investments in even faster fiber-to-the-home as well as “fixed wireless,” where home Internet comes via an antenna connected to a wireless network.

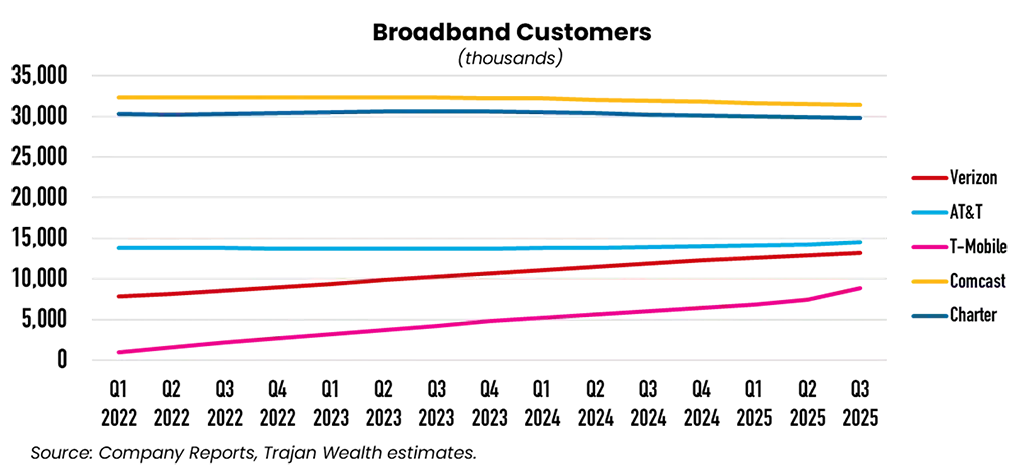

As a result, Comcast and Charter have started to report gradual but persistent declines in broadband subscribers, on top of their losses in Pay TV from cord-cutters. Combined, they shed nearly 1.4 million broadband customers over the past three and a half years. T-Mobile, Verizon, and AT&T added a combined 14 million broadband connections during that same time.

Wireless: Verizon Losing Market Share to T-Mobile and Cable

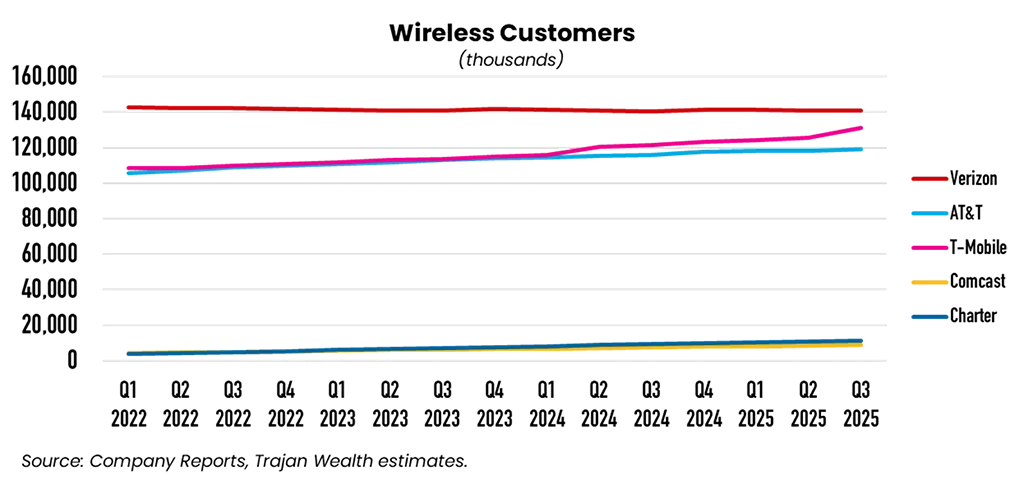

The wireless business is trending in the opposite direction. The cable companies have basically said “if you’re going to steal our broadband customers, we’re coming after your wireless customers.” However, Comcast and Charter don’t actually own nationwide wireless networks. Instead, they rely on wholesale agreements with wireless carriers (mostly Verizon) to provide service, while offloading as much traffic as possible to Wi-Fi hotspots.

Verizon benefits from the wholesale revenue, but Comcast’s Xfinity Mobile and Charter’s Spectrum Mobile can still be a source of competitive pricing pressure for the industry. The even bigger problem (for Verizon especially) has been T-Mobile. Since merging with Sprint in 2020, T-Mobile has used aggressive promotions, customer-centric policies, and improved network coverage to rapidly gain market share.

We estimate that T-Mobile has added more than 22 million new wireless customers over the past 3.5 years. Comcast and Charter have combined for about 12 million new wireless connections. Even AT&T managed to add 13 million connections. The loser was Verizon, which dropped nearly 2 million customers. Telecoms are fortunate to be in a growing industry, so it’s not a zero-sum game. But this explains Verizon’s recent decision to replace its CEO, bringing in PayPal veteran Dan Schulman to cut costs and refocus on Verizon’s customer experience.

The Draw for Investors: Dividends, Free Cash Flow, and Valuation

So here we have a moat-protected, economically defensive business, but with ruthless intra-industry competition. The last piece of the puzzle is valuation.

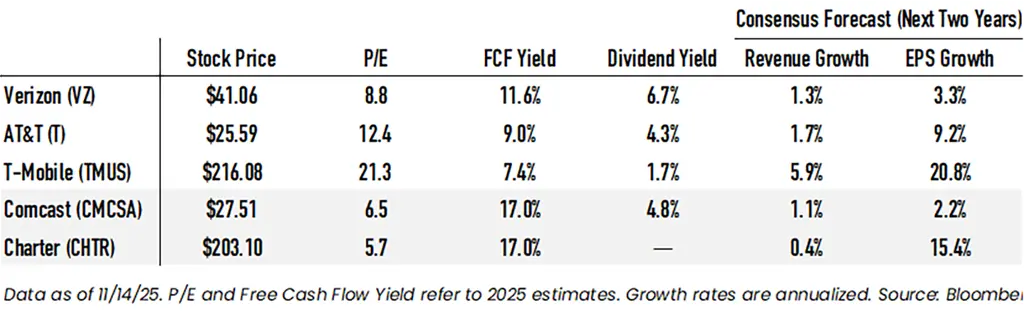

Although it’s incredibly expensive to build a wireless or fixed-line telecom network from scratch, once it’s established the owners tend to generate lots of free cash flow (FCF). Several of them use that free cash flow to fund generous dividends. Investors are worried about competitive disruption to Verizon, Comcast, and Charter, which has left them trading for single-digit price/earnings multiples. The valuation outlier is T-Mobile, whose industry-leading growth has earned it a P/E north of 20.

The following table shows some key statistics for these stocks, using Bloomberg consensus estimates as of Nov. 14, 2025:

Comparing Investment Prospects

As for which telecom stock has the best investment prospects, it’s hard to say. T-Mobile is the obvious “growth” play, but if growth were to slow down, the valuation could take a big hit. Comcast and Charter face the most acute disruption risk, making them the “deep value” options. Verizon and AT&T are somewhere in between, with similar growth prospects, though Verizon has a cheaper valuation than AT&T.

Is Your Portfolio Adequately Diversified?

In a frothy, tech-led stock market, it’s important to maintain some exposure to unloved corners of the market. Contact Trajan Wealth today for a free consultation.