Inheritance is a sensitive topic, often avoided in polite conversation. But the Great Wealth Transfer is coming and for Trajan Wealth clients, it presents both opportunities and potential pitfalls. Over the next decade, trillions of dollars will shift from older generations to younger hands. We see this as a call to action – a chance to guide our clients through this transition, ensuring their legacies are preserved and their financial futures secured.

Understanding the Tectonic Shift

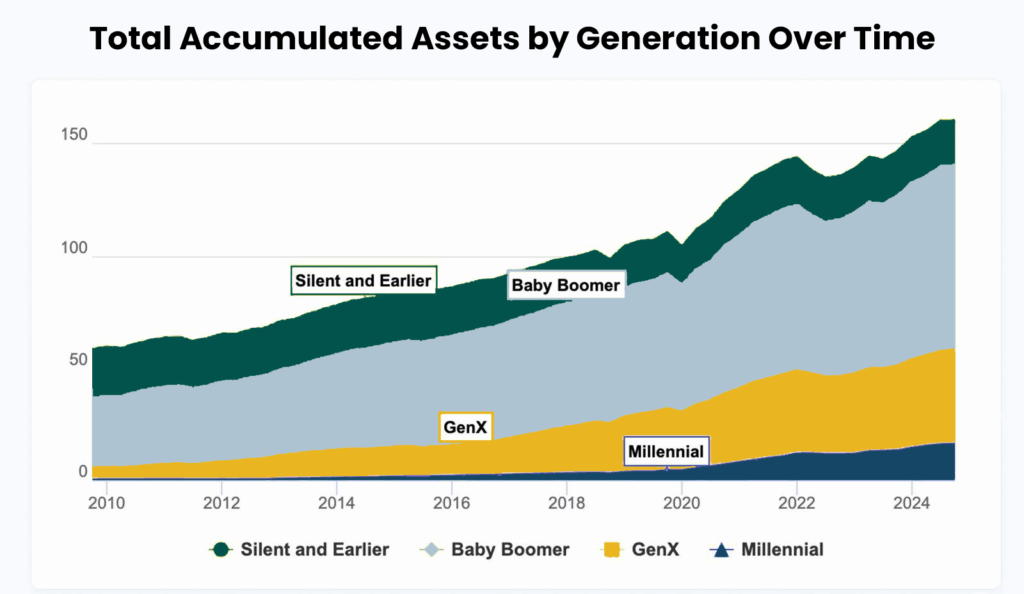

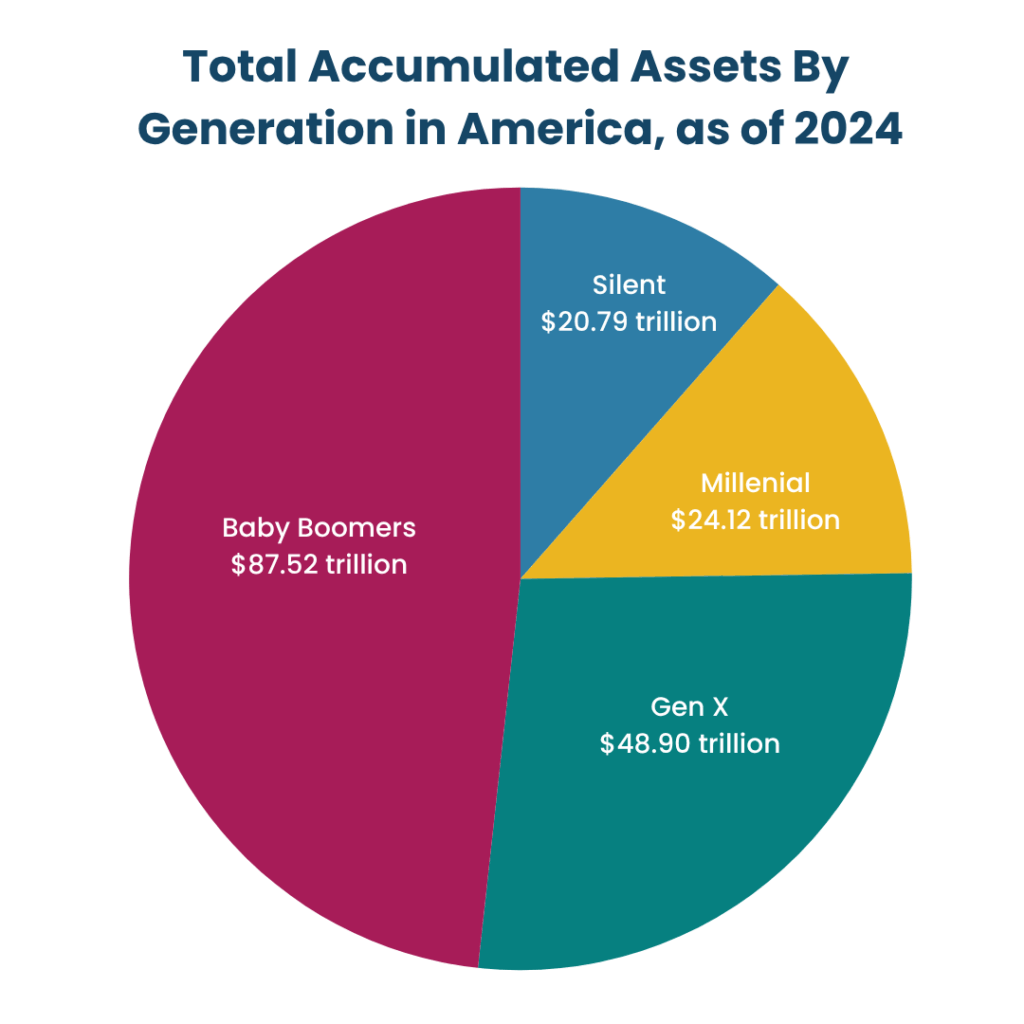

The scale of the Great Wealth Transfer is truly historic. In the United States alone, an estimated $84 trillion will change hands by 2045. Baby Boomers, who benefited from a period of unprecedented economic growth, are now poised to pass on their accumulated wealth to Gen X, Millennials, and Gen Z.

Source: Federal Reserve

Source: Federal Reserve

Securing Your Legacy Through Estate Planning

Baby Boomers preparing for the Great Wealth Transfer must ensure their wishes are carried out and their loved ones are protected from unnecessary costs and delays. This is where strategic estate planning and the guidance of a trusted advisor become your most powerful tools.

The goal is to provide a seamless transfer of assets while maintaining continuity in your financial plan. Without proper planning, an estate can be subjected to probate – a lengthy, public, and often expensive legal process that can deplete assets and cause significant stress for your heirs.

Trajan Wealth emphasizes proactive strategies to avoid probate and ensure your intentions are honored:

- Establishing a Comprehensive Estate Plan: A proper estate plan involves a lot more than a will. It includes a tailored combination of legal documents such as revocable living trusts, which allow assets to be managed during your lifetime and then transferred directly to beneficiaries without court involvement. This provides privacy and control.

- Strategic Asset Titling and Beneficiary Designations: Many assets, such as retirement accounts (IRAs, 401(k)s), life insurance policies, and even bank and investment accounts, allow you to name specific beneficiaries. These designations override a will and can ensure a direct, probate-free transfer. Similarly, holding property in joint tenancy with rights of survivorship (JTWROS) or using transfer-on-death (TOD) deeds for real estate (where permitted by state law) can simplify transitions. JTWROS means when one person dies, the title automatically transitions to the other person(s) on the title. A TOD is similar, but the title automatically transfers to the beneficiaries named on the deed (unlike JTWROS, they don’t have title during the owner’s lifetime).

- Maintaining Continuity in Wealth Management: Trajan Wealth works to foster multi-generational relationships. We encourage open family discussions about wealth and values, helping heirs understand your financial vision and maintain responsible stewardship of your legacy.

- Minimizing Tax Implications: Effective estate planning also involves strategies to reduce potential estate taxes, maximizing the wealth that passes directly to your beneficiaries. We work closely with tax and legal professionals to implement tax-efficient solutions tailored to your unique circumstances.

Comprehensive Service, Under One Roof, for Total Peace of Mind

Navigating the Great Wealth Transfer requires a cohesive strategy that integrates every aspect of your financial life. At Trajan Wealth, we pride ourselves on offering comprehensive services that seamlessly manage the entire process. Unlike firms that outsource critical components, we bring investment, estate, and tax planning services under one roof. This integrated approach means you benefit from a unified strategy where every piece of your financial puzzle, simplifying complex decisions, optimizing outcomes, and providing unparalleled continuity and peace of mind for you and your heirs. Contact us today to learn more about how we can help you prepare a lasting legacy.