November already? If 2025 has sped by, the rapid pace of change in the capital markets has moved even faster. It’s the time of year when the heavy hitters of Wall Street roll out their forecasts, and we’re paying particularly close attention to the battle cries coming from firms like Kravis, Kohlberg & Roberts (KKR) a pioneer of corporate buyout strategies. Their analysis confirms what we at Trajan® Wealth know: The rules of engagement have changed. In this new regime of persistent inflation and higher interest rates, the old playbook is obsolete. KKR posits that the dispersion of returns is narrowing, creating a flatter efficient frontier. What does this mean for your portfolio? Simply put, the classic 60/40 model is facing its fiercest challenge yet. With stock-bond correlations shifting and the prospect of a weaker dollar ahead, diversification isn’t a luxury—it’s a necessity for survival.

We’ve taken KKR’s insights and cross-referenced them with our own unyielding commitment to research to show you where the real opportunities for portfolio enhancement lie. Get ready to discover the truth about building resilience in this evolving market landscape.

Let’s break it down.

Private Markets Provide DiversificationIlliquidity Premium Expected to Increase

Chart Source: KKR Q3 2025 Investment Playbook. Data as at June 17, 2025. Note: Capital markets assumptions are average across all quartiles annualized total returns. Forecasts represent five‐year annualized total return expectations.

In their well-researched piece, KKR anticipates the higher inflation and interest rates, the dispersion of returns across asset classes will narrow. This flatter efficient frontier (e.g., flatter returns) drives a greater need to incorporate asset classes that enhance portfolio diversification.

The Shifting Correlation:Why the Old Playbook is Broken

The underpinnings of our recommendation for a higher number of asset classes stem from the stock-bond correlation shifting from negative to positive since the commencement of tighter monetary policy in 2022. In addition, the prospect of a structurally weaker dollar, builds the case for increased allocations to international markets.

With inflation and interest rate volatility forecasted to increase, KKR expects the illiquidity premium in private equity to widen over the next five years. While this is welcome for allocators in the private markets, the headwinds of high rates and persistent inflation mean that manager selection will be critical given expected performance dispersion within asset classes in the private markets.

Corroborating Research:Valuation Levels and Future Returns

At Trajan® Wealth, we do our own research on capital markets as well as read the research of prominent investment managers. KKR is certainly a blue-chip firm, with a distinguished record of managing assets. However, when predictions are made, we like to corroborate the logic with other asset sector specialists to look for a degree of consistency on the underlying inputs that help arrive at the forecast.

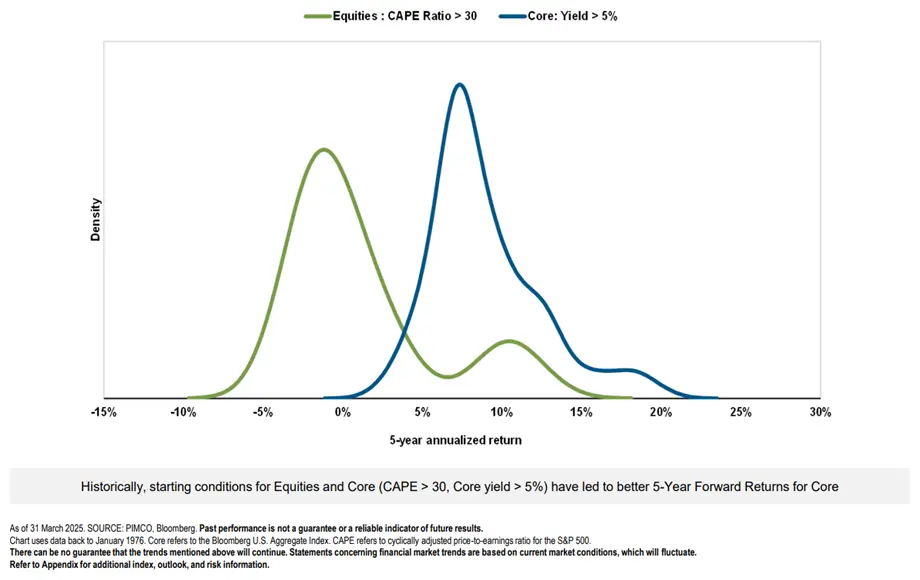

Last summer, I wrote (May 2025) a blog on valuation levels across stock and bond markets and what the valuation levels meant for subsequent returns. The blog was based on a study by fixed income manager, PIMCO, which suggested that elevated levels of valuation had a strong correlation with subdued future performance – see chart below.

Chart Source: PIMCO Advisor Playbook Q4 2025.

Intuitively, the above charts suggest that when stock markets are rich (i.e., when Price to Earnings multiples are high), the distribution of future returns is skewed with high possibility of negative returns – see green series in the above chart. Conversely, when bond yields are high – for instance, near 5% as its is currently, the distribution of returns is skewed in favor of positive outcomes.

Key Takeaways:A New Path to Financial Resilience

1) The Old Playbook is Broken. The easy days are over. In this new world of higher rates, stocks and bonds are acting like twins, not partners—meaning the old 60/40 strategy is losing its power to protect you. It is time to look for new ways to build true financial resilience.

2) Private Markets Offer a New Advantage. The financial reward for putting some money into less-liquid, private investments is expected to get bigger over the next five years. This is your chance to access growth opportunities that are stronger and set apart from the volatile public markets.

3) You Need a Guide to Make the Choice. Because the overall market is getting tougher, being in the right type of investment isn’t enough. You need the KNOWLEDGEABLE, DECISIVE insight of a trusted partner like Trajan® Wealth to help you choose the right solution in this evolving and challenging new environment.

Conclusion:Master Your Portfolio, The Path to Potential

Putting the decisive research of KKR and the strategic insights from PIMCO’s valuation analysis together, a singular, convincing case emerges: investor portfolios require enhanced firepower from a wider array of asset classes. The shift in stock-bond correlation and the historical precedent that rich valuations predict subdued returns means passively riding the market waves is no longer an option. We must take command. Private markets, with their forecasted increase in the illiquidity premium, are primed to enhance core portfolio characteristics. However, as KKR rightly cautions, success hinges on masterful manager selection—a truth we uphold with the highest honor. At Trajan® Wealth, our grit and determination are focused on cutting through the noise to deliver solutions rooted in data and research. Be strong, be decisive. Contact your portfolio manager at Trajan® Wealth today. Let us guide you to the specific, tailored strategies that will help you accomplish true portfolio mastery and capture the opportunities this new regime offers.