On October 1, 2025, the federal government officially shut down after Congress failed to reach a budget deal. That means many agencies have paused “non-essential” work, and hundreds of thousands of federal employees are facing missed paychecks until a resolution is reached.

Shutdowns often make headlines, but what do they really mean for you, your finances, and the markets? Let’s break it down.

What Triggers a Shutdown?

- The federal budget process relies on annual appropriations or continuing resolutions (temporary funding extensions).

- When Congress fails to pass these before the new fiscal year begins (October 1), agencies cannot legally spend money for operations whose budgets have lapsed. (CBS News )

- Agencies must classify functions as essential (“excepted”) which continue operating versus nonessential (“furloughed”) which stop during the lapse. (USAFacts )

How Long do Shutdowns Usually Last?

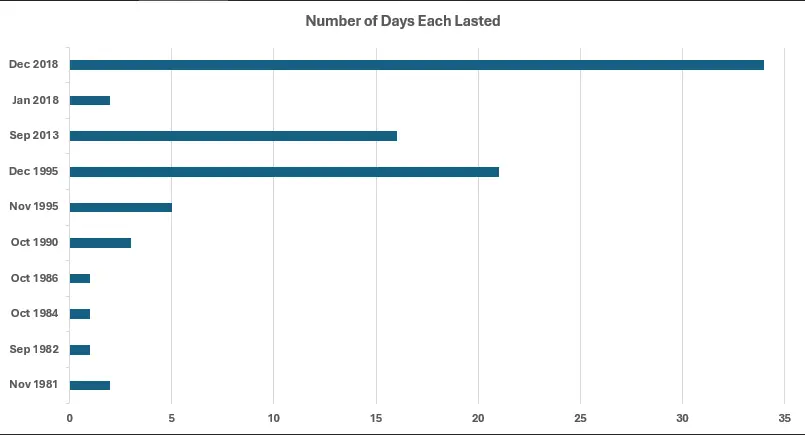

Government shutdowns aren’t new. Since the 1980s, there have been 10 previous shutdowns. Some lasted just a day or two, while the longest one stretched to 34 days in 2018–2019 (Brookings).

Source: U.S. House of Representatives

The reality is this: short shutdowns usually have little impact. Longer ones, however, can ripple through the economy and create more noticeable effects on markets and households.

What It Means for Federal Workers

- Furloughs and delayed pay: Hundreds of thousands of federal workers are either furloughed (told not to work) or working without pay. They’ll receive back pay when the shutdown ends, but that doesn’t help with immediate bills (Federal News Network).

- Contractors are hit harder: Federal contractors often don’t receive back pay, meaning a shutdown can cause lasting financial stress.

- Services slow down: Social Security checks will still go out, but customer service and administrative functions at many agencies may be delayed (USAFacts).

What It Means for The Economy

The White House estimates the shutdown could cost the U.S. economy about $15 billion in lost output per week if it drags on (Politico). Consumer spending can take a hit in areas with many federal workers, and businesses that rely on government contracts often feel the squeeze.

What It Means for The Markets

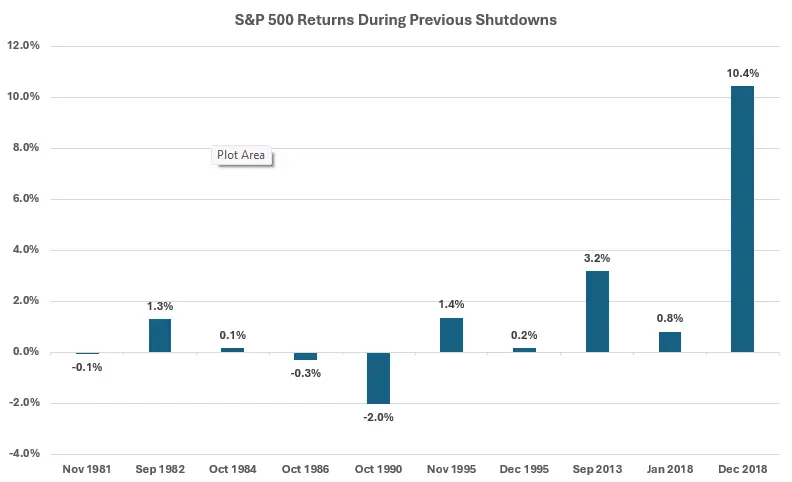

Here’s the good news: markets usually don’t overreact to shutdowns.

- Stocks: Historically, the S&P 500 has often done fine during shutdowns. In fact, during 7 of the last 10 shutdowns, the market gained value.

Source: Bloomberg & Trajan Wealth Estimates

- Bonds: Treasury yields sometimes dip as investors seek safety, but movements are usually small.

The key factor is duration: short shutdowns cause little disruption, while long ones can increase volatility and uncertainty.

What This Means For You As An Investor

- Stay calm, stay invested. Shutdowns are temporary political events. Long-term investors shouldn’t make knee-jerk changes to their portfolios.

- Keep your emergency fund strong. If you or someone in your household is directly affected (federal employee or contractor), having 1–3 months of expenses in accessible savings is important.

- Expect slower service in some areas. Things like tax agency questions, loan approvals tied to federal records, or government program processing could take longer.

At Trajan Wealth, our investment approach is built on long-term discipline, diversification, and aligning with your financial goals. We focus on fundamentals, not headlines.

Bottom Line

Shutdowns make for dramatic headlines, but they rarely change the long-term picture for investors. The biggest risk is if the shutdown lasts a long time and starts to affect consumer spending and confidence.

As your advisory team, we’re here to help you navigate uncertainty. If you’re worried about the impact on your household budget or investments, let’s talk. The best strategy is to stay focused on your goals, not the short-term noise.

If there have been any changes to your financial goals or circumstances since your last progress meeting, or if you have questions about your financial plan, please reach out to your designated portfolio manager.

You can read more about our perspectives on the market, along with financial tips and news here:

Remember to remain patient, stay disciplined, and think long-term!

Thank you for being a part of the Trajan® Wealth family!