Private Equity

What is Private Equity?

“Private Equity” is a generic term for investments in non-publicly traded assets. They are also called “Private Markets” or Illiquid Alternative Assets. These investments are typically structured as pools of capital organized as partnerships and LLCs. The LLC or partnership then invests in non-publicly traded economic entities. Think privately owned companies, commercial real estate, or infrastructure projects, as examples.

Why Invest in Private Equity?

Diversification

Returns when public markets falter

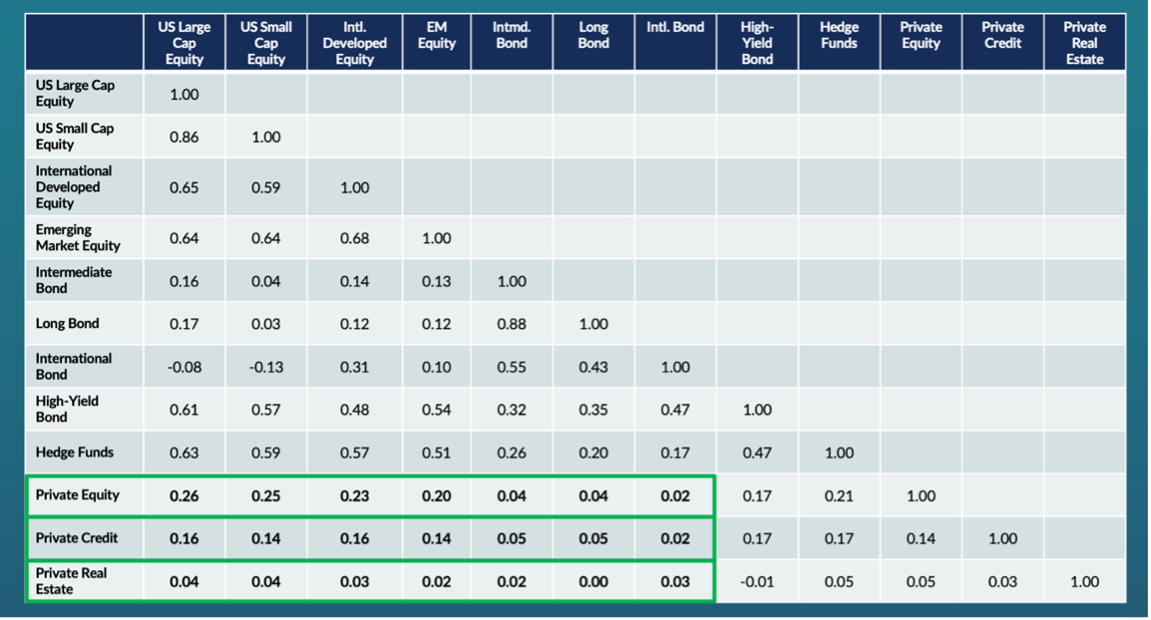

Private equity funds tend to have a low correlation with public markets. Managers invest capital directly into private companies or other private assets and work to increase their value. Valuations conducted periodically reflect the accretion of revenues and profits as a result of the sponsors’ efforts.

Public equity investments, on the other hand, are impacted not just by analyst valuations, but also factors such as momentum trading, leverage (buying with borrowed money), and short selling (speculative selling by borrowing rather than owning the underlying assets).

As a result, prices on private and public assets do not move completely in tandem with each other. The resultant low correlation between private equity and public equities offers diversification benefits for traditional portfolios.

Historical higher returns

In the long-term

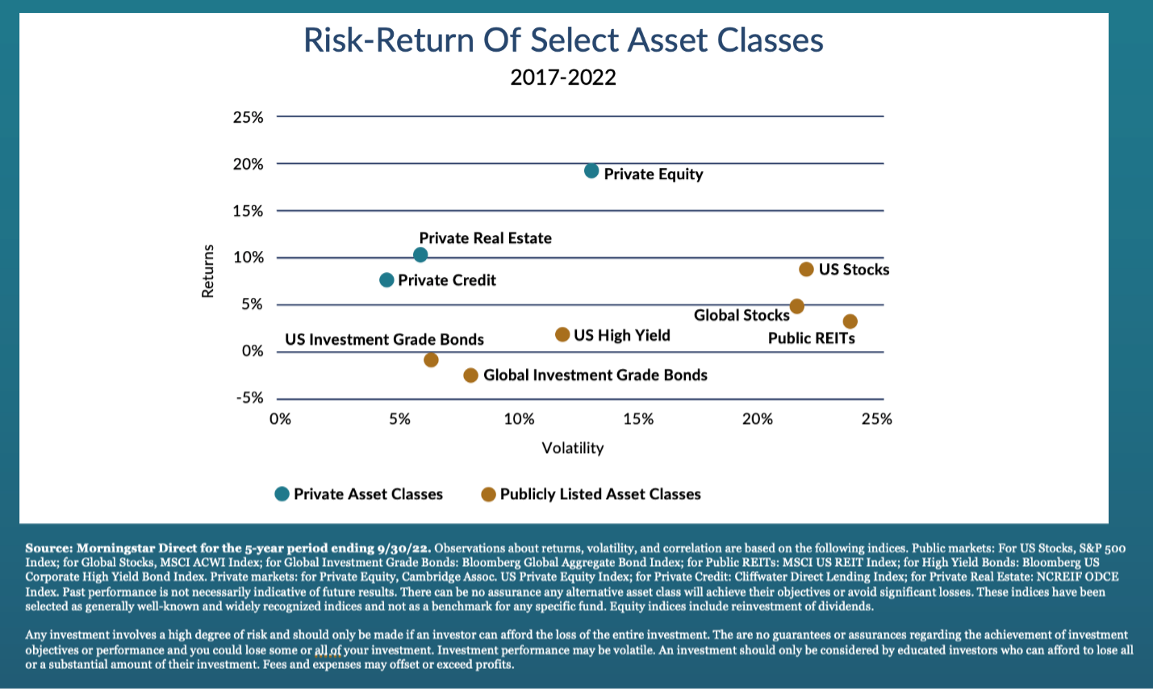

Historically, private markets outperform publicly listed asset classes. This is largely because managers buy assets at prices that enable them to generate an “illiquidity premium” which is required to entice investors to give up the ability to buy and sell assets on a continuous basis. Essentially, investors can receive extra compensation since their assets cannot be easily or quickly cashed in.

The chart on the left, “Risk-Return of Select Asset Classes”, gives comparative performances in the past five years, while longer term comparisons reflect the same performance differentials.

Private Equity Options at Trajan Wealth

These offerings are as of September 2023 and are subject to change. We are expanding these offerings as we carefully vet each fund. Speak with one of our advisors to get the latest updates and details.

Corporate Private Equity

Overlay Capital Innovations Co-Invest Fund (Venture/Growth)

Private Commercial Real Estate

MLG Fund VI

INFRASTRUCTURE

Overlay Capital Kendall Solar Infrastructure Fund

With tightening money supply and lower expected returns from all risk assets in the coming years, we believe allocations to private markets may be essential to generate the type of returns that enable investors to fund-long term liabilities.

Udayan Mitra, CFA

Evolve Your Portfolio

Access private equity investments from experienced managers with Trajan Wealth, with strategies for potential returns outside of the stock market. Contact us for a complimentary consultation. Start today.

*Investment in private equity may require accreditation.*