Following the worst performance for bonds we have experienced in over 40 years, many bond investors find themselves “shell-shocked”. While it was a tough year for bond investors, as with any asset class, investors should look forward to what will happen in the future, and not backward at what happened in the past. This piece is intended to provide some perspective on what happened in 2022 and what we can expect going forward.

The yield curve and bond returns in a rising rate environment:

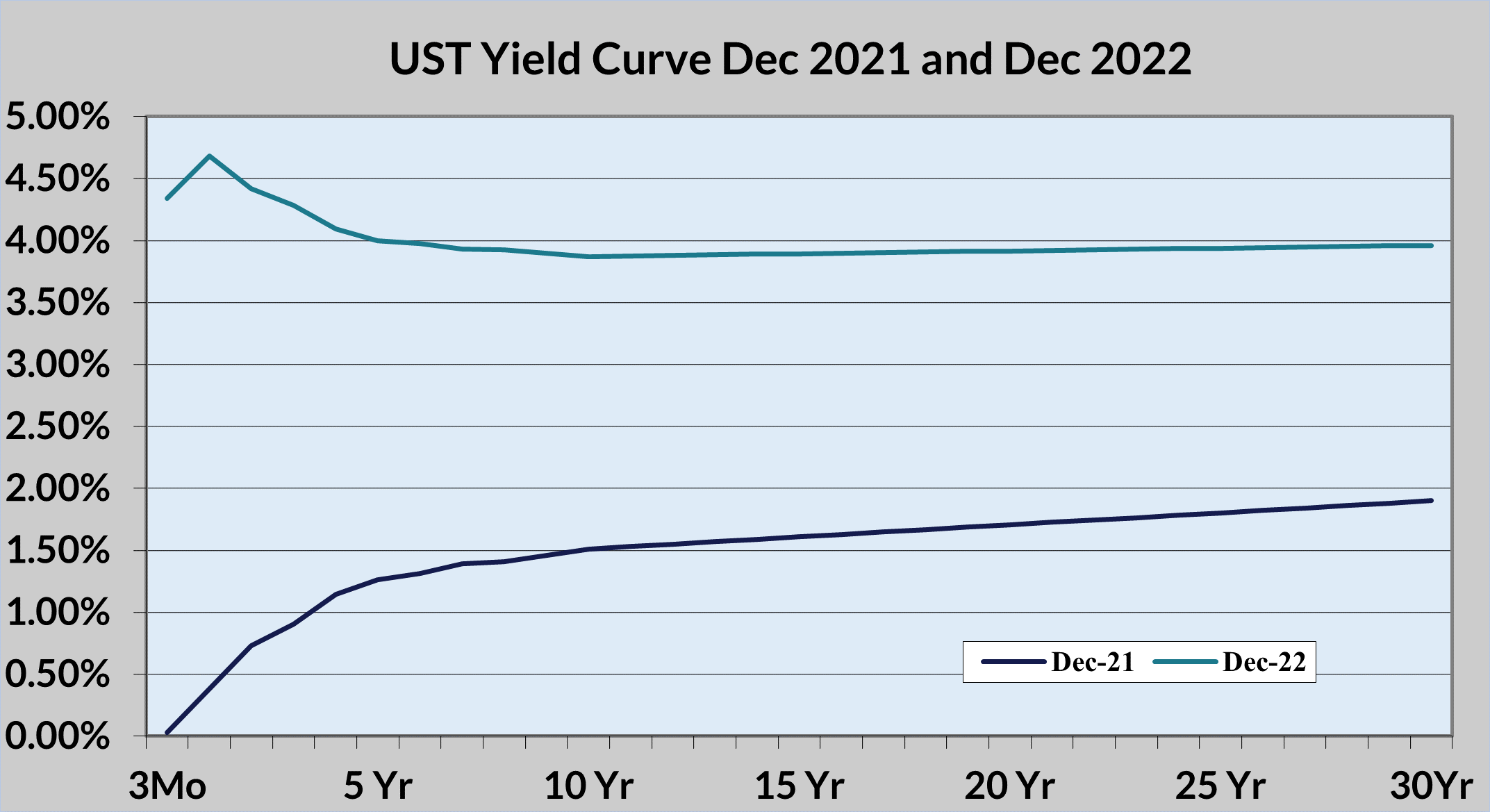

Some perspective is needed when we talk about bond performance in 2022 as being the worst year in many decades (perhaps ever). From a total return perspective, 2022 was a terrible year. There were two factors that contributed to the performance that we have not experienced in the history of the bond market. First, Interest rates started 2022 at levels not seen since the great depression. Second, the pace of rate increases was unprecedented in terms of how quickly Federal Reserve policymakers (The Federal Open Market Committee or FOMC) raised the overnight lending rate (The Federal Funds Rate). The chart below shows the US Treasury yield curve at the end of 2021 and again at the end of 2022.

Source: Bloomberg

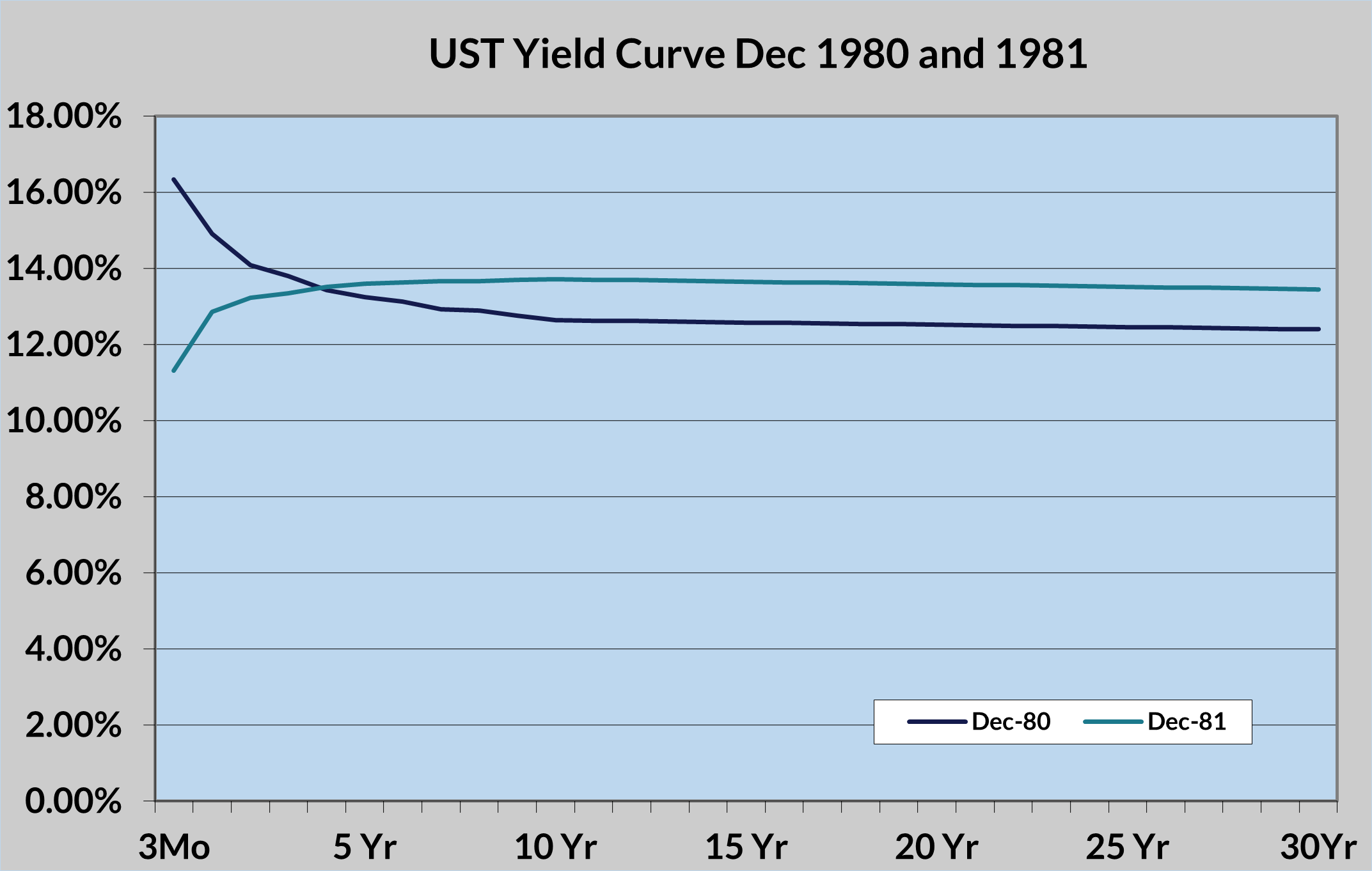

Because bond yields began 2022 at the lowest levels we have seen since the Great Depression of the 1930s, a small increase in interest rates (bond yields) had a much larger impact on the price of the particular bond than it did when interest rates were higher. To illustrate, the chart below shows the yield curve at the end of 1980 and again at the end of 1981. During this period, the FOMC was raising interest rates to the highest levels the US has ever experienced. The difference then was that bond yields were starting from much higher levels.

Source: Bloomberg

The point on the yield curve that best illustrates the impact of higher yields on total returns is that of the 30-year bond. In both periods the yield on the 30-year bond rose nearly 200 basis points or 2%. The table below shows the difference in total return for the 30-year bond in the different interest rate environments.

Duration Adjusted Total Return

Source: Trajan Estimates

As the table above illustrates, the longer the duration and the lower the coupon of a particular bond, the greater the price fluctuation in that bond as interest rates rise or fall – falling interest rates will result in a price increase and positive return on the bond in question. The same math applies to shorter duration/maturity bonds, but the impact of the price change is much lower due to the lower duration. For example, a two-year US Treasury Bond will have a duration of approximately 1.9%, which means an increase in rates of 200 basis points would result in a price return of (3.8)%. In 1980 when the two-year bond was yielding over 13.50% a price return of (3.8)% would result in a positive return of nearly 10%. In today’s environment with the two-year bond yielding 1%, the total return would be (2.8)%. These examples illustrate why 2022 was such a difficult year for bond investors. While 2022 was a difficult year, the result is that the interest rate environment has changed, and bond yields are now over 200 basis points higher than the start of the year. If investors are looking through the front window and not the rearview mirror, they will realize there are now opportunities in the bond market.

Bond Yields and Returns; Looking Ahead

Based on bond market returns in 2022 and the current level of interest rates, we feel bonds are now at yields that are likely to produce positive returns during the next several years. With US treasury bonds and notes now yielding between 3.6 and 4.4%, the return profile is much more attractive. This is even more compelling when one looks at investment-grade corporate bonds, which trade at yields approximately 1% above corresponding US Treasury bonds. In addition, Federal Reserve policymakers remain committed to bringing inflation down to their 2% target. This means to us that interest rates are nearing levels the Fed believes are necessary to bring inflation rates down and support steady long-term growth. If we are correct, bond returns going forward should be positive, and bonds can once again be an important part of an investment portfolio.